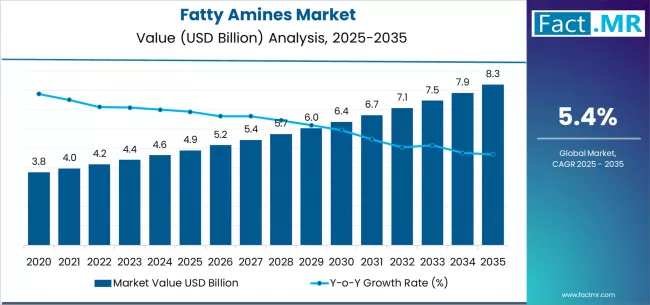

The global fatty amines market is on track for steady expansion over the next decade, supported by increasing demand across water treatment, agrochemicals, personal care, and oilfield chemicals. According to a new analysis by Fact.MR, the market is projected to grow from USD 4.9 billion in 2025 to USD 8.3 billion by 2035, reflecting an absolute growth of USD 3.4 billion and a CAGR of 5.4% during the forecast period.

Fatty amines are essential organic compounds widely used as surfactants, corrosion inhibitors, emulsifiers, and conditioning agents. The market’s momentum is strengthened by rising industrialization, expanding agricultural activities, and growing demand for eco-friendly chemical solutions.

Strategic Market Drivers

Water Treatment Chemicals Propel Market Growth

The surging need for clean water, stringent environmental regulations, and rising industrial wastewater volumes are boosting the adoption of fatty amines. Their excellent coagulation and flocculation properties make them critical ingredients in water purification chemicals.

Agriculture Sector Continues to Dominate Usage

Fatty amines play a crucial role in agrochemicals due to their application in:

- Herbicides

- Fertilizer additives

- Emulsifiers

- Dispersants

The global rise in crop production, focus on yield improvement, and expansion of sustainable farming practices are driving strong consumption.

Rising Use in Personal Care and Home Care

Fatty amines are increasingly used in:

- Hair conditioners

- Skin care formulations

- Fabric softeners

- Detergents

Growing consumer preference for mild, bio-based, and environmentally friendly ingredients is positively impacting demand.

Browse Full Report: https://www.factmr.com/report/fatty-amines-market

Oilfield Chemicals Support Market Expansion

The oil & gas sector uses fatty amines in corrosion inhibition, emulsification, and drilling additives. Recovery in global energy demand and rising offshore exploration are uplifting market growth.

Shift Toward Green Chemistry

Manufacturers are focusing on producing renewable and biodegradable fatty amines, aligning with global sustainability initiatives. This trend is creating new revenue opportunities across industries.

Regional Growth Highlights

North America: Strong Adoption in Water Treatment & Oilfield Chemicals

The U.S. and Canada are witnessing high demand due to:

- Robust environmental regulations

- Increasing shale gas activities

- Rising focus on industrial wastewater treatment

Europe: Sustainability Regulations Fuel Growth

The EU’s strong emphasis on green chemistry and eco-friendly surfactants is driving fatty amine adoption, especially in:

- Cosmetics

- Home care

- Water treatment

Germany, France, and the Nordic countries lead in consumption.

East Asia: Largest Manufacturing Hub

China, India, and Japan dominate production and consumption due to expanding:

- Agrochemical industries

- Personal care sectors

- Chemical manufacturing ecosystems

China continues to be a global leader in fatty amine production.

Emerging Markets: High Growth Potential

Latin America, Southeast Asia, and the Middle East are experiencing rising demand driven by:

- Expansion of agriculture

- Growing industrialization

- Increasing water treatment needs

Market Segmentation Insights

By Product Type

- Primary Fatty Amines – Key usage in agrochemicals and water treatment

- Secondary Fatty Amines – Used in lubricants and surfactants

- Tertiary Fatty Amines – Growing use in personal care and detergents

By Application

- Agrochemicals – Largest and fastest-growing segment

- Water Treatment – Increasing focus on clean water infrastructure

- Personal Care – Expanding use in conditioners and skin care

- Oilfield Chemicals – Growth driven by drilling activities

- Chemical Processing – Wide industrial applications

Challenges Impacting Market Growth

Fluctuating Raw Material Prices

Dependence on natural oils such as palm oil, tallow, and rapeseed creates price volatility.

Environmental and Regulatory Constraints

Strict regulations on chemical usage and VOC emissions increase compliance costs.

Competition from Bio-based Alternatives

Growing popularity of plant-based surfactants presents competitive pressure.

Competitive Landscape

The global fatty amines market is moderately consolidated, with key players investing in capacity expansions, sustainable feedstocks, and innovative formulations.

Key Companies Profiled

- Kao Corporation

- Solvay SA

- Nouryon

- Evonik Industries AG

- Indo Amines Ltd.

- Arkema SA

- Lonza Group

- Huntsman Corporation

- KLK Oleo

- Akzo Nobel N.V.

Companies are prioritizing the development of bio-based fatty amines, green surfactants, and high-performance emulsifiers to strengthen their market presence.

Recent Developments

- 2024: Major market players launched biodegradable amine-based surfactants for water treatment.

- 2023: Expanded global production capacities due to rising demand in Asia-Pacific.

- 2022: Home care and cosmetic manufacturers increased use of fatty amines driven by sustainability goals.

Future Outlook: Sustained Growth Through 2035

The next decade will bring significant advancements driven by:

- Adoption of sustainable, plant-based chemical ingredients

- Increasing demand in agriculture and water treatment

- Rapid industrialization in emerging economies

- Innovations in surfactant chemistry

- Growth in personal care and home care formulations

With rising emphasis on eco-friendly and efficient chemical solutions, the global fatty amines market is all set for strong, long-term expansion through 2035.