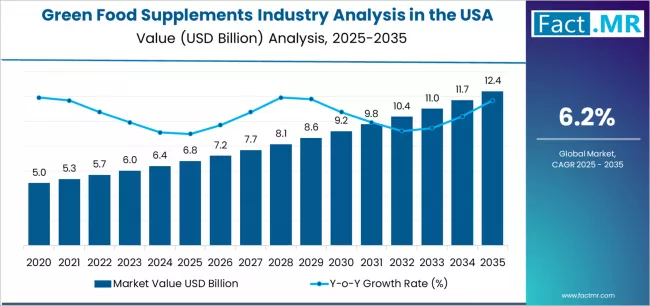

The United States green food supplements market is set for strong expansion over the next decade, fueled by rising consumer focus on preventive healthcare, clean-label nutrition, plant-based supplementation, and sustainable wellness solutions. According to a new analysis, demand for green food supplements in the USA is projected to rise from USD 6.8 billion in 2025 to approximately USD 12.5 billion by 2035, reflecting a 95.8% market growth, at a CAGR of 6.2%, while recording an absolute increase of USD 5.7 billion during the forecast period.

The increasing inclination toward nutrient-dense algae, grasses, and phytonutrient formulations—combined with greater awareness around detoxification, immunity, and gut health—is significantly shaping product innovation and consumer adoption nationwide.

Strategic Market Drivers

Clean-Nutrition Culture Accelerates Green Supplement Uptake

American consumers are increasingly embracing green superfoods such as spirulina, chlorella, wheatgrass, barley grass, moringa, and seaweed extracts for their:

- High antioxidant profile

- Dense micronutrient composition

- Natural detox properties

- Plant-derived protein and fiber support

The trend is rapidly gaining traction across fitness communities, holistic nutrition programs, juice-blend supplement formats, and clean-ingredient dietary routines.

Browse Full Report: https://www.factmr.com/report/united-states-green-food-supplements-industry-analysis

Preventive Wellness and Immunity Support Drive Demand

With growing lifestyle-linked health concerns, consumers are prioritizing proactive nutrition for:

- Immune resilience

- Digestive health

- Stress reduction & energy balance

- Metabolic and inflammatory response support

Green food supplements are now widely recognized as functional additions to daily wellness regimens, furthering mainstream retail adoption and physician-recommended supplement categories.

Rise of Plant-Based and Sustainable Supplement Choices

The sustained shift toward vegan, organic and sustainably-sourced nutrition has encouraged manufacturers to replace synthetic additives with:

- USDA-certified ingredients

- Non-GMO grasses and microgreens

- Clean extraction methods

- Eco-friendly packaging and responsible sourcing

This transition is strongly reinforced by evolving regulatory support for organic and natural dietary supplement labeling standards.

Innovation in Bioavailability & Superfood Blends

Emerging formulation upgrades including fermented green blends, enzyme-activated algae, IoT-enabled wellness tracking integrations, personalized nutrition bundles, and higher absorbability green capsules/powders are boosting performance potential and repeat consumer use.

Market Segmentation Insights

By Product Form

- Powder Blends – Largest segment due to flexibility in smoothies, protein shakes, and health drinks.

- Tablets & Capsules – Steady growth driven by convenience in daily nutrition intake.

- Liquid & Gummies – Rapidly growing as clean-flavor and plant-based gummy technologies evolve.

By Key Ingredient Type

- Algae-Based (Spirulina, Chlorella) – Most preferred for detox and immunity support.

- Green Grasses (Wheatgrass, Barley Grass, Oat Grass) – Popular for energy and alkalizing benefits.

- Leafy Supergreens (Moringa, Kale, Matcha, Sea Greens) – High adoption for antioxidants and metabolism support.

By Distribution Channel

- Health & Nutrition Stores – Highest revenue share due to targeted wellness consumers.

- E-commerce Platforms – Fastest-growing segment supported by subscription supplement models.

- Supermarkets & Pharmacies – Rising penetration through functional supplement aisles.

- Fitness & Wellness Centers – Increased bundling with workout nutrition and detox plans.

Challenges Impacting Market Growth

Premium Pricing of Certified Green Ingredients

Organic and sustainably sourced microgreens, algae, and grasses increase final product costs, creating friction in price-sensitive shopper segments.

Sourcing Complexity and Seasonal Variability

Dependence on natural farming cycles and algae harvesting impacts production consistency and bulk pricing stability.

Regulatory Compliance for Functional Claims

Green supplement brands face greater scrutiny to substantiate product claims, nutrition transparency, and label legitimacy, increasing operational costs.

Competitive Landscape

The U.S. market is moderately consolidated, with companies competing on:

- Organic certification

- Sustainable ingredient sourcing

- Clinical-backed phytonutrient claims

- Flavor-free/no-sweetener formulations

- Subscription-based supplement delivery

Key Companies Profiled

- Amazing Grass

- Now Foods

- Sunfood Superfoods

- GNC Holdings, Inc.

- The Vitamin Shoppe

- Nutrex Hawaii

- Garden of Life

- Green Foods Corporation

- KOS Naturals

- Earthrise Nutritionals

Industry players are increasingly investing in algae-derived protein concentrates, fermented greens, soil-independent vertical farming tie-ups, regenerative farm sourcing, and rare-earth-free natural mineral enrichment.

Recent Industry Developments

- 2024: Introduction of fermented and enzyme-activated supergreen blends for improved digestibility and absorption.

- 2023: Expansion of subscription-based green nutrition supplement bundles supporting repeat purchasing trends.

- 2022: Large retail nutrition chains expand green supplement shelf space driven by organic wellness demand.

Future Outlook: Decade of Green-Wellness Expansion in the USA

The next decade will be defined by:

- Growing adoption of plant-based immunity nutrition

- Expansion of algae, microgreens and grass-powder consumption

- Strong e-commerce subscription sales

- Clean-label compliance

- Personalized phyto-nutrition supplement stacks

As American lifestyles continue to shift toward preventive, sustainable, and functional nutrition ecosystems, the USA green food supplements industry is positioned for long-term growth through 2035.