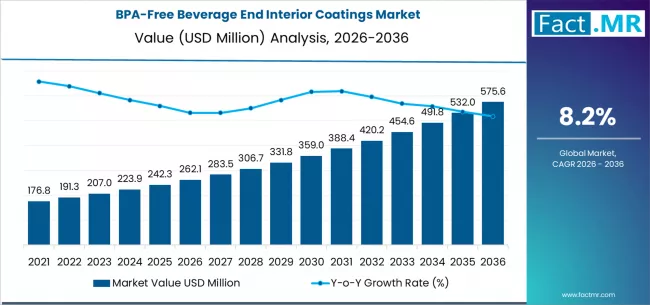

The global BPA-free beverage end interior coatings market is poised for strong expansion over the next decade, driven by tightening food safety regulations, rising consumer awareness regarding health risks associated with Bisphenol-A (BPA), and rapid innovation in sustainable packaging materials. According to a recent analysis by Fact.MR, the market is projected to grow from USD 262.08 million in 2026 to USD 575.56 million by 2036, expanding at a robust CAGR of 8.2% during the forecast period.

The shift toward safe, non-toxic, and regulatory-compliant packaging solutions, particularly in aluminum beverage cans, is significantly accelerating the adoption of BPA-free end interior coatings worldwide.

Browse Full Report: https://www.factmr.com/report/bpa-free-beverage-end-interior-coatings-market

Strategic Market Drivers

Rising Health & Safety Concerns Fuel Market Expansion

Growing evidence linking BPA exposure to potential health risks has prompted governments, food safety agencies, and beverage manufacturers to rapidly eliminate BPA-containing materials from food-contact packaging. BPA-free coatings offer a safer alternative without compromising can durability or beverage integrity.

Global regulatory bodies such as the FDA, EFSA, and WHO are increasingly enforcing strict compliance standards, compelling beverage producers to transition to BPA-free interior coatings.

Surge in Beverage Can Consumption

The increasing consumption of carbonated soft drinks, alcoholic beverages, energy drinks, and functional beverages—especially in urban markets—is driving demand for aluminum beverage cans. BPA-free interior coatings ensure corrosion resistance, flavor protection, and product safety, making them essential for modern can packaging.

Sustainability & Eco-Friendly Packaging Trends

BPA-free coatings align strongly with global sustainability goals. Manufacturers are investing in water-based, bio-based, and low-VOC coating technologies to reduce environmental impact while maintaining high performance.

The push toward circular economy practices and recyclable aluminum packaging further strengthens market growth prospects.

Technological Advancements in Coating Formulations

Innovations in polyester, acrylic, epoxy-alternative, and oleoresin-based coatings are improving chemical resistance, adhesion, and thermal stability. These advancements allow BPA-free coatings to meet high-speed canning requirements without sacrificing performance.

Regional Growth Highlights

North America: Regulatory Leadership & Health Awareness

North America remains a dominant market due to early regulatory action against BPA and strong consumer demand for safe packaging. The U.S. beverage industry continues to adopt BPA-free coatings to comply with FDA regulations and corporate sustainability commitments.

Europe: Stringent Food Safety Regulations Drive Adoption

Europe leads in BPA-free adoption, supported by strict EU food-contact material regulations and high environmental consciousness. Countries such as Germany, France, the U.K., and Italy are accelerating the transition toward BPA-free beverage can coatings.

East Asia: Expanding Beverage Production & Urbanization

China, Japan, and South Korea are witnessing rapid growth due to expanding beverage manufacturing capacity, increasing canned beverage consumption, and rising regulatory scrutiny over food safety materials.

Emerging Markets: Strong Growth Potential

Markets such as India, Southeast Asia, Latin America, and the Middle East are experiencing rising demand due to:

- Growing middle-class population

- Increased consumption of packaged beverages

- Expansion of aluminum can manufacturing infrastructure

Market Segmentation Insights

By Resin Type

- Polyester Coatings – Leading segment due to strong performance and BPA-free compliance

- Acrylic Coatings – Gaining traction for flexibility and chemical resistance

- Oleoresin-Based Coatings – Preferred for natural and bio-based applications

- Other Epoxy Alternatives – Innovation-driven growth

By Beverage Type

- Alcoholic Beverages – Strong adoption in beer and ready-to-drink cocktails

- Carbonated Soft Drinks – High-volume consumption segment

- Energy & Sports Drinks – Fast-growing segment

- Juices & Functional Beverages – Rising health-conscious demand

By Application

- Aluminum Beverage Can Ends – Primary application

- Specialty Beverage Packaging – Premium and niche products

Challenges Impacting Market Growth

Higher Production Costs

BPA-free coatings typically involve higher raw material and R&D costs compared to conventional epoxy coatings, posing challenges for price-sensitive manufacturers.

Performance Trade-Offs

Achieving the same corrosion resistance and flexibility as traditional BPA-based coatings remains a technical challenge, requiring continuous formulation improvements.

Competitive Landscape

The BPA-free beverage end interior coatings market is moderately consolidated, with key players focusing on:

- Advanced resin chemistry

- Sustainable coating technologies

- Strategic partnerships with beverage can manufacturers

Key Companies Profiled

- PPG Industries

- Akzo Nobel N.V.

- Sherwin-Williams Company

- Axalta Coating Systems

- TOYO INK SC Holdings

- Henkel AG & Co. KGaA

- ALTANA AG

- DIC Corporation

Recent Developments

- 2024: Launch of next-generation polyester-based BPA-free coatings with enhanced corrosion resistance

- 2023: Major beverage brands globally commit to 100% BPA-free aluminum packaging

- 2022: Expansion of water-based coating technologies to meet sustainability mandates

Future Outlook: Safe, Sustainable, and High-Performance Packaging

The next decade will witness accelerated innovation in BPA-free beverage end interior coatings, driven by:

- Rising global beverage consumption

- Regulatory bans on BPA-containing materials

- Advancements in bio-based and recyclable coatings

- Corporate sustainability and ESG commitments

As health safety, environmental responsibility, and packaging performance become top priorities, the global BPA-free beverage end interior coatings market is set for strong and sustained growth through 2036.