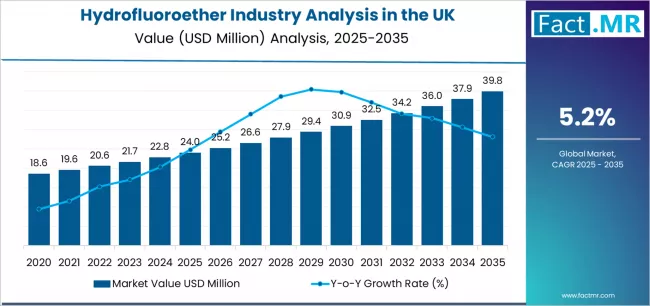

The UK hydrofluoroether market is set for steady expansion through 2035, driven by growing demand for low-global-warming-potential (GWP) solvents and heat-transfer fluids across electronics, aerospace, precision cleaning, and specialized industrial applications. According to a new United Kingdom-focused industry analysis by Fact.MR, the demand for hydrofluoroether in the UK is projected to rise from USD 24.0 million in 2025 to approximately USD 39.6 million by 2035, advancing at a CAGR of 5.2% and recording an absolute market growth of USD 15.6 million over the forecast period.

As environmental regulations tighten and industries seek safer, non-ozone-depleting, and non-flammable fluid alternatives, HFE solutions are becoming an essential component of sustainable industrial transformation in the UK.

Strategic Market Drivers

Electronics and Semiconductor Cooling Demand Surges

With the continued expansion of data centers, 5G infrastructure, and advanced semiconductor manufacturing in the UK, HFEs are gaining traction as preferred dielectric cooling and immersion heat-transfer fluids, owing to their:

- Ultra-low GWP profiles

- High thermal stability

- Electrical non-conductivity

- Fast evaporation and non-flammability

These attributes are increasingly critical for high-density computing environments where reliability and environmental safety are non-negotiable.

Browse Full Report: https://www.factmr.com/report/united-kingdom-hydrofluoroether-industry-analysis

Growth in Aerospace & High-Precision Engineering

The UK aerospace sector—including defense avionics, satellite manufacturing, and aircraft maintenance—is accelerating adoption of HFE fluids for:

- Precision component cleaning

- Heat management in constrained environments

- Sensitive electronic and optical system maintenance

Their ability to operate without corrosion, fire risk, or residue is positioning HFE products as mission-critical specialty fluids in the UK’s innovation-driven industrial landscape.

Rising Need for Sustainable Cleaning Solvents

The transition away from high-GWP and ozone-depleting solvents in industries such as automotive electronics, medical devices, and precision cleaning is fueling demand for eco-efficient, fast-drying specialty solvents like HFEs.

Government-backed net-zero objectives and industrial sustainability mandates are acting as powerful incentives for manufacturers to integrate low-impact fluid chemistries into their production systems.

Advancements in Material-Compatible Fluid Chemistry

Ongoing innovations in dielectric fluid blends, rare-earth-free alternatives, and improved chemical compatibility are broadening HFE usability in sensitive applications, including:

- Surgical instrument cleaning

- Optical component maintenance

- Advanced thermal interface systems in robotics

Market Segmentation Insights

By Functionality

- Solvents & Cleaning Fluids – Largest segment, backed by demand from precision engineering and medical cleaning.

- Dielectric Heat-Transfer & Immersion Cooling Fluids – Fastest-growing, aligned with growth in data infrastructure and electronics.

By End-Use Industry

- Electronics & Data Centers – High-growth segment, driven by thermal management needs.

- Aerospace & Defense – Strong adoption, for sensitive system maintenance.

- Medical & Precision Cleaning – Increasing uptake, for residue-free and rapid-drying applications.

- Industrial Engineering – Consistent demand, for non-flammable, stable specialty fluids.

Challenges Impacting Market Growth

Premium Product Cost

HFE fluids remain costlier than conventional solvents due to highly engineered chemical properties, limiting wider adoption in price-sensitive segments.

Limited Domestic Production Capacity

While the UK is a strong end-user hub, reliance on imports and specialized global supply chains for specific HFE formulations can impact long-term pricing stability and availability.

Need for Application-Specific Compatibility Testing

Certain HFE formulations require in-depth validation for material, elastomer, and surface compatibility, increasing onboarding time for manufacturers.

Competitive Landscape

The UK HFE market remains technology-focused rather than volume-driven, with companies prioritizing:

- Low-GWP dielectric fluid innovation

- Cooling fluid efficiency improvements

- Thermal interface chemistry enhancement

- Safe, non-flammable cleaning solvent development

Although the market is smaller compared to global solvent categories, it carries high strategic value across defense, electronics, and medical applications.

Key Companies Profiled by Fact.MR

- 3M

- Solvay S.A.

- Honeywell International

- Arkema S.A.

- Daikin Industries Ltd.

- The Chemours Company

Companies are increasingly exploring alternative fluid chemistries and sustainability-led dielectric solutions, while investing in recycling models and advanced immersion cooling applications for digital infrastructure.

Recent Industry Trends

- 2024: Growing emphasis on immersion cooling pilots for data centers using dielectric fluid chemistries like HFEs.

- 2023: Increased demand from aerospace for engineering-safe cleaning and maintenance solvents.

- 2022: Specialty fluid suppliers align product portfolios with UK’s low-GWP and safety mandates.

Future Outlook: Sustainability-Aligned Specialty Fluid Expansion

Through 2035, the UK is expected to witness:

- Greater penetration of HFE fluids in electronic cooling and aerospace systems

- Increased replacement of legacy solvents with low-GWP cleaning fluids

- Expansion of data-infrastructure dielectric cooling ecosystems

- Shift toward environment-safe, non-flammable fluid adoption

As industries in the UK accelerate digital and sustainability transformation, hydrofluoroether technology is positioned as one of the country’s most reliable low-GWP specialty fluid solutions.