The global photodiode market is projected to grow from US$ 476.6 million in 2024 to over US$ 1.01 billion by 2034, registering a CAGR of approximately 7.8%. Growth is fueled by technological advancements, increasing adoption in consumer electronics, telecom, healthcare, and industrial automation, and expansion across emerging regions.

Market Segmentation and Size

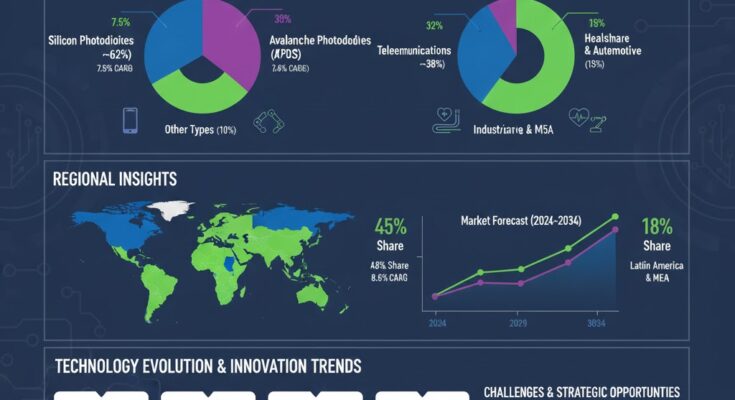

By Photodiode Type

-

Silicon Photodiodes: Leading segment with ~62% share in 2024, driven by cost-effectiveness and wide application in consumer electronics, ambient light sensing, and optical communication. Forecast to grow at a CAGR of 7.5%, reaching US$ 690 million by 2034.

-

Avalanche Photodiodes (APDs): High-sensitivity segment for telecom and LiDAR applications, currently 28% of market value, expected to grow at CAGR of 8.4%, surpassing US$ 280 million by 2034.

-

Other Types (Germanium, InGaAs, Organic): Combined share ~10%, projected CAGR 9.1% due to increasing adoption in high-end imaging and aerospace systems.

By Application

-

Consumer Electronics: Largest segment (~38% share), valued at US$ 181 million in 2024, driven by smartphones, wearables, and smart home devices. CAGR of 7.3% through 2034.

-

Telecommunications: Second largest (~32% share), primarily for optical transceivers and fiber networks, growing at 8.1% CAGR. Market size expected to reach US$ 320 million by 2034.

-

Healthcare & Medical Devices: 15% of the market, projected CAGR 8.0% due to pulse oximeters, imaging, and diagnostic equipment.

-

Industrial & Automotive: 15% share, CAGR 7.9%, driven by machine vision, robotics, and LiDAR sensors in autonomous vehicles.

Regional Insights

Asia Pacific

-

Largest market (~45% global share in 2024); value: US$ 214 million.

-

Projected CAGR: 8.2%, driven by China, Japan, South Korea, and Taiwan.

-

Growth fueled by electronics manufacturing, optical communication infrastructure, and government incentives for smart manufacturing and semiconductor production.

North America

-

~28% market share (~US$ 133 million in 2024).

-

CAGR: 7.5%; major growth in healthcare devices, automotive ADAS, aerospace, and data centers.

-

U.S. dominates, supported by high R&D investments and early adoption of advanced photodiode technologies.

Europe

-

~18% share (~US$ 86 million in 2024).

-

CAGR: 7.2%, steady growth from automotive sensing, industrial automation, and telecommunications infrastructure.

-

Germany, UK, and France are key contributors.

Latin America & MEA

-

Combined ~9% share (~US$ 43 million in 2024).

-

CAGR: 8.0%, with growth potential in expanding digital infrastructure and industrial automation.

Technology Evolution & Innovation Trends

Miniaturization and Integration

-

Devices are shrinking to sub-millimeter footprints for wearables, smartphones, and IoT devices.

-

Integrated photodiode modules with electronics enable higher sensitivity and lower power consumption, particularly in portable and battery-powered devices.

Material Innovations

-

Silicon photodiodes dominate ~62% of production, but InGaAs and Germanium photodiodes are growing at >9% CAGR, especially for telecom and defense.

-

Organic/printed photodiodes: Emerging segment projected to reach US$ 25 million by 2034, CAGR ~10%.

Advanced Functionalities

-

Avalanche photodiodes (APDs) account for 28% of market, primarily for optical fiber networks and LiDAR in autonomous vehicles.

-

Organic photodiodes and flexible printed devices are gaining adoption for wearable and flexible electronics.

Market Forecast (2025–2036)

| Metric | 2024 | 2029 | 2034 | CAGR (2024–2034) |

|---|---|---|---|---|

| Global Market Size (US$ million) | 476.6 | 680 | 1,010 | 7.8% |

| Silicon Photodiodes | 296 | 425 | 690 | 7.5% |

| Avalanche Photodiodes | 133 | 200 | 280 | 8.4% |

| Organic & Others | 48 | 55 | 65 | 9.1% |

Regional Forecasts (2034):

-

Asia Pacific: US$ 380 million

-

North America: US$ 220 million

-

Europe: US$ 140 million

-

Latin America & MEA: US$ 90 million

Application Forecasts (2034):

-

Consumer Electronics: US$ 330 million

-

Telecom: US$ 320 million

-

Healthcare: US$ 150 million

-

Industrial & Automotive: US$ 150 million

Competitive Landscape

Key global players focus on innovation, production scale, and strategic partnerships:

-

Hamamatsu Photonics – High-end optical sensors and APDs.

-

ON Semiconductor – Broad portfolio across consumer and industrial applications.

-

Everlight Electronics – Cost-effective silicon photodiodes.

-

Rohm Semiconductor – Automotive and industrial focus.

-

II-VI Incorporated – Advanced photodiodes for telecom and defense.

-

OSRAM Opto Semiconductors – Sensor modules and LiDAR components.

-

Kyosemi Corporation – Specialized high-sensitivity APDs.

-

First-Sensor AG – Industrial and medical photodiode applications.

Challenges & Strategic Opportunities

Challenges:

-

High cost for specialized APDs and InGaAs devices.

-

Supply chain constraints in semiconductor raw materials.

Opportunities:

-

LiDAR, AR/VR sensors, and autonomous vehicle adoption.

-

Integration of organic and printed photodiodes into flexible electronics.

-

Expansion in emerging markets with industrial automation and healthcare technology growth.

Browse Full Report : https://www.factmr.com/report/1664/photodiode-market

Conclusion

The photodiode market is set for sustained growth, doubling in revenue over the next decade. Asia Pacific will remain the growth leader, while North America and Europe maintain strong innovation-driven expansion. Technological innovations—miniaturization, advanced materials, and integrated sensor modules—will drive adoption across consumer electronics, telecom, healthcare, automotive, and industrial sectors. Strategic investments and emerging applications such as LiDAR and wearable sensors present significant opportunities for stakeholders through 2036.