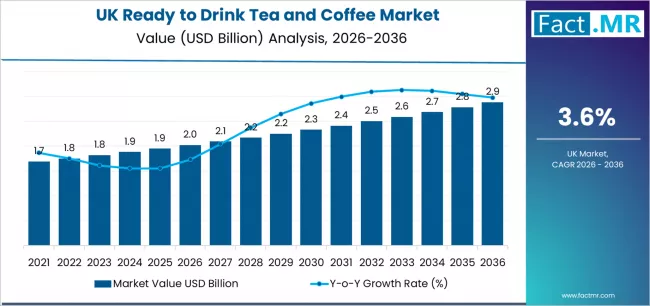

The United Kingdom ready-to-drink tea and coffee market is set for steady expansion over the next decade, supported by evolving consumer lifestyles, rising demand for on-the-go beverages, and growing interest in health-focused and premium formulations. According to a new analysis by Fact.MR, the market is projected to grow from USD 2.02 billion in 2026 to approximately USD 2.88 billion by 2036, reflecting a 42.6% total increase and a compound annual growth rate (CAGR) of 3.6% during the forecast period.

The market’s growth trajectory is shaped by strong convenience-driven consumption habits, increased popularity of cold-brew and iced beverages, and a gradual shift toward low-sugar, functional, and clean-label drinks across the UK.

Browse Full Report: https://www.factmr.com/report/united-kingdom-ready-to-drink-tea-and-coffee-market

Strategic Market Drivers

Convenience-Driven Lifestyles Fuel RTD Consumption

Busy urban lifestyles, longer commuting times, and increased demand for grab-and-go beverage solutions are driving widespread adoption of RTD tea and coffee products across the UK. Ready-to-drink formats offer:

- Instant consumption without preparation

- Consistent taste and quality

- Easy availability across retail and foodservice channels

This convenience factor has positioned RTD beverages as a preferred alternative to traditional brewed drinks, particularly among young professionals and students.

Rising Popularity of Cold-Brew and Iced Beverages

Cold-brew coffee and iced tea variants are gaining strong traction, driven by:

- Smoother taste profiles

- Lower acidity levels

- Premium and artisanal positioning

Seasonal demand spikes and growing café-style consumption at home are accelerating innovation in bottled cold-brew coffee, iced lattes, and flavored iced teas.

Health-Oriented Consumption Shapes Product Innovation

Health-conscious UK consumers are increasingly seeking:

- Low-sugar and no-added-sugar beverages

- Natural ingredients and clean-label formulations

- Functional benefits such as antioxidants, adaptogens, and plant-based ingredients

RTD tea, especially green tea, herbal tea, and kombucha-inspired drinks, is benefiting from its strong association with wellness and hydration.

Sustainability and Premiumization Influence Buying Decisions

Sustainable packaging, ethically sourced coffee beans, and responsibly sourced tea leaves are becoming key purchase drivers. Premium RTD beverages featuring:

- Organic ingredients

- Plant-based milk alternatives

- Recyclable or eco-friendly packaging

are gaining shelf space across UK retail outlets.

UK Market Growth Highlights

Strong Urban Consumption Patterns

Major cities such as London, Manchester, Birmingham, and Leeds are witnessing higher consumption of RTD tea and coffee, supported by dense retail networks, workplace consumption, and evolving café culture.

Retail and Foodservice Expansion

Supermarkets, convenience stores, petrol stations, and online grocery platforms continue to drive volume growth. Additionally, foodservice partnerships and vending machine installations are expanding RTD beverage accessibility.

Market Segmentation Insights

By Product Type

- RTD Coffee – Dominant segment due to strong coffee culture and cold-brew popularity

- RTD Tea – Fast-growing, supported by wellness trends and herbal formulations

By Packaging

- Bottles – Leading segment due to portability and resealability

- Cans – Increasing adoption among younger consumers

By Distribution Channel

- Supermarkets & Hypermarkets – Primary sales channel

- Convenience Stores – High impulse purchases

- Online Retail – Rapid growth driven by subscription models and home delivery

Challenges Impacting Market Growth

Price Sensitivity

Premium RTD beverages often carry higher price points, which can limit penetration among cost-conscious consumers.

Shelf-Life and Storage Constraints

Maintaining freshness while avoiding preservatives remains a challenge for clean-label RTD formulations.

Competitive Landscape

The UK RTD tea and coffee market is moderately competitive, with players focusing on:

- Flavor innovation

- Functional ingredients

- Sustainable packaging

- Brand differentiation

Key Companies Operating in the Market

- Nestlé

- Coca-Cola (Costa Coffee RTD)

- PepsiCo

- Starbucks

- Unilever

- Innocent Drinks

- Local and private-label brands

Recent Developments

- 2024: Expansion of cold-brew coffee product lines across UK supermarkets

- 2023: Increased launches of low-sugar and dairy-free RTD coffee options

- 2022: Growth of sustainably packaged RTD tea products to meet ESG goals

Future Outlook: Steady Growth Backed by Lifestyle Evolution

Over the next decade, the UK ready-to-drink tea and coffee market is expected to benefit from:

- Continued shift toward convenience consumption

- Rising health and wellness awareness

- Premium and functional beverage innovation

- Growth in cold-brew and plant-based RTD offerings

As UK consumers increasingly prioritize convenience, health, and sustainability, the RTD tea and coffee market is positioned for stable, long-term growth through 2036.