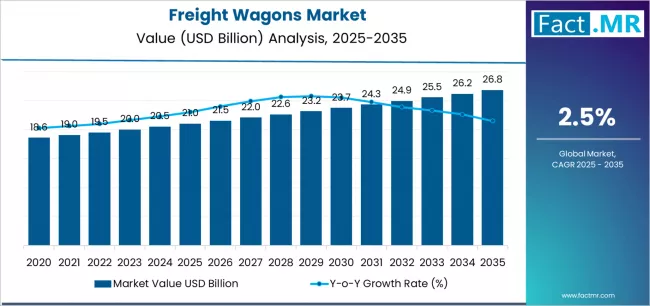

The global freight wagons market is set for steady expansion over the next decade, supported by rising rail freight volumes, growing cross-border trade, and increasing emphasis on cost-effective and low-carbon transportation. According to a new analysis by Fact.MR, the market is valued at USD 21.0 billion in 2025 and is projected to reach USD 26.8 billion by 2035, reflecting an absolute growth of USD 5.8 billion over the forecast period. This represents a total growth of 27.6%, with the market expanding at a CAGR of 2.5% from 2025 to 2035.

The shift toward sustainable logistics, modernization of rail infrastructure, and growing demand for bulk commodity transportation are significantly accelerating freight wagon adoption worldwide.

Strategic Market Drivers

Rail Freight Expansion Strengthens Demand

Rising movement of bulk goods such as coal, minerals, agricultural products, cement, steel, and containers is driving consistent demand for freight wagons. Rail remains a preferred mode for long-haul, heavy-load transportation due to its cost efficiency, high load capacity, and lower environmental impact compared to road freight.

Government investments in rail corridors and dedicated freight routes are further boosting wagon procurement.

Browse Full Report: https://www.factmr.com/report/3359/freight-wagons-market

Sustainability and Low-Carbon Transport Push

As countries work toward carbon reduction targets, rail freight is gaining momentum as a greener logistics solution. Freight wagons play a central role in reducing fuel consumption, emissions, and congestion, especially for intercity and cross-border freight movement.

Environmental regulations and sustainability commitments from logistics operators are reinforcing long-term market growth.

Infrastructure Modernization and Fleet Renewal

Many rail networks across Europe, Asia, and emerging economies are upgrading aging wagon fleets with modern, higher-capacity, and technologically advanced freight wagons. Features such as lightweight materials, higher axle loads, improved braking systems, and enhanced safety standards are driving replacement demand.

Growth in Intermodal and Containerized Freight

The rise of intermodal transportation—combining rail, road, and port logistics—is increasing demand for specialized container wagons. Expanding global trade and port connectivity are strengthening this trend, particularly across Asia-Pacific and Europe.

Regional Growth Highlights

Europe: Rail Freight Backbone of Trade

Europe continues to dominate the freight wagons market due to its extensive rail network, strong cross-border trade, and focus on shifting freight from road to rail. Germany, France, Poland, and Eastern European countries remain key contributors, supported by EU sustainability initiatives.

Asia-Pacific: Infrastructure Expansion Fuels Growth

China and India are witnessing strong demand driven by large-scale infrastructure development, mining activities, and agricultural transport. Government-backed rail freight corridor projects and industrial growth are sustaining steady wagon demand.

North America: Modernization and Bulk Transport

The U.S. and Canada maintain stable demand for freight wagons, particularly for commodities such as coal, chemicals, grains, and petroleum products. Fleet modernization and safety upgrades are key growth drivers.

Emerging Markets: Rising Trade and Industrialization

Latin America, the Middle East, and Africa are experiencing gradual growth, supported by expanding mining activities, port connectivity, and public investments in rail logistics.

Market Segmentation Insights

By Wagon Type

- Open Wagons – Widely used for coal, minerals, and construction materials

- Covered Wagons – Strong demand for agricultural goods and weather-sensitive cargo

- Flat Wagons – Growing use in containerized and intermodal transport

- Tank Wagons – Essential for chemicals, fuels, and liquid cargo

By Cargo Type

- Bulk commodities

- Containers

- Liquid cargo

- Automotive and industrial goods

By End User

- Mining and metals

- Agriculture

- Oil & chemicals

- Logistics and intermodal operators

Challenges Impacting Market Growth

High Capital Investment

Freight wagons involve high upfront manufacturing and procurement costs, which can limit rapid fleet expansion, especially in developing economies.

Long Replacement Cycles

Freight wagons typically have long service lives, resulting in slower replacement rates and moderate market growth compared to other transport equipment sectors.

Regulatory and Standardization Complexities

Cross-border rail operations require compliance with multiple safety and technical standards, increasing design and operational complexity for manufacturers.

Competitive Landscape

The global freight wagons market is moderately consolidated, with manufacturers focusing on durable designs, higher payload capacity, and compliance with international safety standards. Strategic collaborations with rail operators and government bodies are shaping competitive strategies.

Key Companies Profiled

- Greenbrier Companies

- Trinity Industries

- Tatravagónka

- United Wagon Company

- CRRC Corporation

- Amsted Rail

- Arbel Fauvet Rail

- Titagarh Wagons

Companies are investing in lightweight materials, digital monitoring systems, and enhanced safety technologies to improve operational efficiency.

Recent Developments

- 2024: Rail operators increase procurement of high-capacity freight wagons for dedicated freight corridors

- 2023: Expansion of container wagon fleets to support intermodal logistics growth

- 2022: Adoption of advanced braking and safety systems to meet stricter rail regulations

Future Outlook: Steady Growth in Rail Logistics

The freight wagons market is expected to witness stable, long-term growth driven by:

- Expansion of rail freight corridors

- Rising focus on sustainable transportation

- Growth in bulk and containerized trade

- Fleet modernization initiatives

- Increasing role of rail in global supply chains

As governments and logistics providers prioritize efficiency, safety, and environmental performance, the global freight wagons market is positioned for consistent growth through 2035.