European Biomethane Market Outlook 2025–2035: Rapid scale-up underway as industry eyes €30–€40bn investment window A new market outlook released today finds Europe’s biomethane sector at an inflection point: production has moved from niche to material, public policy has set ambitious volume and investment targets, and corporate activity is consolidating supply chains — all pointing to a strong expansion through 2035. The report projects robust mid-to-high single-digit to low-double-digit growth in market value and capacity, driven by grid injections, transport decarbonisation, and industrial offtake.

Key findings

-

Rapid recent growth: European biomethane output rose sharply in the early 2020s, with total renewable gas (biogases + biomethane) deliveries in the order of tens of bcm today. That momentum underpins near-term scale-up.

-

Policy anchor: The EU’s REPowerEU objective to reach 35 billion cubic metres (bcm) of biomethane by 2030 — implying very large additional capacity compared with current baselines — remains the central policy signal and corresponds to an estimated investment need in the range of €30–€40 billion through 2030. This target is the primary demand driver for projects, infrastructure, and certification schemes.

-

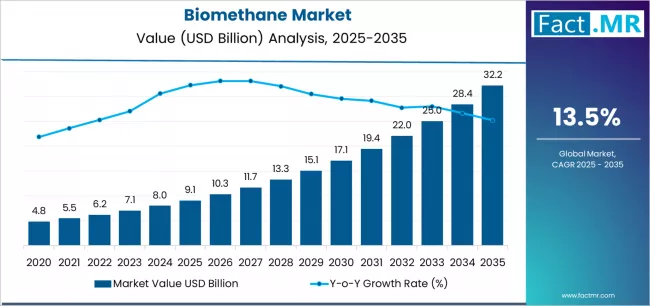

Market value trajectory: Europe’s biomethane market value is expected to roughly double to triple over the 2025–2035 decade, with one scenario placing market size near USD 30–33 billion by 2035. This translates to an annual growth profile that supports sustained capital flows for plant builds, grid upgrades, and gas-to-value applications.

-

Geographic concentration and winners: Production remains concentrated in a handful of leading countries — notably Germany, France, Italy, the Netherlands, Denmark, and Sweden — which together account for the majority of current EU biomethane output. National policy frameworks and grid access rules explain much of the variation in deployment speed.

Drivers and risks

Policy certainty (targets, guarantees of origin, and support mechanisms), availability of sustainable feedstocks (agricultural residues, wastewater, organic municipal waste), and investment in grid interconnection and upgrading are the three critical enablers. Conversely, feedstock competition, permitting delays, and the ability to scale digestate markets or alternative valorisation routes are principal risks that could temper growth.

Industry activity and capital flows

Major utilities and industrial gas players are actively acquiring assets and building portfolios to secure biomethane supply for decarbonised gas offerings and transport fuel contracts. Strategic transactions and portfolio reshuffles have accelerated, illustrating the shift from pilot projects to strategic scale — a trend visible in multiple high-profile deals and sale processes across Europe.

Browse Full Report : https://www.factmr.com/report/biomethane-market

Outlook & implications

Over 2025–2035, the sector is expected to mature structurally: project sizes will increase, financing will broaden beyond specialist green funds, and new commercial models (e.g., long-term offtakes indexed to green gas certificates) will emerge. If the EU and member states deliver predictable policy frameworks and streamline permitting, achieving or approaching the 2030 ambitions will unlock the investment case for the next wave of industrial-scale plants and cross-border gas-to-gas trade.

About the report

“European Biomethane Market Outlook 2025–2035: Key Developments and Future Scope” synthesises public datasets, industry reports, and market transactions to provide a data-driven outlook for investors, policymakers, and corporate off-takers seeking to navigate the next decade of renewable gas scale-up.