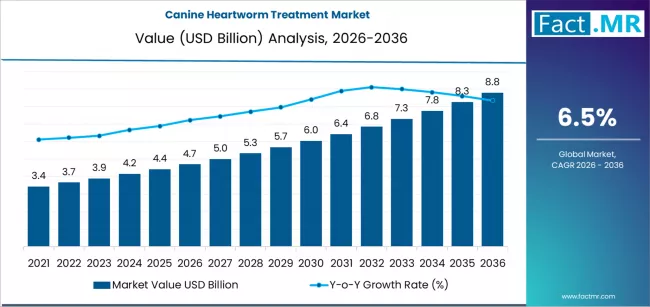

The global canine heartworm treatment market is undergoing a significant clinical and commercial expansion, with its valuation projected to rise from USD 4.71 billion in 2026 to USD 8.80 billion by 2036. According to a specialized industry analysis, the market is set to expand at a compound annual growth rate (CAGR) of 6.5%, driven by rising pet ownership, the expanding geographic range of vectors, and a fundamental shift toward proactive, long-term veterinary care.

As climate patterns shift and mosquito habitats expand into previously non-endemic regions, heartworm disease (Dirofilaria immitis) has become a year-round threat. For veterinary professionals and investors, the market is moving beyond traditional monthly oral treatments toward integrated, “blockbuster” combination therapies and long-acting injectables that ensure 100% compliance.

Summary Table: Canine Heartworm Treatment Outlook

| Metric | Details |

| Market Value (2026E) | USD 4.71 Billion |

| Forecast Value (2036F) | USD 8.80 Billion |

| Projected CAGR (2026-2036) | 6.5% |

| Leading Therapy | Macrocyclic Lactone Preventives (37.8% Share) |

| Primary End-User | Veterinary Clinics (67.2% Share) |

| Leading Application | Preventive Therapy (56.7% Share) |

Request for Sample Report | Customize Report – https://www.factmr.com/connectus/sample?flag=S&rep_id=13588

Core Market Dynamics: Answering the Strategic ‘Who,’ ‘What,’ and ‘Why’

Canine heartworm treatment encompasses a range of pharmaceuticals, including preventative macrocyclic lactones, adulticides for established infections, and supportive therapies.

-

Who is leading the sector? Industry titans including Zoetis, Boehringer Ingelheim, Merck Animal Health, Elanco, and Virbac are at the forefront, leveraging innovation in multi-modal treatments that protect against heartworms and external parasites in a single dose.

-

What is the dominant technology? Macrocyclic Lactone Preventives command the commercial backbone of the market with a 37.8% share. This segment is anchored by its essential role as the first line of defense in global veterinary guidelines.

-

Where is growth most accelerated? North America remains the largest hub, accounting for approximately 44% of the market, while Asia-Pacific is emerging as the fastest-growing region. Growth in these areas is fueled by a surge in urban pet ownership and a rapid increase in specialized veterinary infrastructure.

-

Why is the technology shifting? The market is moving toward Combination Products. There is an escalating demand for “all-in-one” medications—such as the recently launched Credelio Quattro—which provide broad-spectrum protection against fleas, ticks, heartworms, and intestinal parasites.

Sector Insights: Preventive Therapy and Veterinary Clinics Lead Demand

The Preventive Therapy segment constitutes the dominant application, accounting for 56.7% of total revenue. This reflects the fundamental veterinary economic principle that prophylaxis is significantly more cost-effective and safer than the high-risk, expensive treatment of adult infections.

“The primary growth driver is the increasing humanization of pets coupled with rising owner willingness to invest in preventive healthcare,” the analysis states. “Veterinary advocacy for year-round protocols has transformed preventives into a stable, recurring revenue stream. By moving toward long-acting injectable formulations, we are seeing the responsibility of protection shift from the pet owner back to the veterinarian, effectively eliminating the ‘compliance gap’ that leads to infection.”

Key Market Trends and Strategic Outlook

1. Optimization through Long-Acting Injectables and Palatable Chews

One of the most significant absolute dollar opportunities lies in Extended-Release Injectables. These formulations provide up to 12 months of protection with a single veterinary visit. Simultaneously, oral chewables are rapidly expanding, currently accounting for nearly 40% of revenue due to superior palatability and ease of administration.

2. The Rise of Industry 4.0 and E-Commerce Distribution

While Veterinary Clinics remain the dominant distribution channel with a 67.2% share, the Online Pet Pharmacies & E-Commerce segment is projected to grow at the fastest CAGR. Subscription-based models and digital reminders are helping pet owners maintain strict dosing schedules, further supporting market volume.

3. Diagnostic Integration and Resistance Management

A critical trend is the rise of Diagnostic Product Bundles. As reports of drug-resistant heartworm strains emerge—particularly in the Mississippi River Valley—manufacturers are focusing on antigen test kits and high-potency microfilaricidal agents to ensure early detection and effective management of complex cases.

Investment Perspective: A High-Value Animal Health Pillar

The canine heartworm treatment market represents a robust opportunity for pharmaceutical and diagnostic firms. As the global “Circular Economy” of pet care matures, the demand for high-efficacy health solutions—capable of preventing a life-threatening disease through convenient, low-intervention delivery—is expected to remain a primary growth engine through 2036.

Browse Full Report: https://www.factmr.com/report/canine-heartworm-treatment-market