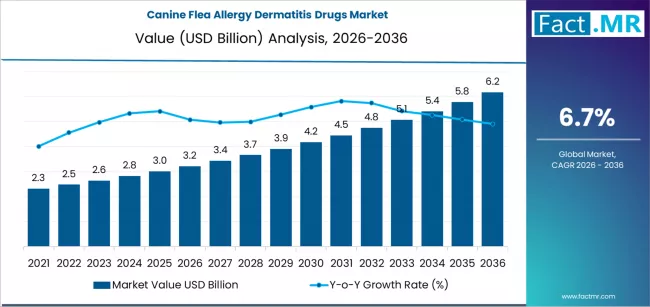

Global Market Research Insights — The global canine flea allergy dermatitis (FAD) drugs market is poised for sustained and robust growth over the next decade, offering compelling opportunities for veterinary pharmaceutical companies, investors, and healthcare innovators. The market is projected to expand from an estimated USD 3.22 billion in 2026 to USD 6.17 billion by 2036, registering a Compound Annual Growth Rate (CAGR) of approximately 6.7% during the 2026–2036 period.

This growth trajectory reflects both persistent clinical demand for effective flea allergy therapeutics and ongoing innovation in drug technology that enhances treatment efficacy, safety, and convenience for both clinicians and dog owners.

Market Growth Drivers: Persistent Flea Infestations & Rising Pet Healthcare Spend

Flea allergy dermatitis remains one of the most common dermatological conditions affecting companion dogs worldwide. The condition is triggered by hypersensitivity to flea saliva, leading to severe itching, inflammation, and secondary infections if untreated. The high prevalence of flea infestations, driven by climate variability and expanding seasonal windows for parasite activity, ensures robust base demand for both preventive and therapeutic drug categories.

In parallel, increasing pet ownership rates, heightened awareness of allergic skin diseases, and growing expenditure on veterinary dermatology contribute to rising treatment uptake. Modern pet owners view their dogs as integral family members and are more willing to invest in premium therapeutic solutions, including advanced parasiticides and immunomodulators.

Technological Evolution: From Isoxazolines to Immunotherapy

A major shift in the treatment landscape has been the adoption of systemic, long‑acting parasiticides—particularly Isoxazoline products—which have transformed preventive and therapeutic approaches to FAD. These agents now represent the largest drug segment by market share, accounting for 44.1% of total revenues in 2026. Their rapid onset, extended duration of efficacy, and systemic flea kill capabilities break the flea life cycle efficiently, making them preferred choices among veterinarians for both prevention and as part of multimodal treatment strategies.

Alongside parasiticides, there is continued reliance on corticosteroids for managing acute inflammatory flares and emerging interest in immunotherapy products designed to address underlying hypersensitivity responses. Combination products that deliver both anti‑parasite action and anti‑inflammatory effects are gaining traction as integrated solutions, reflecting a trend toward more holistic management of allergic dermatologic conditions.

Application Landscape: Acute Flares, Chronic Control & Preventive Management

The market’s application landscape underscores the dual nature of clinical demand:

-

Acute flare management leads all application categories with 46.2% share, driven by the urgent need to control intense pruritus and inflammation. During severe allergic episodes, fast‑acting corticosteroids, sometimes administered via injection, are critical to preventing further skin trauma and infection.

-

Chronic condition control and preventive management also represent significant segments, as veterinarians and pet owners recognize the importance of year-round flea control to reduce disease recurrence and improve long-term outcomes.

This multi‑segmented application demand underscores a broad spectrum of therapeutic needs, from immediate relief to ongoing prevention—a dynamic that manufacturers can strategically address through diversified product portfolios.

Sales Channels: Veterinary Clinics Dominate

Veterinary clinics remain the most influential sales channel, commanding a dominant 65.1% market share in 2026. This is largely attributable to the clinical expertise required to diagnose flea allergy dermatitis accurately and to prescribe the most appropriate drug regimen. Many advanced therapies are prescription-only, making the veterinarian–client relationship central to treatment decisions and follow-up care.

Emerging distribution channels, such as online veterinary pharmacies, are also gaining relevance, particularly in markets where telehealth and digital prescription services are expanding. However, the trusted, expert guidance provided by veterinary professionals continues to be paramount in driving product adoption.

Regional Demand & Growth Scenarios Through to 2036

The market is experiencing high growth potential across multiple regions, with emerging markets showing particularly strong momentum:

| Country/Region | Projected CAGR (2026–2036) |

|---|---|

| India | 9.4% |

| China | 9.1% |

| Brazil | 8.7% |

| USA | 7.5% |

| France | 7.4% |

| UK | 7.2% |

| Germany | 7.0% |

-

India: Rapidly expanding veterinary infrastructure, a large companion animal population, and climatic conditions conducive to flea proliferation.

-

China: Urban pet ownership growth, improved diagnostic awareness, and rising demand for advanced therapeutics.

-

Brazil: High endemic flea pressure and growing utilization of both acute and chronic treatments.

-

USA & Europe: Advanced veterinary dermatology specialization, higher pet health expenditure, and strong regulatory frameworks for quality pharmaceuticals.

These regional growth scenarios underscore the expanding global footprint of canine flea allergy dermatitis drugs, with emerging markets in South and East Asia showing particularly strong momentum.

Competitive Landscape: Strategic Innovation & Partnerships

The canine FAD drugs market is highly competitive and increasingly innovative. Leading global players include:

-

Zoetis Inc.

-

Elanco Animal Health Incorporated

-

Boehringer Ingelheim International GmbH

-

Virbac S.A.

-

Ceva Santé Animale S.A.

These companies are leveraging R&D investment, practitioner education programs, and product diversification strategies to capture market share. Investments in new formulations, combination therapies, and next-generation immunomodulators are expected to reshape competitive dynamics further.

Notably, broader technological advances in veterinary care—such as enhanced digital diagnostics, telehealth integration, and predictive analytics for parasite risk modeling—are also influencing prescribing behaviors and client management protocols.

Market Outlook & Forecast Scenarios to 2036

Under optimistic, base, and conservative scenarios, the market shows resilient growth, driven by:

-

Sustained prevalence of flea infestations and allergic reactions

-

Continuous innovation in drug mechanisms and formulations

-

Greater veterinary specialization and pet health literacy

-

Expanding global companion animal population

These factors collectively position the canine FAD drugs market as one of the most dynamic segments in veterinary pharmaceuticals over the next decade.

Browse Full Report : https://www.factmr.com/report/canine-flea-allergy-dermatitis-drugs-market

Conclusion: Strategic Imperatives for Industry Stakeholders

The canine flea allergy dermatitis drugs market is entering a period of transformative growth, characterized by technological innovation, widening clinical applications, and deepening regional penetration. For manufacturers, strategic product development, enhanced veterinary engagement, and market-specific distribution strategies will be essential to capitalize on the projected USD 6+ billion market by 2036.

Industry players that successfully integrate efficacy, convenience, and cost-value propositions—while also anticipating emerging clinical needs—will be best positioned to lead this evolving market segment.