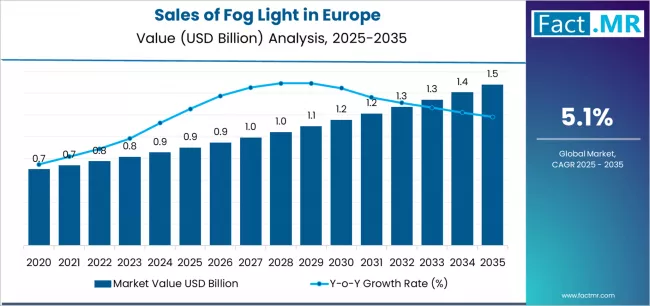

The European fog light market is set for steady growth over the next decade, supported by tightening vehicle safety regulations, rising automotive production, and increasing consumer preference for advanced visibility solutions. According to a new analysis by Fact.MR, the demand for fog lights in Europe is projected to grow from USD 0.9 billion in 2025 to approximately USD 1.4 billion by 2035, marking an absolute increase of USD 540.0 million during the forecast period. This reflects a strong 63.9% total growth, expanding at a CAGR of 5.1% between 2025 and 2035.

Fog lights—critical for safe driving in low-visibility conditions—are witnessing heightened demand as European nations emphasize road safety, weather-adaptive lighting, and sustainable mobility technologies.

Strategic Market Drivers

Stringent Road Safety Regulations Fuel Market Expansion

Europe’s strict vehicle safety norms—set by the EU and country-specific transport authorities—are driving automakers to integrate advanced fog lighting systems across vehicle categories. Regulations mandating improved nighttime visibility, adaptive lighting, and safety-focused automotive components are strengthening market demand.

Growing Vehicle Production and Aftermarket Sales

Steady automotive manufacturing in Germany, France, the U.K., Italy, and Eastern Europe continues to uplift OEM demand. Additionally, strong aftermarket sales—driven by frequent replacements, vehicle customization trends, and adoption of LED technologies—are significantly contributing to overall revenue growth.

Browse Full Report: https://www.factmr.com/report/sales-of-fog-light-in-europe

Rise of Advanced Lighting Technologies

Rapid advancements in automotive lighting, including:

- LED fog lights

- Laser-based lighting systems

- Adaptive and intelligent front-lighting

are reshaping the fog light landscape. These innovations deliver higher brightness, lower power consumption, and extended lifespan, making them increasingly preferred in both passenger and commercial vehicles.

Growth of Electric Vehicles (EVs) and Premium Car Segments

Premium and EV manufacturers are integrating high-performance fog lights as part of advanced lighting packages. As Europe accelerates EV adoption, demand for energy-efficient LED fog lights continues to rise.

Regional Growth Highlights

Germany: Technology & Automotive Manufacturing Hub

Germany’s strong automotive ecosystem, presence of leading OEMs, and fast adoption of LED lighting technologies position it as the dominant contributor to market growth.

France & U.K.: Strong Regulatory Push

Both nations emphasize road safety and environmental sustainability, driving mandatory adoption of efficient, long-lasting fog lighting systems.

Nordic Countries: High Need for Visibility Solutions

Frequent fog, snow, and harsh weather conditions across Sweden, Norway, and Finland are driving strong uptake of fog lights, especially in utility vehicles and premium passenger cars.

Eastern Europe: Growing Manufacturing & Aftermarket Demand

Countries such as Poland, Czech Republic, and Hungary are witnessing increased vehicle production and surge in aftermarket sales, contributing to regional expansion.

Market Segmentation Insights

By Technology

- LED Fog Lights – Fastest-growing segment due to energy efficiency, durability, and superior visibility

- Halogen Fog Lights – Widely used in budget and legacy vehicles

- HID Fog Lights – Niche adoption in performance vehicles

By Vehicle Type

- Passenger Cars – Largest market share driven by safety standards and premium features

- Commercial Vehicles – Growing adoption for enhanced road safety and compliance

- Two-wheelers – Increasing use in fog-prone regions across Europe

By Sales Channel

- OEMs – Strong growth from new vehicle production

- Aftermarket – Significant demand from lighting upgrades and replacements

Challenges Impacting Market Growth

High Cost of Advanced Lighting Technologies

LED and intelligent fog lighting systems add to vehicle manufacturing costs, limiting adoption in lower-priced vehicle categories.

Stringent Material & Energy Regulations

Sustainability standards related to lighting materials, recycling, and energy consumption create manufacturing challenges.

Competition from Adaptive Headlights

Modern adaptive headlights can partially reduce dependence on traditional fog lights, posing long-term competition.

Competitive Landscape

The European fog light market is moderately competitive, with companies focusing on LED innovation, smart lighting integrations, and durability improvements.

Leading Companies Profiled

- Philips

- Osram Continental

- Hella GmbH

- Valeo

- Koito Manufacturing

- Magneti Marelli

- Stanley Electric

- ZKW Group

These players are emphasizing:

- Lightweight fog light assemblies

- LED & laser-based innovations

- High-lumen efficiency technologies

- Automotive-grade weather-resistant materials

Recent Developments

- 2024: European OEMs expand adoption of intelligent LED fog lights integrated with driver-assist systems.

- 2023: Surge in aftermarket demand for customizable LED and RGB fog lighting kits.

- 2022: Leading Tier-1 suppliers introduce energy-efficient fog lights tailored for electric vehicles.

Future Outlook: Fog Lights Set for Steady, Technology-Led Growth

The next decade will witness steady advancements in Europe’s fog light ecosystem driven by:

- Evolution of LED and laser fog lighting

- Increasing EV and premium vehicle sales

- Stricter visibility and safety regulations

- Weather-adaptive and smart lighting systems

- Rising aftermarket customization trends

As Europe continues to prioritize road safety, sustainability, and high-performance lighting solutions, the fog light market is primed for consistent growth through 2035.