The global automotive and mobility industry is entering a decade defined by performance optimization, safety compliance, and materials innovation. Within this landscape, high-temperature brake line couplings have emerged as a mission-critical component, supporting braking systems that must perform reliably under extreme thermal and mechanical stress. The high-temperature brake line couplings market is positioned for steady, data-backed growth, offering actionable intelligence for manufacturers, OEMs, suppliers, and investors focused on long-term value creation.

Market Size, Growth Outlook, and Value Trajectory

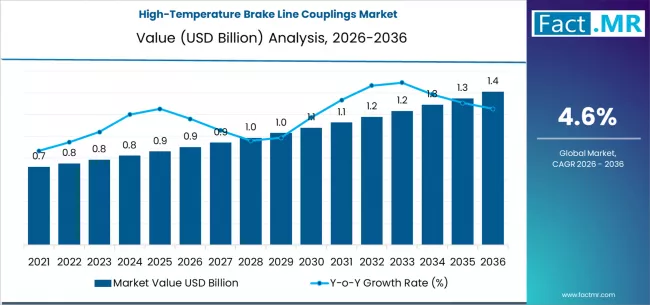

Analysis indicates that the global high-temperature brake line couplings market is projected to grow from USD 0.9 billion in 2026 to USD 1.4 billion by 2036, reflecting a compound annual growth rate (CAGR) of 4.6% over the forecast period. This growth represents a total market expansion of approximately 48.4%, underscoring the segment’s resilience and its essential role in next-generation braking architectures.

Unlike short-cycle automotive components, brake line couplings benefit from long product lifecycles, stringent safety standards, and recurring demand across OEM and aftermarket channels. These characteristics provide a stable revenue base while still allowing room for innovation-led differentiation.

Core Growth Drivers: Safety, Heat Resistance, and Vehicle Evolution

Several macro and micro-level drivers are shaping demand. First, rising brake system temperatures—driven by higher vehicle weights, increased power output, and the rapid adoption of electric and hybrid vehicles—are intensifying the need for couplings that can withstand sustained thermal stress without deformation or leakage.

Second, global safety regulations continue to tighten. Regulatory bodies in key markets are enforcing stricter braking performance and durability standards, pushing OEMs to specify high-temperature-resistant materials and precision-engineered couplings as standard equipment.

Third, the evolution of vehicle platforms, including EVs, performance vehicles, and heavy-duty commercial fleets, is reshaping braking system design. Regenerative braking, higher braking loads, and compact system architectures all require couplings that deliver both thermal stability and mechanical integrity under complex operating conditions.

Material Trends: Stainless Steel Leads the Market

From a materials perspective, stainless steel is the dominant material category, accounting for over half of the global market share in 2026. Stainless steel’s leadership is rooted in its superior properties: high thermal resistance, corrosion resistance, pressure tolerance, and long service life.

For product development teams, this dominance signals two parallel opportunities. On one hand, optimizing stainless steel coupling designs—through improved alloys, surface treatments, or weight reduction—remains a core competitive lever. On the other, there is growing interest in advanced composites and specialty alloys for niche applications where weight savings or extreme temperature thresholds are critical.

Sales Channels: OEM Line-Fit as the Primary Revenue Engine

In terms of sales channels, OEM line-fit applications account for more than 65% of total market share, making them the primary revenue driver through 2036. This reflects the increasing integration of high-temperature couplings at the vehicle design stage, rather than as aftermarket upgrades.

For suppliers, this trend reinforces the importance of early-stage collaboration with OEMs, compliance with automotive qualification standards, and the ability to scale production while maintaining tight tolerances. Meanwhile, the aftermarket segment continues to offer steady, margin-friendly demand, particularly in performance vehicles, commercial fleets, and regions with aging vehicle populations.

Regional Insights: Where Growth Is Concentrated

Geographically, North America, Europe, and Asia Pacific are the key growth regions. North America and Europe benefit from strong regulatory frameworks, high adoption of advanced braking technologies, and a mature OEM base. Asia Pacific, meanwhile, stands out for its expanding vehicle production volumes, rapid industrialization, and growing emphasis on safety and quality standards.

For growth planning, these regional dynamics suggest differentiated strategies: technology leadership and compliance-driven value propositions in Western markets, and scale, cost efficiency, and localization in Asia Pacific.

Strategic Implications for Stakeholders

The data-driven insights provide several high-value takeaways for decision-makers:

-

For manufacturers, sustained market growth at a 4.6% CAGR supports continued investment in R&D, automation, and material science.

-

For OEMs, early adoption of advanced coupling solutions can improve system reliability, reduce warranty risk, and enhance brand perception around safety.

-

For investors and strategists, the market’s moderate but stable growth profile, combined with high entry barriers and regulatory dependence, positions it as a defensible, long-term industrial segment.

Browse Full Report : https://www.factmr.com/report/high-temperature-brake-line-couplings-market

Looking Ahead: Innovation as a Growth Multiplier

While the topline growth rate is steady rather than explosive, innovation remains a critical multiplier. Smart manufacturing, advanced testing under extreme thermal cycles, and integration with next-generation braking systems will define competitive advantage over the next decade. Companies that align product development with these clear data signals will be best positioned to capture incremental share in a market where reliability, compliance, and performance are non-negotiable.

In summary, the High-Temperature Brake Line Couplings Market 2026–2036 is poised for steady growth, offering a data-driven foundation for strategic planning, product innovation, and sustainable development. As vehicles continue to evolve and safety expectations rise, high-temperature brake line couplings will remain a small but indispensable component—quietly powering the future of mobility with precision and resilience.