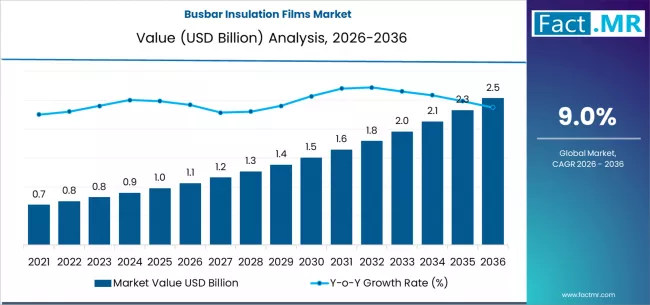

The global busbar insulation films market is set for strong and sustained growth over the next decade, driven by rapid electrification, expanding renewable energy infrastructure, and surging demand from electric vehicles (EVs) and power distribution systems. According to a new analysis by Fact.MR, the market is projected to grow from USD 1.07 billion in 2026 to USD 2.53 billion by 2036, reflecting a robust compound annual growth rate (CAGR) of 9.0% during the forecast period.

This growth represents a 136.4% increase in market value, underlining the critical role of high-performance insulation materials in modern electrical systems.

The rising need for compact, thermally stable, and high-dielectric-strength insulation solutions in high-voltage applications is significantly accelerating global adoption of busbar insulation films.

Browse Full Report: https://www.factmr.com/report/busbar-insulation-films-market

Strategic Market Drivers

Electrification of Power Infrastructure Fuels Demand

Global investments in power generation, transmission, and distribution networks are increasing the deployment of insulated busbar systems. Busbar insulation films enhance:

- Electrical safety

- Thermal performance

- System durability

- Space efficiency

They are becoming indispensable in switchgear, transformers, substations, and power control panels.

Electric Vehicles and Battery Systems Accelerate Adoption

The rapid growth of electric vehicles, charging infrastructure, and battery energy storage systems (BESS) is a major catalyst for the busbar insulation films market. These films are widely used in:

- EV battery packs

- Power electronics

- Inverters and converters

Their ability to withstand high temperatures, voltages, and mechanical stress makes them ideal for next-generation mobility solutions.

Renewable Energy Expansion Strengthens Market Outlook

The global shift toward solar, wind, and energy storage systems is driving the need for efficient electrical insulation. Busbar insulation films play a vital role in:

- Solar inverters

- Wind power converters

- Grid-scale energy storage systems

Government-backed clean energy initiatives are further reinforcing market growth.

Advancements in High-Performance Film Materials

Continuous innovations in polyimide, polyester, and fluoropolymer films are improving thermal resistance, flame retardancy, and lifespan. These advancements enable manufacturers to meet the stringent safety and efficiency standards of high-voltage and high-power applications.

Regional Growth Highlights

East Asia: Manufacturing & Electronics Hub

China, Japan, and South Korea dominate the market due to:

- Large-scale electronics manufacturing

- Strong EV production

- Expanding renewable energy installations

China leads in both production and consumption of busbar insulation films.

North America: EV and Energy Storage Growth

The U.S. market is expanding rapidly with increased investments in:

- Electric vehicles

- Grid modernization

- Renewable energy projects

Advanced safety regulations and technological adoption continue to drive demand.

Europe: Sustainability & Energy Efficiency Regulations

Strict EU regulations promoting energy efficiency and carbon neutrality are accelerating adoption across:

- EV manufacturing

- Industrial automation

- Renewable power systems

Germany, France, and the Nordic countries are key contributors.

Emerging Markets: Infrastructure & Industrial Expansion

India, Southeast Asia, Latin America, and the Middle East are witnessing strong growth due to:

- Power infrastructure development

- Rapid industrialization

- Growing EV penetration

Market Segmentation Insights

By Material Type

- Polyimide Films – Expected to account for 34.0% of the market in 2026, driven by superior thermal stability and dielectric strength

- Polyester Films

- Fluoropolymer Films

- Other High-Performance Films

By Application

- Power Distribution Systems

- Electric Vehicles & Charging Infrastructure

- Renewable Energy Systems

- Industrial Equipment

- Consumer Electronics

By End Use

- Automotive & E-Mobility

- Energy & Utilities

- Industrial Manufacturing

- Electronics & Electrical Equipment

Challenges Impacting Market Growth

High Material Costs

Advanced insulation films, particularly polyimide-based materials, involve higher production costs, limiting adoption in price-sensitive markets.

Complex Manufacturing Processes

Precision coating, lamination, and quality control requirements increase production complexity and operational costs.

Supply Chain Volatility

Fluctuations in raw material availability can impact pricing and delivery timelines.

Competitive Landscape

The busbar insulation films market is moderately competitive, with manufacturers focusing on:

- High-temperature-resistant materials

- Thin, lightweight insulation solutions

- Compliance with international safety standards

- Customization for EV and renewable energy applications

Key Companies Profiled

- DuPont

- Toray Industries

- 3M Company

- Mitsubishi Chemical Group

- Kaneka Corporation

- Coveme

- Tesa SE

- Elantas

- Rogers Corporation

Recent Developments

- 2024: Introduction of ultra-thin polyimide insulation films for high-density EV battery systems

- 2023: Expansion of production capacity to support renewable energy and grid storage applications

- 2022: Increased adoption of flame-retardant insulation films to meet global safety regulations

Future Outlook: High-Voltage Efficiency and Electrification Drive Growth

The next decade will witness strong innovation and adoption in the busbar insulation films market, supported by:

- Rapid electrification across industries

- Growth of EVs and battery storage systems

- Expansion of renewable energy infrastructure

- Demand for compact and high-efficiency power systems

As the world moves toward clean energy, smart grids, and electric mobility, busbar insulation films will remain a critical component of safe, reliable, and high-performance electrical systems through 2036 and beyond.