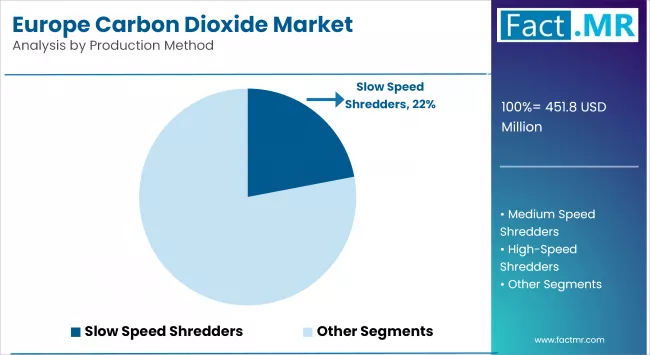

The Europe carbon dioxide market is poised for strong expansion over the next decade, supported by rising demand across food and beverage processing, enhanced oil recovery (EOR), chemicals, healthcare, and industrial manufacturing. According to a new analysis by Fact.MR, the market is projected to grow from USD 451.8 million in 2025 to USD 905.5 million by 2035, registering a robust CAGR of 7.2% during the forecast period.

The market’s growth reflects increasing utilization of CO₂ as a processing aid, refrigerant, carbonation agent, and feedstock for industrial and energy applications—alongside rising emphasis on carbon capture, utilization, and storage (CCUS) technologies across Europe.

Browse Full Report: https://www.factmr.com/report/europe-carbon-dioxide-market

Strategic Market Drivers

Food & Beverage Industry Fuels Demand

The food and beverage sector remains the largest consumer of carbon dioxide in Europe, driven by:

- Beverage carbonation (soft drinks, beer, sparkling water)

- Modified atmosphere packaging (MAP)

- Food preservation and freezing

- Dairy and meat processing

Rising consumption of packaged and processed foods, combined with stringent food safety regulations, continues to accelerate CO₂ adoption across the region.

Industrial Applications Strengthen Market Expansion

Carbon dioxide plays a critical role in multiple industrial processes, including:

- Metal fabrication and welding

- Chemical synthesis

- Fire suppression systems

- pH control in wastewater treatment

The resurgence of manufacturing activities and infrastructure development across Europe is contributing to sustained industrial CO₂ demand.

Enhanced Oil Recovery (EOR) and Energy Applications

CO₂ is increasingly used in enhanced oil recovery operations, particularly in mature oil fields. Additionally, growing investment in carbon capture and utilization (CCU) technologies is positioning CO₂ as a valuable industrial input rather than just an emission byproduct.

Growth of Healthcare and Pharmaceutical Applications

In the healthcare sector, CO₂ is widely used for:

- Minimally invasive surgeries

- Cryotherapy

- Medical imaging

- Respiratory therapies

Europe’s expanding healthcare infrastructure and aging population are supporting steady growth in medical-grade carbon dioxide consumption.

Regional Growth Highlights

Western Europe: Strong Industrial and Food Processing Base

Countries such as Germany, France, the U.K., Italy, and Spain dominate regional consumption due to:

- Large-scale food and beverage manufacturing

- Advanced chemical and industrial sectors

- Strong cold-chain logistics infrastructure

Northern Europe: Sustainability and CCUS Leadership

Nordic countries are at the forefront of carbon capture, utilization, and storage initiatives, creating long-term opportunities for recycled and low-carbon CO₂ production.

Eastern Europe: Emerging Industrial Growth

Industrial expansion, urbanization, and growing beverage consumption are driving increasing CO₂ demand across Poland, Czech Republic, Hungary, and Romania.

Market Segmentation Insights

By Source

- Natural CO₂ – Widely used in food and beverage applications

- By-product CO₂ – Gaining traction due to sustainability benefits

- Captured CO₂ – Fastest-growing segment driven by decarbonization efforts

By Application

- Food & Beverages – Largest market share

- Oil & Gas (EOR) – Growing adoption

- Chemical Processing – Steady industrial demand

- Healthcare – Rising medical usage

- Metal Fabrication & Welding – Consistent industrial growth

By End Use

- Industrial

- Commercial

- Medical

Challenges Impacting Market Growth

Supply Chain Volatility

Disruptions in ammonia and hydrogen production—key sources of by-product CO₂—can impact availability and pricing.

Regulatory Pressure on Emissions

While carbon capture initiatives support long-term growth, strict environmental regulations increase compliance costs for producers.

Storage and Transportation Constraints

CO₂ requires specialized storage and transportation infrastructure, adding logistical complexity and operational costs.

Competitive Landscape

The Europe carbon dioxide market is moderately consolidated, with leading players focusing on:

- Expansion of CO₂ recovery and purification facilities

- Investments in carbon capture technologies

- Long-term supply contracts with food and industrial customers

Key Companies Profiled

- Air Liquide

- Linde plc

- Air Products and Chemicals

- Messer Group

- Nippon Gases

- SOL Group

- Praxair (Linde)

These companies are actively investing in low-carbon CO₂ production, recycling technologies, and sustainable supply chains.

Recent Developments

- 2024: Increased investments in CCUS projects across Western and Northern Europe

- 2023: Expansion of food-grade CO₂ production facilities amid beverage industry growth

- 2022: Industrial gas companies enhance CO₂ recovery from bioethanol and ammonia plants

Future Outlook: Sustainable Growth Through Carbon Utilization

The Europe carbon dioxide market is entering a transformative phase driven by:

- Rising food and beverage consumption

- Growth in industrial manufacturing

- Expansion of carbon capture and utilization technologies

- Healthcare sector advancements

- Europe’s commitment to net-zero emissions

As carbon dioxide increasingly shifts from an emission challenge to a valuable industrial resource, the Europe CO₂ market is set for sustained, high-value growth through 2035.