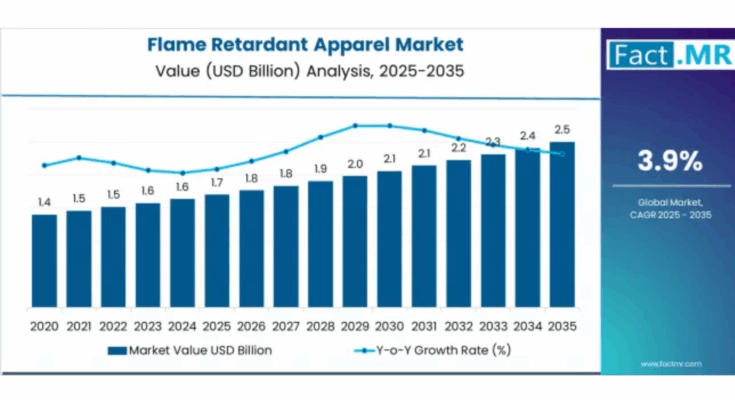

The global flame retardant apparel market is entering a decade-long growth phase, driven by stricter workplace safety regulations, expanding industrial activity, and increasing adoption of advanced personal protective equipment (PPE) across high-risk environments. According to industry analysis by Fact.MR, the market is projected to grow from USD 1.7 billion in 2025 to USD 2.5 billion by 2035, reflecting a CAGR of 3.9% over the forecast period.

This steady expansion highlights the accelerating demand for fire-resistant clothing technologies across industrial safety, military uniforms, motorsports, and specialized protective applications. The industry stands at the threshold of transformation as manufacturers focus on treated cotton blends, high-performance fibers, and enhanced comfort-driven safety solutions.

Strategic Market Drivers

Industrial Safety Regulations Accelerate Adoption

Rising enforcement of occupational safety standards across oil & gas, chemicals, utilities, mining, and manufacturing sectors is a major growth catalyst. Flame retardant (FR) apparel is becoming mandatory to reduce burn injuries and ensure compliance with international safety norms such as NFPA, ISO, and ASTM standards.

Industries are increasingly replacing conventional workwear with certified fire-resistant garments to improve workforce protection and reduce liability risks.

Browse Full Report: https://www.factmr.com/report/2830/flame-retardant-apparel-market

Defense, Military & Tactical Applications Expand Demand

Military organizations worldwide are investing heavily in flame-resistant combat uniforms and protective gear to enhance soldier survivability in combat and training environments. FR apparel is widely used in:

- Military uniforms

- Aviation and naval operations

- Tactical and special forces gear

The shift toward lightweight, durable, and multi-threat protective fabrics is reinforcing long-term demand from defense procurement programs.

Growth in Oil & Gas, Energy, and Utilities

Workers in refineries, offshore rigs, power plants, and electrical maintenance face continuous exposure to fire and arc-flash hazards. Flame retardant apparel plays a critical role in mitigating risks in these environments.

Expansion of energy infrastructure—especially in emerging economies—is further strengthening demand for industrial PPE and fire-resistant workwear.

Advancements in Fabric Technology

Innovations in textile engineering are improving comfort, breathability, moisture management, and durability of FR apparel. Manufacturers are increasingly adopting:

- Treated cotton blends

- Aramid-based fabrics

- Modacrylic and advanced fiber composites

These advancements are helping overcome traditional barriers related to heat retention and wearer discomfort.

Regional Growth Highlights

North America: Strong Regulatory Framework

North America leads the market due to strict OSHA and NFPA regulations, high industrial safety awareness, and strong demand from oil & gas, utilities, and defense sectors. The U.S. remains the dominant contributor.

Europe: Compliance-Driven Expansion

Stringent EU workplace safety laws and increasing investments in industrial modernization are driving steady adoption. Countries such as Germany, the U.K., and France are key markets for high-quality certified FR apparel.

Asia-Pacific: Industrialization & Infrastructure Growth

Rapid industrial expansion in China, India, Southeast Asia, and South Korea is fueling demand for flame retardant clothing, particularly in manufacturing, construction, and energy sectors.

Middle East & Latin America: Energy Sector Demand

Oil & gas operations and expanding power infrastructure in the Middle East and Latin America are creating consistent demand for flame retardant industrial apparel.

Market Segmentation Insights

By Material Type

- Treated Cotton & Cotton Blends – Widely used due to cost-effectiveness and comfort

- Aramid Fibers – High-performance protection for extreme conditions

- Modacrylic & Blended Fabrics – Growing adoption in industrial PPE

By Application

- Industrial PPE – Largest segment driven by manufacturing and energy sectors

- Military & Defense – Strong growth due to modernization programs

- Motorsports & Firefighting – Specialized high-performance requirements

By End User

- Oil & Gas

- Utilities & Power

- Manufacturing

- Defense & Law Enforcement

- Automotive & Motorsports

Challenges Impacting Market Growth

Higher Cost Compared to Standard Workwear

Flame retardant apparel carries higher production costs due to specialized treatments and compliance requirements, limiting adoption among smaller enterprises.

Comfort & Wearability Concerns

Despite innovation, balancing protection with comfort remains a key challenge, particularly in hot and humid working environments.

Compliance & Certification Complexity

Meeting multiple regional and industry-specific safety standards increases manufacturing complexity and costs.

Competitive Landscape

The flame retardant apparel market is moderately fragmented, with players focusing on fabric innovation, compliance certification, and long-term supply contracts with industrial and defense organizations.

Key Companies Profiled

- DuPont

- 3M Company

- Honeywell International

- Lakeland Industries

- Bulwark Protection

- Ansell Limited

- Sioen Industries

- VF Corporation

Manufacturers are investing in lighter fabrics, sustainable flame-retardant treatments, and enhanced garment durability to gain competitive advantage.

Future Outlook: A Decade of Safety-Driven Growth

The flame retardant apparel industry is set for consistent expansion through 2035, supported by:

- Rising industrial safety awareness

- Expansion of energy and infrastructure projects

- Defense modernization programs

- Advances in protective textile technology

- Increasing focus on worker health and regulatory compliance

As industries continue to prioritize workplace safety, regulatory adherence, and advanced protective solutions, the global flame retardant apparel market is well-positioned for stable, long-term growth over the next decade.