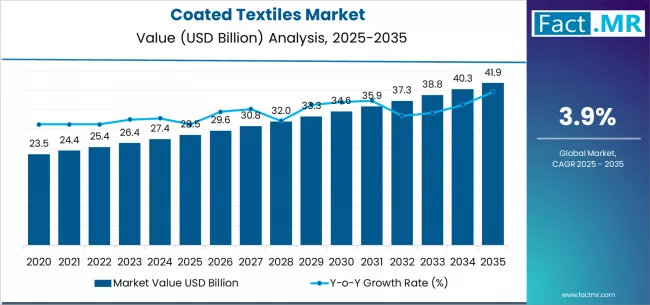

The global coated textiles market is set for steady expansion over the next decade, supported by rising demand across automotive, industrial, medical, and protective apparel applications. According to a new analysis by Fact.MR, the market is projected to increase from USD 28.5 billion in 2025 to USD 41.9 billion by 2035, marking an absolute growth of USD 13.4 billion and a CAGR of 3.9% during the forecast period.

Growing emphasis on durable, waterproof, UV-resistant, and chemical-resistant materials—combined with advancements in polymer coatings—is driving widespread adoption across commercial and industrial sectors.

Strategic Market Drivers

Rising Demand in Automotive & Transportation

Coated textiles play a crucial role in the automotive sector for airbags, seat covers, interior linings, truck tarpaulins, and vehicle insulation.

The expansion of global vehicle production and rising need for lightweight materials are boosting market demand.

Browse Full Report: https://www.factmr.com/report/coated-textiles-market

Expansion of Industrial & Protective Applications

Industrial growth and stringent workplace safety standards are increasing the consumption of coated fabrics for:

- Protective clothing

- Safety gear

- Tents and tarps

- Conveyor belts

- Geotextiles

Their chemical resistance, flame retardancy, and exceptional strength make coated textiles ideal for challenging environments.

Growth in Healthcare & Medical Fabrics

The medical sector is emerging as a major contributor as hospitals adopt coated textiles for:

- Surgical gowns

- Mattress covers

- Medical drapes

- Antimicrobial fabrics

The post-pandemic emphasis on hygiene and infection control further amplifies demand.

Technological Advancements in Coating Materials

Innovations in:

- Polyurethane coatings

- PVC and PE coatings

- Silicone-based textiles

- Nanotechnology-enhanced coatings

are improving performance attributes such as breathability, waterproofing, and UV stability, expanding coated textile adoption across diverse industries.

Regional Growth Highlights

North America: Strong Demand from Automotive & Industrial Sectors

The U.S. and Canada demonstrate strong adoption driven by:

- Expanding automotive production

- Stringent safety regulations

- Rapid growth in the protective clothing industry

Rising infrastructure investments also contribute to geotextile demand.

Europe: Regulatory Push Toward Safety & Sustainability

Europe remains a leading market due to:

- Strict product safety standards

- High consumption in protective gear and industrial textiles

- Advanced automotive and aerospace sectors

Germany, France, Italy, and the U.K. are key contributors.

East Asia: Fastest-Growing Manufacturing Hub

China, Japan, and South Korea dominate global coated textile production, supported by:

- Massive industrial output

- Booming automotive sector

- Growing export demand

Investment in high-performance technical textiles continues to rise.

Emerging Markets: Strong Infrastructure & Industrial Expansion

India, Southeast Asia, Latin America, and the Middle East exhibit accelerating demand due to:

- Rapid industrialization

- Rising construction activity

- Growth in transportation & logistics

- Increasing use of protective apparel

Market Segmentation Insights

By Product Type

- Polymer-Coated Fabrics – Dominant segment due to flexibility, waterproofing, and durability.

- Rubber-Coated Fabrics – Widely used in industrial and protective applications.

- Fabric-Backed Wall Coverings – Growing in commercial interiors.

By Application

- Transportation – Largest segment led by automotive interiors and tarpaulins.

- Industrial – High usage in conveyor belts, protective clothing, and machinery covers.

- Protective Clothing – Fastest-growing segment.

- Furniture – Rising adoption in upholstery and marine seating.

- Medical – Increased use in antimicrobial and easy-clean fabrics.

- Others – Military gear, sports equipment, and outdoor applications.

Challenges Affecting Market Growth

Environmental Concerns Around PVC

Most coated textiles use PVC, which faces scrutiny due to environmental impacts and disposal challenges.

Volatility in Raw Material Prices

Fluctuations in polymer and chemical prices affect production costs.

Complex Manufacturing Requirements

Specialized coating technologies and machinery increase operational costs for manufacturers.

Competitive Landscape

The coated textiles market is moderately consolidated, with companies focusing on high-performance materials, sustainability, and expansion into specialized applications.

Leading Companies Profiled

- Saint-Gobain

- Omnova Solutions

- Continental AG

- Serge Ferrari Group

- Spradling International

- Heytex Group

- Trelleborg AB

- Takata / Joyson Safety Systems

- Sioen Industries

- Seaman Corporation

Key strategies include developing eco-friendly coatings, recyclable materials, and high-durability technical textiles.

Recent Developments

- 2024: Introduction of bio-based PU-coated fabrics for sustainable apparel and outdoor gear.

- 2023: Major automakers adopt advanced coated textiles for lightweight interior components.

- 2022: Hospitals worldwide increase procurement of antimicrobial coated fabrics post-pandemic.

Future Outlook: Toward Sustainable & High-Performance Textiles

The next decade will witness significant advancements propelled by:

- Growing safety and hygiene requirements

- Innovations in polymer science and nanotechnology

- Expansion in transportation and industrial infrastructure

- Rising demand for eco-friendly, recyclable coated fabrics

With industries increasingly prioritizing performance, durability, and sustainability, the global coated textiles market is set for promising, long-term growth through 2035.