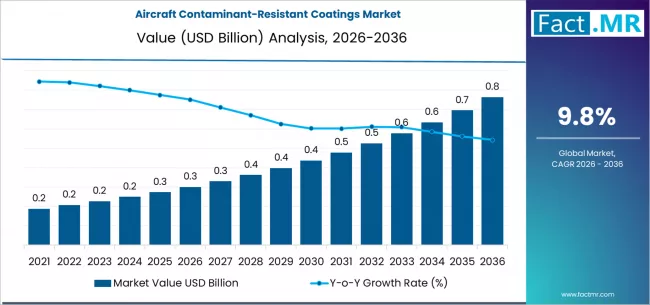

The global aircraft contaminant-resistant coatings market is poised for significant growth over the 2026–2036 period. The market is projected to expand from approximately USD 0.3 billion in 2026 to around USD 0.8 billion by 2036, reflecting a compound annual growth rate (CAGR) of about 9.8 percent. This growth is driven by increasing demand for advanced surface protection solutions, evolving regulatory standards, and the need for operational efficiency and lifecycle cost reduction in the aviation sector.

Market Segmentation

The market can be segmented by coating type, application layer, contaminant type, application area, and end-user. Among coating layers, topcoats are expected to dominate, capturing more than 50 percent of the market share in 2026. These coatings are widely adopted due to their superior protective capabilities against environmental contaminants and hydraulic fluids. Clearcoats and primers are also growing steadily as aircraft manufacturers and maintenance, repair, and overhaul (MRO) providers seek comprehensive surface protection solutions.

Application areas for these coatings are diverse. Nacelles and belly surfaces account for approximately 37 percent of the total market, as these sections of the aircraft are highly susceptible to contamination from fuel, oil, hydraulic fluids, and de-icing chemicals. Wing and fuselage lower surfaces, landing gear doors, and other exposed components also contribute significantly to market demand.

Contaminant types influencing the market include hydraulic and Skydrol fluids, fuel and oil, de-icing fluids, and other corrosive or abrasive materials. Hydraulic fluids and fuel-based contaminants are particularly critical, as they can severely degrade unprotected aircraft surfaces, increase maintenance cycles, and reduce the operational lifespan of components.

Market Drivers

The demand for contaminant-resistant coatings is primarily driven by the need to protect aircraft surfaces from harsh operational environments. Airlines and MRO providers are increasingly investing in coatings that reduce cleaning and maintenance frequency, thereby lowering operational costs. Advanced coatings also help maintain aerodynamic efficiency by preventing surface roughness caused by contaminant accumulation, which contributes to fuel savings and improved performance.

Operational efficiency is another key driver. Coatings that resist contaminants extend the service intervals of aircraft components and reduce downtime. This is particularly relevant for commercial airlines operating in high-frequency routes, where turnaround times and reliability are critical. By minimizing maintenance-related delays, contaminant-resistant coatings contribute to overall fleet efficiency and profitability.

Regulatory standards and industry policies are also influencing market growth. Stricter safety and quality requirements across regions such as North America, Europe, and Asia-Pacific encourage the adoption of advanced coatings. Airlines and OEMs are increasingly required to meet specific performance criteria for surface protection, driving demand for high-performance, contaminant-resistant coatings.

Market Restraints

Despite the growth potential, the market faces certain challenges. The high cost of advanced contaminant-resistant coatings can limit their adoption, particularly among budget-focused airlines and retrofit applications. Technical complexity in application and curing processes also poses a barrier, as specialized equipment and trained personnel are required for proper coating deployment.

Strategic Trends and Innovation Drivers

Innovation in the aircraft contaminant-resistant coatings market is focused on enhancing performance, reducing operational complexity, and improving cost-effectiveness. Automated application systems are gaining traction, allowing precise and consistent coating deployment while reducing labor costs. Such systems are particularly beneficial for large aircraft fleets, where manual application would be time-consuming and inconsistent.

Material innovation is another major trend. The development of hydrophobic, nano-engineered, and multi-functional coatings enhances resistance to multiple contaminant types while reducing maintenance frequency. These advanced materials can repel water, oils, and other fluids simultaneously, offering comprehensive protection for aircraft surfaces.

Multi-parameter compatibility is becoming increasingly important. Coatings that can be applied to different aircraft components and withstand a range of environmental conditions simplify logistics and inventory management for airlines and MRO providers. This versatility reduces the number of coating types required and streamlines maintenance operations.

Regional Outlook

The market exhibits variation in growth rates across different regions. China is expected to experience the fastest expansion, driven by rapid aviation infrastructure growth and increased regulatory focus on surface protection technologies. Brazil is also witnessing strong growth due to investment in maintenance infrastructure and expanding airline operations.

The United States, with its large commercial and military aviation sectors, maintains steady growth driven by precision performance requirements. South Korea and Germany represent mature markets, with high-quality standards and technological innovation supporting adoption. The United Kingdom and Japan continue to adopt advanced coating technologies to enhance fleet reliability and maintenance efficiency.

Competitive Landscape

The market is highly competitive, with several global and regional players actively developing innovative solutions. Key players focus on enhancing the chemical and physical properties of coatings, improving application methods, and expanding their geographic footprint. Companies are investing in research and development to produce coatings that provide longer-lasting protection, lower maintenance requirements, and better environmental sustainability.

Strategic collaborations between coating manufacturers, OEMs, and MRO providers are becoming increasingly common. Early integration of contaminant-resistant coatings during aircraft production offers a competitive advantage, as it reduces lifecycle costs and enhances surface performance from the outset.

Growth Opportunities

Several growth opportunities exist in the market. Partnering with OEMs to integrate advanced coatings during the production phase ensures early adoption and long-term market stability. Expanding MRO services to include automated and high-performance coating applications allows providers to capture additional revenue streams.

Emerging regions, particularly in Asia-Pacific, Latin America, and the Middle East, offer significant potential due to fleet expansion and regulatory alignment. Airlines in these regions are investing in modern aircraft and advanced maintenance practices, creating a favorable environment for contaminant-resistant coatings adoption.

Technological innovation remains a key growth driver. Development of hydrophobic, self-cleaning, and multi-functional coatings reduces maintenance cycles, improves aircraft performance, and enhances operational efficiency. Companies that can deliver high-performance, cost-effective, and environmentally friendly coatings are expected to capture a significant share of the growing market.

Browse Full Report : https://www.factmr.com/report/aircraft-contaminant-resistant-coatings-market

Conclusion

The global aircraft contaminant-resistant coatings market is set to experience strong growth over the next decade, driven by the increasing demand for high-performance surface protection, operational efficiency, and regulatory compliance. Key market drivers include the need to minimize maintenance cycles, protect against diverse contaminants, and improve aircraft lifecycle performance. Challenges such as high costs and technical complexity exist but are being addressed through innovation and automation.

The market presents ample opportunities for manufacturers and MRO providers, particularly in emerging regions and through technological advancements. Companies that prioritize multi-functional, high-performance coatings, coupled with efficient application methods, are well-positioned to capitalize on the growing demand. With continued innovation, strategic partnerships, and regional expansion, the aircraft contaminant-resistant coatings market is expected to reach significant value by 2036, offering sustainable growth and enhanced operational performance for the aviation industry.