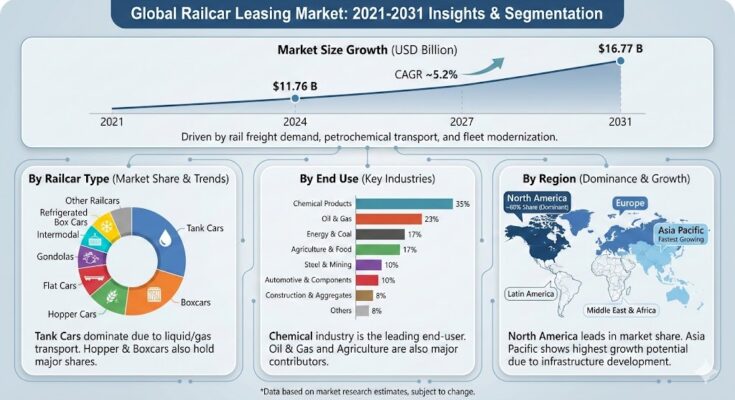

The global Railcar Leasing Market is poised for substantial growth over the next decade, driven by rising demand for cost-effective freight transportation, flexible logistics solutions, and the modernization of rail infrastructure. According to recent market intelligence, the market is projected to reach $11.8 billion by 2032, growing at a CAGR of 5.4% from 2025 to 2032.

This expansion underscores the increasing reliance on leased railcars as a strategic alternative to capital-intensive ownership, particularly in regions such as North America and Asia-Pacific, which together account for over 60% of the market share.

Data Highlights Industry Trends

-

Market Size & Growth: The global railcar leasing market was valued at $7.8 billion in 2024, up from $7.1 billion in 2023, reflecting a year-over-year growth of 9.9%. Analysts attribute this growth to surging industrial production, expanding e-commerce logistics, and rising cross-border trade.

-

Regional Insights: North America dominates the market with 38% of total revenue, driven by high rail freight utilization in the U.S. and Canada. The Asia-Pacific region is the fastest-growing, projected to witness a CAGR of 6.7% between 2025 and 2032, propelled by industrial expansion in China, India, and Southeast Asia.

-

Segment Performance: Tank cars remain the largest segment, representing 42% of the market, followed by hopper cars (28%) and boxcars (18%). Notably, demand for refrigerated railcars is increasing at a 7.2% CAGR, reflecting the growth of perishable goods transportation.

Driving Forces Behind Market Expansion

-

Operational Flexibility: Leasing provides shippers and logistics operators with scalable solutions, reducing the burden of upfront capital expenditure. A survey conducted by Rail Logistics Analytics (RLA) in 2025 found that 67% of freight operators prefer leasing over ownership for seasonal and cyclical demand fluctuations.

-

Technological Advancements: Smart railcars equipped with IoT sensors, GPS tracking, and predictive maintenance systems are reshaping leasing strategies. Companies adopting these technologies have reported up to 15% reductions in maintenance costs and enhanced asset utilization.

-

Regulatory & Environmental Factors: Governments worldwide are investing in rail infrastructure as a sustainable transport solution. With rail emissions 75% lower than road transport, companies increasingly opt for leased railcars to meet ESG targets while optimizing supply chains.

Competitive Landscape and Key Players

The railcar leasing market is highly fragmented, featuring a mix of global leasing companies, regional operators, and specialized service providers. Leading players include FreightCar America, Trinity Industries, The Greenbrier Companies, Union Tank Car Company, and CIT Rail, collectively accounting for nearly 48% of global market revenue.

Market consolidation through strategic acquisitions and partnerships is intensifying. For instance, in 2024, Trinity Industries expanded its leasing portfolio in North America by acquiring 5,000 new tank and hopper cars, aimed at serving energy and chemical sectors.

Strategic Implications for Stakeholders

For investors, the railcar leasing market represents a high-growth opportunity, particularly in emerging economies where rail infrastructure investments are accelerating. Logistics providers can leverage leasing to reduce capital outlay, optimize fleet utilization, and enhance operational flexibility. Additionally, technology integration offers a competitive edge through predictive analytics, real-time tracking, and automated fleet management.

Future Outlook

The market’s growth trajectory is expected to remain strong, with analysts projecting a $11.8 billion valuation by 2032. Key factors include:

-

Increasing intermodal freight demand driven by e-commerce and industrial supply chain diversification.

-

Rising preference for sustainable transport solutions aligned with ESG mandates.

-

Technological innovation in railcar design, tracking, and predictive maintenance.

As companies navigate fluctuating freight volumes and rising logistics costs, leased railcars provide a reliable, scalable, and cost-efficient solution, ensuring continuity and flexibility in supply chain operations.

Browse Full Report : https://www.factmr.com/report/264/railcars-leasing-market

About the Report

The insights presented in this release are based on the Global Railcar Leasing Market Report 2025-2032, a comprehensive market intelligence study that incorporates revenue forecasting, segmental analysis, competitive benchmarking, and regional dynamics. The report leverages proprietary databases, industry surveys, and regulatory filings to provide actionable insights for investors, logistics providers, and rail operators worldwide.