The global transition toward electric mobility is reshaping material demand across automotive electronics, with flame retardant compounds emerging as a mission-critical enabler of safety, reliability, and regulatory compliance. Between 2026 and 2036, the EV Control Unit (ECU) Flame Retardant Compounds Market is expected to experience robust expansion, driven by accelerating electric vehicle (EV) penetration, rising power densities in electronic systems, and increasingly stringent fire-safety standards worldwide.

Market Size and Growth Trajectory

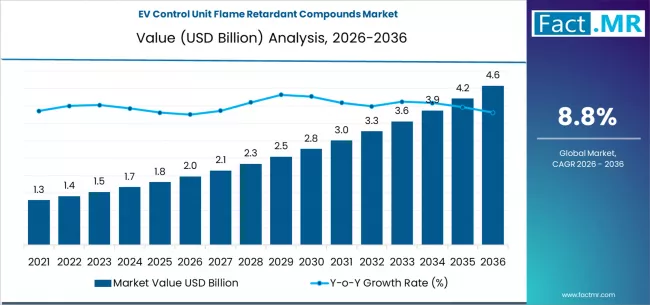

The global EV control unit flame retardant compounds market is projected to grow from approximately USD 2.0 billion in 2026 to about USD 4.6 billion by 2036, registering a compound annual growth rate (CAGR) of around 8.8% over the forecast period. This growth significantly outpaces the broader flame retardants market, highlighting the strategic importance of EV-specific electronic applications within the wider materials ecosystem.

The strong outlook reflects the rapid increase in electronic content per vehicle. Modern EVs rely on multiple control units for battery management systems (BMS), power electronics, inverters, onboard chargers, advanced driver-assistance systems (ADAS), and vehicle control modules. Each of these components operates under high thermal and electrical loads, making flame-retardant polymer compounds essential to mitigate fire risk and ensure long-term operational stability.

Key Strategic Trends Shaping the Market

1. Electrification and Power Density Growth

As automakers push for higher efficiency, faster charging, and extended driving ranges, ECU designs are becoming more compact while handling greater power loads. This trend drives demand for advanced flame retardant compounds capable of maintaining mechanical integrity, dielectric performance, and thermal resistance in confined spaces. The shift from internal combustion engine vehicles to EVs is a structural, long-term demand driver.

2. Shift Toward Halogen-Free Flame Retardants (HFFR)

Sustainability and regulatory compliance are reshaping material selection. Halogen-free flame retardant compounds are expected to account for over one-third of total market share, supported by tightening environmental regulations worldwide. OEMs and Tier-1 suppliers increasingly favor HFFR solutions to reduce toxic smoke emissions and improve recyclability without compromising fire performance.

3. Dominance of Engineering Plastics

Polyamide-based flame retardant compounds are projected to remain the leading polymer matrix, capturing more than 35% of market share by volume. Their combination of high heat resistance, mechanical strength, and compatibility with advanced flame-retardant additives makes them ideal for ECU housings, connectors, and structural electronic components.

Innovation Drivers and Technology Evolution

Innovation in the EV control unit flame retardant compounds market is increasingly focused on multi-functional performance. Beyond flame resistance, next-generation materials are being engineered to deliver:

- Enhanced thermal management, supporting efficient heat dissipation from power electronics.

- Lightweighting, which contributes directly to improved vehicle range and energy efficiency.

- Processability and design flexibility, enabling complex geometries required for compact ECU architectures.

R&D investments are also targeting inorganic and phosphorus-based flame retardants, which offer improved thermal stability and reduced environmental impact compared to traditional systems. The broader inorganic flame retardants segment is forecast to grow steadily, reinforcing its relevance for high-temperature EV electronics applications.

Regional Growth Hotspots

Asia-Pacific is expected to dominate the EV control unit flame retardant compounds market throughout the forecast period, led by China, Japan, and South Korea. China’s leadership in EV production, combined with strong domestic electronics manufacturing and government support for new-energy vehicles, positions the region as the primary growth engine.

Europe represents a high-value market driven by stringent safety and environmental regulations, as well as premium EV production. European automakers are early adopters of halogen-free and sustainable flame retardant materials, accelerating innovation and adoption rates.

North America is projected to witness steady growth, supported by rising EV adoption, investments in domestic battery and electronics manufacturing, and a renewed focus on vehicle safety standards.

Growth Opportunities Across the Value Chain

The 2026–2036 period presents significant opportunities for material suppliers, compounders, and technology developers:

- Strategic partnerships with EV OEMs and Tier-1 electronics suppliers to co-develop application-specific compounds.

- Expansion of sustainable product portfolios, including recyclable and bio-based flame retardant systems.

- Customization for next-generation ECUs, such as high-voltage architectures and integrated power modules.

As EV platforms evolve toward higher levels of electrification and autonomy, the role of flame retardant compounds will expand beyond compliance to become a differentiating factor in performance, safety, and brand trust.

Browse Full Report : https://www.factmr.com/report/ev-control-unit-flame-retardant-compounds-market

Outlook to 2036

Looking ahead, the global EV control unit flame retardant compounds market is set to nearly double in value by 2036, driven by the convergence of electrification, regulatory pressure, and materials innovation. Companies that align early with halogen-free technologies, advanced engineering plastics, and collaborative development models are likely to secure a competitive advantage in this fast-growing, high-value segment of the EV supply chain.

In an era where vehicle safety, sustainability, and electronic reliability are non-negotiable, flame retardant compounds for EV control units will remain a foundational material solution—quietly enabling the future of electric mobility.