The United States cheese shreds market is set for steady long-term expansion, driven by strong consumer preference for convenience-based dairy products, rapid growth of quick-service restaurants (QSRs), and increasing use of shredded cheese in packaged food and ready-to-eat (RTE) categories.

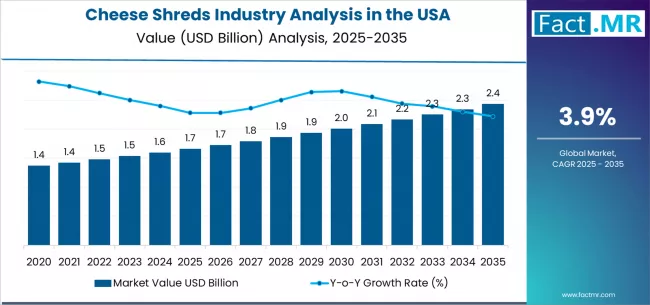

According to a new analysis by Fact.MR, demand for cheese shreds in the USA is projected to rise from USD 1.66 billion in 2025 to approximately USD 2.42 billion by 2035, marking an absolute increase of USD 760.0 million over the decade. This reflects total growth of 45.78% and a CAGR of 3.90% during 2025–2035.

Strategic Market Drivers

Surge in Convenience & Ready-to-Eat (RTE) Foods

Consumers across the U.S. are increasingly opting for easy-to-use, pre-prepared food products. Shredded cheese—widely used in pizzas, pastas, salads, tacos, and baked snacks—has become integral to the booming convenience food market.

The rise of busy urban lifestyles and expanding workforce participation continues to fuel this demand.

Expansion of QSRs, Pizzerias & Fast-Casual Chains

The rapid growth of pizzerias, Tex-Mex outlets, fast-casual restaurants, cafés, and delivery platforms is a major driver of shredded cheese consumption. High-volume purchases from foodservice providers significantly strengthen market demand.

Growth in Packaged Food & Frozen Meal Categories

Shredded cheese is a key ingredient in frozen meals, ready-to-cook kits, and pre-packaged grocery items. As consumers gravitate toward meal kits, frozen pizzas, and prepared entrées, the market for cheese shreds continues to expand.

Browse Full Report: https://www.factmr.com/report/united-states-cheese-shreds-industry-analysis

Innovation in Dairy Processing & Packaging

Advancements such as:

- better anti-caking agents,

- extended shelf-life packaging,

- plant-based and low-fat variant development, and

- automation in cheese shredding processes

are strengthening the value chain and improving product consistency and convenience.

Regional Growth Highlights

Western USA: Leading Consumption Hub

High pizza consumption, strong foodservice penetration, and mature dairy processing infrastructure make the West a dominant market.

Midwest: Strong Production & Distribution Base

Home to major dairy cooperatives and cheese manufacturers, the Midwest remains central to nationwide supply.

South & Southeast: Fastest-Growing Market

Driven by population growth, rising QSR chains, and increasing adoption of Tex-Mex cuisine.

Northeast: High Demand in Urban Foodservice

Dense metropolitan regions boost steady demand for shredded cheese in cafés, delis, convenience stores, and bakeries.

Market Segmentation Insights

By Cheese Type

- Mozzarella Shreds – Largest segment, driven by pizza and Italian cuisine popularity

- Cheddar Shreds – High household use and bakery applications

- Blend Shreds (Cheddar-Mozzarella, Mexican blend) – Rising demand in foodservice

- Specialty & Premium Shreds – Includes organic, low-fat, and artisanal varieties

By Source

- Conventional Dairy – Dominant share

- Plant-Based Alternatives – Rapidly emerging niche due to rising lactose intolerance awareness and vegan preferences

By End Use

- Foodservice – Leading segment, driven by QSRs, restaurants, cafés

- Household Consumers – Growing due to convenience cooking

- Food Processing Industry – Increasing integration into frozen meals, snacks, and packaged foods

Challenges Affecting Market Growth

Volatility in Milk Prices

Fluctuating dairy supply and feed costs impact the production economics of cheese and cheese shreds.

Shorter Shelf Life vs. Block Cheese

Despite packaging improvements, shredded cheese has a comparatively shorter shelf life, affecting logistics.

Competition from Private Labels

Store brands are gaining traction due to affordability, challenging branded manufacturers.

Competitive Landscape

The U.S. cheese shredding industry is moderately consolidated, with strong competition among dairy cooperatives, national brands, and private labels.

Key Companies Profiled

- Dairy Farmers of America (DFA)

- Kraft Heinz

- Sargento Foods

- Bel Brands USA

- Saputo Inc.

- Hilmar Cheese Company

- Great Lakes Cheese

- FrieslandCampina

Manufacturers are focusing on product innovations, including:

- organic and non-GMO offerings,

- premium blends,

- plant-based shreds,

- improved packaging for freshness and convenience.

Recent Developments

- 2024: Launch of resealable, extended-shelf-life packaging with improved anti-caking properties.

- 2023: Surge in plant-based shredded cheese introductions amid rising flexitarian consumption.

- 2022: Major dairy processors expand supply partnerships with national QSR chains.

Future Outlook: A Decade of Steady Market Expansion

The U.S. cheese shreds industry is expected to benefit from:

- stronger demand for convenience foods,

- increasing foodservice penetration,

- continuous innovation in dairy processing,

- growth of frozen and RTE meal segments, and

- rising popularity of global cuisines that use shredded cheese.

With evolving consumer preferences toward convenience, flavor diversification, and high-quality dairy ingredients, the U.S. cheese shreds market is positioned for healthy growth through 2035.