The hemato-oncology testing market — covering diagnostics and monitoring of blood cancers and hematological malignancies (such as leukemia, lymphoma, myeloma, and related disorders) — is expected to see robust growth over the coming decade. Increasing incidence of blood cancers, rising adoption of advanced molecular diagnostics, and growing emphasis on personalized and precision medicine are fueling strong demand. Enhanced awareness, improved access to diagnostic services, and expanding healthcare infrastructure are also supporting uptake, positioning hemato-oncology testing as a critical segment in global oncology diagnostics.

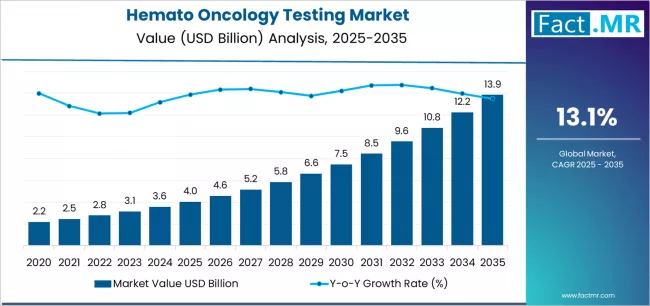

Quick Stats (2025–2035)

-

Global Market Value 2024–2025 (baseline): Approx. USD 3.6–4.4 billion

-

Short-Term Forecast (by 2030): Market projected to reach around USD 7.4–7.9 billion

-

Estimated Growth (2025–2030): CAGR ~12–13%

-

Long-Term Forecast (by 2035): Given ongoing trends, market is expected to expand significantly beyond 2030 baseline, sustained by recurrent testing, technological advancements, and expanded patient detection and monitoring.

-

Major Cancer Type Segment (current): Lymphoma — holds the largest share among hemato-oncology tests.

-

Dominant Testing Service/Product Mix: Services (diagnostic & monitoring) remain a key share, with assay kits & reagents rising rapidly due to molecular testing demand.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=8235

Key Market Drivers

1. Rising Incidence & Prevalence of Hematologic Malignancies

-

Blood cancers such as leukemia, lymphoma, and myeloma are showing increasing incidence globally, leading to higher demand for diagnostic and monitoring services.

-

Early detection campaigns, increased screening, and better healthcare access result in more diagnosed cases — driving testing volume across all stages (diagnosis, treatment planning, monitoring, relapse detection).

2. Advances in Molecular Diagnostics & Precision Medicine

-

Growth in molecular technologies — including PCR, next-generation sequencing (NGS), flow cytometry, cytogenetics and immunophenotyping — has improved the sensitivity and accuracy of blood-cancer diagnostics.

-

Molecular profiling enables personalized treatment approaches, targeted therapies, and better prognosis tracking — boosting demand for complex, high-value tests.

-

Emerging methods (liquid biopsy, minimal residual disease (MRD) detection, single-cell sequencing) are expanding testing use cases beyond initial diagnosis to long-term monitoring and relapse detection.

3. Shift Toward Early Detection & Monitoring / Surveillance

-

With improved awareness and screening protocols, more at-risk patients and early-stage cases are being tested.

-

Post-treatment monitoring, minimal residual disease detection, and long-term follow-up testing are becoming standard care in many settings — generating recurring testing demand.

4. Growth in Healthcare Infrastructure & Oncology Services

-

Expansion of specialized oncology centers, diagnostic laboratories, and hospital-based testing facilities increases access to hemato-oncology diagnostics.

-

Increased funding, government support, and private investment in cancer care facilitate adoption of advanced diagnostic services.

5. Demand for Personalized & Targeted Therapies

-

As therapeutic regimens move toward targeted treatments, immunotherapies, and precision medicine, clinicians rely on detailed molecular and genetic test data to guide treatment decisions.

-

This increases reliance on high-end hemato-oncology tests, driving demand for sophisticated assay kits, reagents, and diagnostic workflows.

Market Structure & Segment Insights

By Test Product/Service Type

-

Diagnostic & Monitoring Services: Use in hospitals, diagnostic labs, and oncology centers remains largest share — for initial diagnosis, staging, and treatment monitoring.

-

Assay Kits & Reagents: Rapidly growing segment as molecular diagnostics adoption increases; these kits support PCR, NGS, cytogenetics, flow cytometry and other test formats.

By Testing Technology

-

Molecular Diagnostics (PCR, NGS, etc.): Leading and fastest-growing technology segment — chosen for sensitivity, accuracy, and ability to detect genetic and molecular markers.

-

Flow Cytometry & Cytogenetics: Essential for classifying blood cancers, immunophenotyping, and monitoring disease progression.

-

Immunohistochemistry (IHC) & Other Conventional Methods: Still in use, especially in settings with limited molecular infrastructure or for complementary diagnostic confirmation.

By Cancer Type / Disease Indication

-

Lymphoma (Hodgkin & Non-Hodgkin): Currently dominates the market by cancer type, due to high incidence, extensive testing needs including diagnosis, classification, and monitoring.

-

Leukemia & Other Hematologic Cancers: Significant share — especially for subtypes requiring continuous monitoring.

-

Myeloma / Multiple Myeloma & Related Disorders: Growing demand due to rising prevalence and need for specialized molecular and monitoring tests.

By End-User / Testing Setting

-

Hospitals & Specialized Oncology Centers: Largest end-user group — with capacity for complex diagnostics, longitudinal patient monitoring, and integrated treatment workflows.

-

Diagnostic Laboratories & Reference Labs: Increasing use especially for molecular and high-throughput testing outsourced from hospitals.

-

Research Institutions & Biopharma / CROs: Using assays and reagents for drug development, clinical trials, and biomarker discovery — contributing to overall market demand.

Challenges & Market Constraints

-

High Cost of Advanced Diagnostic Tests: Molecular diagnostics, sequencing, and advanced assays involve expensive equipment, reagents, and technical expertise — which may limit adoption in resource-constrained settings.

-

Infrastructure & Skilled Personnel Requirements: Accurate hemato-oncology testing requires trained technicians, pathologists, molecular biologists, and robust lab infrastructure — gaps in these areas limit reach.

-

Regulatory & Reimbursement Uncertainties: In some regions, high costs, limited insurance coverage, or regulatory barriers can delay or restrict test adoption.

-

Accessibility & Equity in Low-Resource Regions: Lack of diagnostic infrastructure and limited healthcare funding may hinder access to advanced testing for hematologic cancers in underserved areas.

Opportunities & Strategic Directions

1. Expansion of Molecular & Precision-Diagnostics Capacity

-

Investment in diagnostic labs and molecular testing infrastructure can widen access — especially for personalized and targeted therapy support.

-

Introducing cost-effective, high-throughput, or multiplex assays to lower per-test cost and improve adoption.

2. Growth in Monitoring & Minimal Residual Disease (MRD) Testing

-

Increasing use of liquid biopsy, MRD assays, and long-term surveillance creates recurring revenue streams beyond initial diagnosis.

-

Development of standardized MRD protocols and affordable assays could expand usage substantially.

3. Integration with Personalized Therapy & Drug-Diagnostics Collaboration

-

As more targeted therapies and immunotherapies emerge, demand for companion diagnostics will rise.

-

Partnerships between diagnostic developers, pharmaceutical companies, and healthcare providers can drive adoption and improve patient outcomes.

4. Expansion in Emerging Markets & Under-Served Regions

-

Building diagnostic infrastructure in emerging economies can tap unmet needs — especially given rising cancer incidence globally.

-

Mobile or decentralized testing solutions (remote labs, sample transport, regional centers) can broaden access.

5. Innovation in Assay Kits & Reagents, and Cost-Effective Testing Solutions

-

Development of affordable, robust test kits for flow cytometry, PCR, and NGS tailored for varying lab capacities.

-

Streamlining workflows, reducing turnaround times, and offering bundled diagnostic solutions will attract more users.

Outlook

The hemato-oncology testing market is on a strong growth trajectory, with global value expected to nearly double between the mid-2020s and the early 2030s. Continuous growth will be driven by increasing incidence of blood cancers, widespread adoption of molecular diagnostics, expansion of oncology care infrastructure, and rising demand for personalized medicine and long-term disease monitoring.

Providers that invest in scalable, cost-effective diagnostic solutions, expand geographic reach, and leverage partnerships for therapy-linked diagnostics will be well-positioned to lead. As the field evolves, hemato-oncology testing is likely to become more accessible, standardized, and central to global cancer care — making it a critical component of modern oncology diagnostics and treatment planning worldwide.

Browse Full Report: https://www.factmr.com/report/hemato-oncology-testing-market