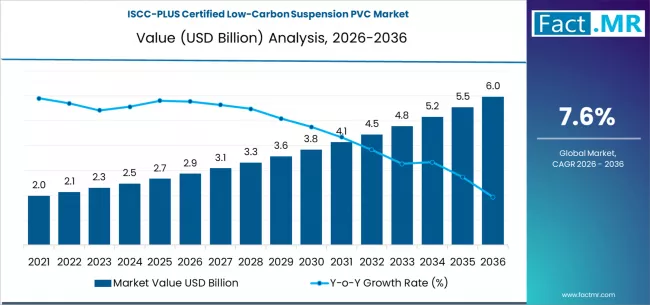

The global ISCC-PLUS certified low-carbon suspension PVC market is poised for strong and sustained expansion over the next decade, driven by rising sustainability regulations, decarbonization initiatives across the plastics value chain, and growing demand for eco-friendly construction materials. According to a new analysis by Fact.MR, the market is projected to grow from USD 2.87 billion in 2026 to USD 5.94 billion by 2036, representing a 107.0% increase and registering a robust CAGR of 7.6% during 2026–2036.

This growth reflects a global shift toward certified low-carbon polymers, increased adoption of circular economy principles, and rising use of ISCC-PLUS compliant PVC in construction, infrastructure, and industrial applications.

Browse Full Report: https://www.factmr.com/report/iscc-plus-certified-low-carbon-suspension-pvc-market

Strategic Market Drivers

Sustainability Regulations Accelerate Adoption

Governments and regulatory bodies worldwide are tightening carbon-emission norms across building materials, packaging, and industrial plastics. ISCC-PLUS certification ensures traceability of bio-based, recycled, and low-carbon feedstocks, making certified suspension PVC an attractive solution for manufacturers aiming to meet ESG and carbon-neutral targets.

Construction Sector Drives Volume Demand

The construction industry remains the primary demand engine for ISCC-PLUS certified low-carbon suspension PVC. Applications such as:

- Pipes & fittings

- Window profiles

- Flooring

- Cable insulation

are increasingly transitioning to low-carbon PVC formulations. Construction-grade formulations are projected to account for 42.1% of total market share in 2026, underscoring their dominance.

Circular Economy & Carbon Reduction Initiatives

Brands and manufacturers are prioritizing mass-balance certified materials to reduce Scope 3 emissions. ISCC-PLUS certified PVC enables the integration of renewable and recycled raw materials without compromising performance, accelerating adoption across global supply chains.

Rising Corporate ESG Commitments

Multinational construction material producers, infrastructure developers, and chemical companies are aligning procurement strategies with ISCC-PLUS standards to enhance transparency, traceability, and sustainability credentials.

Regional Growth Highlights

Europe: Sustainability Regulations Lead the Market

Europe remains the frontrunner due to strict carbon-reduction policies, green building mandates, and widespread adoption of ISCC-PLUS certification. Germany, France, and the Netherlands are key contributors.

North America: Green Construction Gains Momentum

The U.S. and Canada are witnessing growing demand for low-carbon PVC driven by sustainable infrastructure investments, green building certifications, and corporate net-zero commitments.

East Asia: Manufacturing Scale Meets Sustainability

China, Japan, and South Korea are rapidly integrating ISCC-PLUS certified polymers into construction and industrial PVC applications, supported by large-scale manufacturing capabilities and rising sustainability awareness.

Emerging Markets: Infrastructure Expansion Creates Opportunity

India, Southeast Asia, Latin America, and the Middle East are experiencing increased demand due to:

- Rapid urbanization

- Infrastructure development

- Adoption of green construction practices

- Rising exports of certified polymer products

Market Segmentation Insights

By Application

- Construction & Infrastructure – Largest segment, driven by pipes, profiles, and fittings

- Electrical & Electronics – Insulation and cable applications

- Industrial Applications – Sheets, coatings, and specialty components

- Packaging – Select rigid PVC applications

By Grade

- Construction-Grade Formulations – 42.1% market share in 2026

- Industrial-Grade Formulations

- Specialty & Modified PVC Grades

By End User

- Building & Construction

- Electrical & Cable Manufacturers

- Industrial Product Manufacturers

Challenges Impacting Market Growth

Higher Production Costs

ISCC-PLUS certified low-carbon PVC carries a premium due to certified feedstock sourcing, traceability requirements, and compliance costs.

Limited Availability of Certified Feedstocks

Supply constraints for bio-based and recycled raw materials can impact scalability and pricing stability.

Certification & Compliance Complexity

Achieving and maintaining ISCC-PLUS certification requires rigorous audits and supply-chain transparency, posing challenges for smaller manufacturers.

Competitive Landscape

The market is moderately consolidated, with key players focusing on:

- Expanding ISCC-PLUS certified product portfolios

- Investing in bio-based and recycled feedstocks

- Strengthening supply-chain traceability

- Partnering with construction and infrastructure leaders

Key Companies Profiled

- Westlake Corporation

- Shin-Etsu Chemical Co., Ltd.

- INEOS Group

- Formosa Plastics Corporation

- LG Chem

- Hanwha Solutions

- Occidental Chemical Corporation

- Vinnolit GmbH & Co. KG

Recent Developments

- 2024: Major PVC producers expanded ISCC-PLUS certified suspension PVC capacity to support low-carbon construction projects

- 2023: Construction material manufacturers increased procurement of mass-balance certified PVC to meet ESG targets

- 2022: Global chemical companies invested in bio-based feedstock integration and traceability systems

Future Outlook: Sustainable PVC Shapes the Next Decade

The next ten years will be transformative for the ISCC-PLUS certified low-carbon suspension PVC market, driven by:

- Green construction and infrastructure growth

- Corporate net-zero and ESG commitments

- Circular economy adoption

- Expansion of certified bio-based and recycled feedstocks

- Rising global demand for low-carbon building materials

As sustainability becomes central to material selection, ISCC-PLUS certified low-carbon suspension PVC is set to play a critical role in shaping a greener, more transparent plastics ecosystem through 2036.