The United Kingdom’s hydrofluoroether (HFE) industry is poised for steady long-term expansion as regulatory pressure, sustainability goals, and advanced manufacturing needs increasingly shift demand toward low–global-warming-potential (GWP) solvent alternatives.

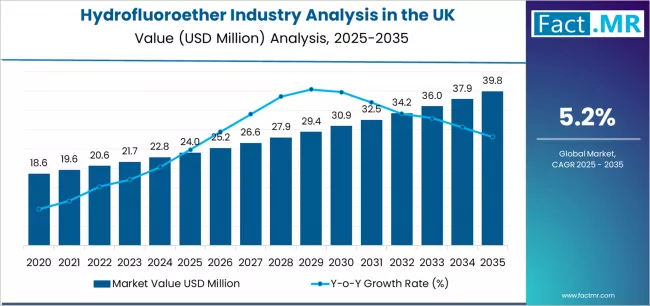

According to a detailed analysis published here the UK HFE market is projected to grow from USD 24.0 million in 2025 to USD 39.6 million by 2035, rising at a CAGR of 5.2% and recording an absolute increase of USD 15.6 million over the forecast period.

Hydrofluoroethers—recognized for their low toxicity, thermal stability, minimal environmental impact, and superior solvency—are becoming central to next-generation industrial cleaning, precision electronics, and specialty chemical applications.

Key Market Drivers

Transition Toward Low-GWP and Non-Ozone-Depleting Solvents

As the UK accelerates compliance with F-gas regulations and climate targets, industries are rapidly replacing high-GWP solvents with environmentally responsible HFEs. Their non-flammable nature and excellent materials compatibility make HFEs an ideal alternative for precision cleaning, vapor degreasing, and heat transfer applications.

Growing Use in Electronics and Semiconductor Manufacturing

The rising sophistication of UK electronics production—including printed circuit boards, microelectronic components, EV battery systems, and aerospace electronics—continues to push demand for ultra-clean, residue-free solvents. HFEs serve as efficient cleaning agents that meet stringent purity and reliability requirements.

Expanding Application in Industrial and Medical Cleaning

HFEs’ benign toxicological profile and low reactivity are driving their adoption across industrial equipment maintenance, medical device sterilization, and aerospace cleaning operations. Their use ensures safety, compliance, and performance even in highly regulated sectors.

Sustainability and Green Manufacturing Initiatives

As UK industries move toward circular, low-impact manufacturing systems, HFEs gained traction for their recyclability, low environmental risk, and suitability for closed-loop cleaning systems—reducing carbon footprint and operational emissions.

Browse Full Report: https://www.factmr.com/report/united-kingdom-hydrofluoroether-industry-analysis

Regional Market Insights

England: Strongest Market Concentration

Home to key electronics clusters, aerospace hubs, and advanced manufacturing units, England accounts for the largest share of the UK HFE market. Growing investment in precision engineering and clean production technologies is accelerating uptake.

Scotland: Rising Opportunities in High-Tech and Energy Sectors

Scotland’s expanding semiconductor activity, renewable energy components production, and biomedical device manufacturing support strong growth prospects for HFEs.

Wales & Northern Ireland: Emerging Adoption

Developing industrial bases and rising interest in regulatory-compliant solvents are enabling moderate but consistent adoption of HFEs across specialized manufacturing and industrial cleaning applications.

Market Segmentation Highlights

By Product Type

- Pure Hydrofluoroethers – Preferred for electronics, aerospace, and precision cleaning.

- Blended Hydrofluoroether Formulations – Customized for degreasing, coating, and thermal management solutions.

By End Use

- Electronics & Semiconductor Manufacturing – Leading application for high-purity HFEs.

- Industrial Cleaning – Broad adoption in equipment maintenance and vapor degreasing.

- Aerospace & Defense – Critical use in precision cleaning and component preparation.

- Healthcare & Medical Devices – Growing use in safe, high-performance sterilization.

- Automotive & EV Manufacturing – Expanding role in battery, sensor, and component cleaning.

Market Challenges

Despite solid growth prospects, the UK HFE market faces several challenges:

- High Product Cost: Premium pricing of HFEs may limit their use in cost-sensitive industrial segments.

- Dependence on Imports: Limited domestic production increases exposure to global supply fluctuations.

- Regulatory Scrutiny: Ongoing environmental assessments require continuous product innovation.

- Availability of Alternatives: Hydrofluorocarbons (HFCs) and emerging bio-based solvents compete in certain applications.

Competitive Landscape

The UK hydrofluoroether market remains moderately consolidated, with global chemical manufacturers strengthening their presence through strategic distribution partnerships, technical support, and new environmentally safe product lines.

Prominent Companies Include:

- 3M

- Honeywell International

- Chemours

- AGC Inc.

- Solvay

- Daikin Industries

- Tianhe Chemicals

These companies focus on developing next-generation HFEs with lower GWP, improved cleaning performance, and enhanced thermal stability to support high-tech UK industries.

Future Outlook: Toward Eco-Efficient Solvent Innovation

Over the next decade, the UK hydrofluoroether industry will play a pivotal role in driving sustainable transformations across electronics, aerospace, medical, and industrial manufacturing sectors.

As regulatory pressures intensify and industries transition to climate-aligned processes, HFEs will gain strategic importance as essential, high-performance cleaning and heat-transfer fluids.

Businesses that invest in product innovation, supply chain resilience, and application-specific HFE formulations will be best positioned to capitalize on the market’s rising potential through 2035 and beyond.