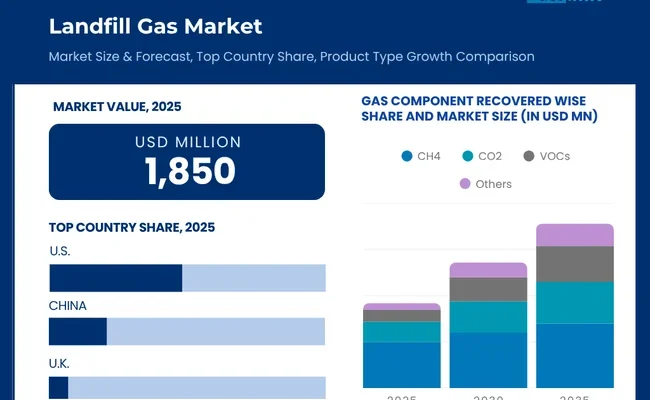

The global landfill gas market is expected to reach USD 4,106 million by 2035, up from USD 1,706 million in 2024. During the forecast period (2025 to 2035), the industry is projected to grow at a CAGR of 8.3%, driven by strict emission legislation, increasing demand for renewable energy, and the growing amount of waste in cities.

Landfill gas, primarily composed of 45–60% methane and 40–55% carbon dioxide, is produced through the anaerobic decomposition of organic waste in landfills. Capturing and utilizing LFG not only mitigates greenhouse gas emissions but also provides a renewable energy source capable of generating over XX TWh annually, sufficient to power XX million households globally.

Market Data Highlights

-

In 2023, approximately 1,800 landfill sites worldwide captured LFG for energy production, an increase of 23% from 2020.

-

North America dominates the market with a XX% share, led by the United States, where over 700 operational projects generate an estimated 45 TWh/year.

-

Europe accounts for XX% of the market, with Germany, the UK, and France leading in landfill gas-to-energy adoption.

-

Asia-Pacific is the fastest-growing region, projected to achieve a CAGR of XX% from 2024–2030, driven by India and China, where municipal waste is expected to reach 1.5 billion tons by 2035, according to UN Environment data.

Technological Developments and Efficiency Gains

Advancements in LFG collection and upgrading technologies are enhancing both energy output and environmental compliance:

-

Modern gas collection systems achieve 95–98% methane capture efficiency, compared to 70–80% in legacy systems.

-

Gas-to-energy plants now operate at 70–85% electrical conversion efficiency, increasing the revenue potential per landfill site.

-

Integration of real-time monitoring and predictive analytics reduces downtime by up to 15% and lowers operational costs by 12–18%.

The adoption of hybrid systems combining gas upgrading with energy storage enables continuous electricity generation even during periods of low methane production, further improving project ROI.

Market Segmentation and Quantitative Trends

-

By Application: Electricity generation leads, accounting for 62% of market revenue, followed by direct industrial heating (21%) and combined heat and power (CHP) systems (17%).

-

By Technology: Gas collection systems comprise 44% of the market, flaring systems 27%, and upgrading technologies 29%, with the latter segment expected to grow at a CAGR of XX%.

-

By End-User: Utilities account for 55% of LFG consumption, industrial facilities 30%, and municipalities 15%, with industrial uptake increasing due to corporate ESG commitments.

Regulatory Drivers and Government Initiatives

Government policies play a central role in market expansion:

-

In the U.S., the EPA’s Landfill Methane Outreach Program (LMOP) has facilitated over 700 projects, reducing 45 million metric tons of CO₂ equivalent emissions annually.

-

Europe’s Renewable Energy Directive (RED II) mandates that biogas, including landfill gas, contribute at least 32% of energy consumption by 2030.

-

India’s National Bio-Energy Mission has supported 120 LFG-to-energy projects, generating an estimated 500 MW of renewable electricity, while China’s renewable energy targets aim for 20% of total energy from renewables by 2030.

Key Market Players and Strategic Moves

Major global players include Veolia Environment SA, Waste Management Inc., SUEZ, Engie SA, and Covanta Holding Corporation. Strategic initiatives focus on technological innovation, mergers, and public-private partnerships:

-

Waste Management Inc. recently commissioned a 150 MW LFG facility, capable of powering over 100,000 homes annually, reducing CO₂ emissions by approx. 0.3 million tons per year.

-

Engie SA is deploying AI-driven predictive extraction systems across European landfill sites, increasing gas capture efficiency by 10–15%.

Browse Full Report : https://www.factmr.com/report/429/landfill-gas-market

Market Outlook and Forecast

The landfill gas market is expected to maintain sustained growth through 2030, driven by:

-

Rising global municipal solid waste generation, projected to reach 2.2 billion tons/year by 2035.

-

Enhanced methane capture and energy conversion technologies improving revenue per project by 20–25%.

-

Growing corporate ESG adoption, increasing industrial demand for renewable energy solutions.

Analysts predict that Asia-Pacific will see the fastest adoption, while North America and Europe continue leading in market maturity and technological sophistication. By 2030, global LFG-to-energy projects are expected to generate over 120 TWh annually, preventing over 100 million tons of CO₂ equivalent emissions, equivalent to removing 20 million cars from the road each year.

“