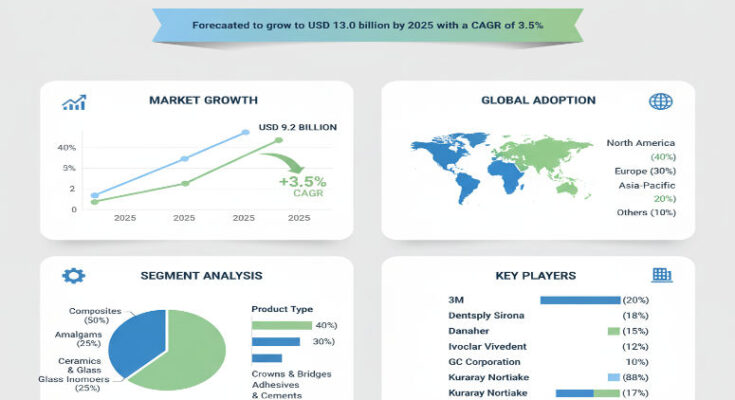

The global dental restorative supplies market is estimated at USD 9.2 billion in 2025, and is forecast to grow to about USD 13.0 billion by 2035, representing a compound annual growth rate (CAGR) of approximately 3.5% over the decade. This implies an absolute increase of around USD 3.8 billion during the forecast period, or roughly a 41.3% growth overall. The market is expected to nearly expand by 1.4× over this period, reflecting steady adoption of restorative materials and supplies in dental practice, clinics, and hospital settings.

Market Dynamics and Growth Drivers

Several forces are driving growth in this market. Rising awareness of oral health, especially amongst aging populations, is increasing demand for restorative treatments. More people are seeking dental restorations for decayed, damaged or missing teeth, partly driven by cosmetic and preventive dentistry trends. Clinicians are increasingly using advanced restorative materials and supplies that offer better aesthetics, biocompatibility, and durability.

Technological advances in dental materials (e.g. composite resins, adhesives, improved bonding systems) are enabling better restorative outcomes with higher performance and patient comfort. Practitioners are adopting minimally invasive techniques, micro-bonding systems, and improved clinical protocols, which rely on high quality restorative supplies that meet strict standards.

Moreover, the market is being boosted by cosmetic dentistry and preventive restorative procedures. Many patients now choose restorations not only for function but for appearance, demanding materials that closely match natural tooth color and structure. Dental clinics and hospitals are incorporating supplies that facilitate efficient procedures, better longevity of restorations, and improved patient satisfaction.

Segmentation: Products, Materials, End Use

In terms of product categories, restorative or filling materials are a leading segment, expected to account for about 49.0% share in 2025. These include direct restoratives, indirect inlays/onlays, core build-ups, and other filling / restoration supplies used in dental procedures.

By material type or supply category, composites are dominant, capturing about 44.0% share of the market in 2025. Composite resins (light-cured or dual-cured), adhesive systems, resin materials, and other advanced composite restorative supplies are key contributors. Other materials such as glass ionomer, amalgam (in some regions), and other restorative materials also contribute but are trailing in growth relative to composites.

End use is largely concentrated in dental clinics, dental hospitals and specialist dental facilities. Dental practitioners rely on restorative supplies as essential consumables for routine and cosmetic dental procedures. Dental labs, teaching institutions, and research institutes also contribute, particularly when supplies are used in training, materials testing, or lab-fabricated restorations.

Regional Insights

Regionally, growth is supported across mature and emerging markets. North America and Europe remain strong markets for restorative supplies due to advanced dental care infrastructure, high patient awareness, and significant cosmetic dentistry adoption. Clinics in these regions are more likely to use premium restorative materials and advanced supplies with tighter standards.

In Asia-Pacific, growth is relatively faster, underpinned by rising dental awareness, increasing per-capita income, expanding dental clinic networks, and growing demand for aesthetic dentistry in emerging economies. The middle class in large countries is increasingly able to afford dental restorative services, driving demand for restorative supplies and high-quality materials.

Emerging markets in Latin America, Middle East & Africa also show potential as dental infrastructure improves and more clinics adopt standardized restorative practices, increasing the need for reliable restorative supplies.

Competitive Landscape and Key Players

The competitive environment is fairly mature, with established dental materials and supplies manufacturers competing on innovation, material performance, regulatory compliance, and product portfolio breadth. Key players in the market include globally recognized dental materials suppliers and restorative product manufacturers.

These companies are focused on enhancing formulation, improving aesthetic matching, increasing material durability, and launching new product lines that meet strict clinical and regulatory standards. They are also expanding distribution networks, entering partnerships with dental practitioners, clinics, and dental laboratory networks, and offering training / technical support to dental professionals to ensure correct use of restorative supplies.

Challenges and Market Restraints

Although growth is solid, some restraints exist. The relatively modest CAGR of 3.5% suggests a somewhat mature market where competition is high and margins may be pressured. Cost sensitivity in certain emerging markets can limit adoption of premium restorative supplies.

Also, regulatory requirements for dental materials (biocompatibility, safety, clinical validation) are stringent, and manufacturers must ensure compliance with regional standards. Training of dental staff to use advanced restorative materials properly is also necessary to achieve intended outcomes.

Furthermore, in some regions, older materials (e.g. lower cost restoratives or simpler filling materials) may still be used, slowing the shift to more advanced composites or aesthetic restorative supplies.

Future Outlook and Strategic Implications

Looking ahead to 2035, the dental restorative supplies market presents stable expansion opportunities. Companies should focus on developing higher performance composite materials, adhesive systems with improved bonding, and materials that offer better aesthetics and longevity of restorations.

Expanding into growth markets, especially in Asia-Pacific and other emerging regions, could unlock new demand as dental infrastructure and patient awareness expand. Offering training, technical support, and value-added services will help dental clinics adopt these advanced restorative supplies more confidently.

Manufacturers that can deliver materials with improved biocompatibility, better matching of natural tooth appearance, and durability while maintaining competitive costs will be well positioned.

Browse Full Report: https://www.factmr.com/report/1588/dental-restorative-supplies-market

Editorial Perspective

The dental restorative supplies market may not be one of the fastest-growing segments in healthcare, but it is a critical backbone of everyday dental practice. As people demand better dental aesthetics, longer-lasting restorations, and minimally invasive procedures, restorative supplies become more than just materials — they enable clinic efficiency, patient satisfaction, and treatment quality. Companies that innovate in restorative materials and supply systems while adapting to regional clinic needs can capitalize on this steady growth through 2035 and beyond.