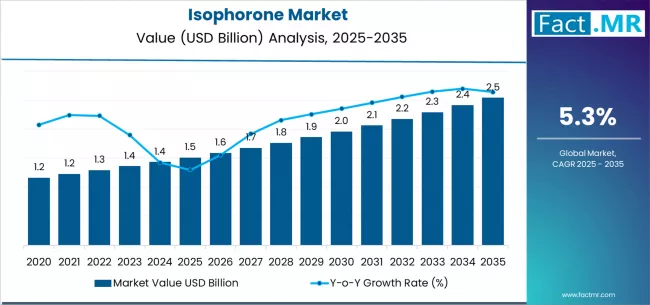

The isophorone market is expected to increase at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2035, from USD 1.51 billion in 2025 to roughly USD 2.54 billion.

Isophorone is a highly versatile solvent widely used in industrial production. It is a key intermediate in manufacturing isophorone diisocyanate (IPDI), isophorone diamine (IPDA), and other derivatives that go into producing polyurethanes, coatings, sealants, elastomers, and engineering plastics. Its excellent solvency for resins, pigments, and polymers makes it especially useful for formulators in the coatings and adhesives sectors.

The market is supported by increasing demand for eco-friendly and durable coatings, strong infrastructure investments, and growing usage in high-performance composite materials. In addition, the expansion of the automotive and construction sectors is creating strong momentum for advanced coatings where isophorone-based chemicals are essential.

Quick Stats (2025–2035)

-

Market Value 2025: USD 1.05 billion

-

Market Value 2035: USD 1.82 billion

-

CAGR (2025–2035): ~5.9%

-

Largest End-Use Industry: Paints & coatings

-

Fastest-Growing Segment: Adhesives & sealants

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=966

Key Market Drivers

1. Growth in the Paints & Coatings Industry

The paints and coatings sector is the largest consumer of isophorone. Growing construction activity, industrial maintenance, architectural coatings, automotive refinishing, and protective coatings all rely heavily on high-solvency chemicals. Isophorone is prized for improving coating flow, leveling, gloss, and surface finish.

2. Increasing Use in Polyurethane Applications

Isophorone derivatives such as IPDI are vital ingredients in polyurethane production. These polyurethanes are used in elastomers, adhesives, high-performance paints, and specialty coatings that require weather resistance and UV stability, particularly in automotive and aerospace applications.

3. Rising Demand for High-Performance Adhesives

Industries such as packaging, construction, electronics, and transportation are adopting high-strength adhesives. Isophorone provides excellent compatibility and solubility for resin systems used in pressure-sensitive adhesives and sealants.

4. Expansion in Agrochemical and Chemical Synthesis

Isophorone acts as an important intermediate in synthesizing agrochemicals, herbicides, and specialty chemicals. As agriculture modernizes and demand for efficient crop-protection solutions grows, usage of isophorone-based intermediates continues to rise.

5. Growth in Plastics and Polymer Additives

Engineering plastics and polymer additives benefit from isophorone derivatives due to their ability to enhance material properties such as flexibility, durability, and resistance to chemicals and heat.

Market Segmentation

By Application

Paints & Coatings (Largest Segment)

The segment benefits from the chemical’s ability to improve paint formulation quality, drying characteristics, and spreadability.

Adhesives & Sealants (Fastest Growing)

Due to the shift toward lightweight materials and advanced bonding solutions, demand for isophorone-based adhesive formulations is accelerating.

Chemicals & Intermediates

Isophorone is widely used in synthesizing diisocyanates, amines, and other specialty intermediates critical for advanced chemical manufacturing.

Agrochemicals

Used in pesticide and herbicide formulations requiring stable, effective solvents.

By End-Use Industry

-

Construction: High-performance coatings, sealants, and adhesives drive usage.

-

Automotive & Transportation: Demand for durable polyurethane coatings and adhesives supports market expansion.

-

Industrial Manufacturing: Used in machinery maintenance, industrial coatings, metal coatings, and specialty solvents.

-

Aerospace: High-performance coatings using IPDI derivatives are increasingly adopted.

Regional Insights

-

North America: Strong demand from construction, automotive refinishing, and specialty coatings.

-

Europe: Major hub for chemical synthesis and polyurethane production.

-

Asia-Pacific (Fastest Growing): Rapid industrialization, infrastructure expansion, and growing coatings production support market dominance.

-

Latin America & Middle East: Increasing industrial development boosts solvent demand.

Key Challenges

-

Environmental and Regulatory Pressure: Solvent regulations and VOC emission norms increase compliance costs.

-

Availability of Substitutes: Other high-boiling solvents and eco-friendly alternatives may limit growth.

-

Volatility in Raw Material Prices: Fluctuations in acetone costs impact profitability.

Opportunities Ahead

-

Development of low-VOC and eco-friendly isophorone grades

-

Rising demand for high-performance polyurethane coatings

-

Expansion in aerospace and automotive coatings

-

Growth in advanced adhesives and elastomers

-

Innovations in bio-based isophorone production

Future Outlook

The isophorone market is poised for sustainable growth through 2035 driven by increasing demand for advanced coatings, rising construction activity, growing adhesive applications, and expanded use in polyurethane chemistry. Technological advancements, regulatory compliance, and innovation in green chemicals will further shape the market landscape. Manufacturers that focus on high-purity isophorone, environmentally friendly formulations, and value-added derivatives will hold strong competitive advantages in the years ahead.

Browse Full Report: https://www.factmr.com/report/966/isophorone-market