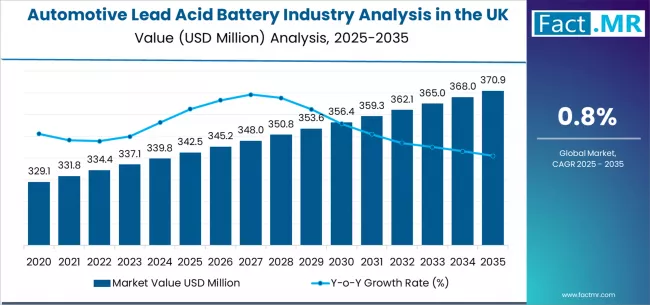

The United Kingdom’s automotive lead acid battery industry is set for steady expansion over the next decade, supported by rising vehicle parc density, consistent aftermarket replacement demand, and the widespread use of lead acid batteries in both conventional and start-stop vehicles. According to the latest insights from Fact.MR the UK market is expected to grow from USD 342.5 million in 2025 to USD 372.8 million by 2035, marking an absolute increase of USD 30.3 million. This reflects total growth of 8.8%, with a CAGR of 0.8% throughout the forecast period (2025–2035).

Lead acid batteries—known for their affordability, recyclability, and reliable performance—remain indispensable across a wide range of vehicle categories. While the UK continues its transition toward hybrid and electric mobility, lead acid batteries hold a critical position in auxiliary power functions and start-stop systems, ensuring continued relevance.

Browse Full Report: https://www.factmr.com/report/united-kingdom-automotive-lead-acid-battery-industry-analysis

Key Market Drivers

Consistent Aftermarket Replacement Demand

With millions of vehicles on UK roads, lead acid batteries remain one of the most frequently replaced automotive components. Their economical cost, established supply chain, and suitability for both passenger and commercial vehicles contribute to ongoing, predictable aftermarket demand.

High Adoption in Start-Stop and Internal Combustion Vehicles

Despite shifts toward electrification, a large portion of the UK vehicle fleet still relies on internal combustion engines and micro-hybrid systems. Lead acid batteries, especially AGM and EFB variants, are essential for powering start-stop technology, contributing significantly to sustained market consumption.

Strong Focus on Cost-Efficiency and Recyclability

Lead acid batteries maintain dominance due to their low cost per kilowatt-hour, robustness, and high recycling rate—often exceeding 95%. Their environmental advantage in recyclability aligns with the UK’s sustainability priorities and circular economy initiatives.

Regional & Market Insights

Aftermarket Leads Market Share

The UK automotive aftermarket remains the primary revenue generator, driven by replacement cycles, cold-weather battery failures, and the need for reliable performance in aging vehicles.

OEM Demand Steady but Impacted by EV Shift

Original equipment manufacturers continue to incorporate lead acid batteries for auxiliary power functions, even in hybrid and plug-in hybrid vehicles. However, the growing EV market slightly moderates OEM demand growth over time.

Commercial Vehicle Segment Remains a Core Consumer

Delivery fleets, logistics vehicles, buses, and heavy trucks depend heavily on high-capacity lead acid batteries due to their compatibility with power-intensive electrical systems and cost advantages.

Market Segmentation Insights

By Battery Type

- Flooded Lead Acid Batteries – Widely used in standard vehicles due to cost-effectiveness.

- AGM (Absorbent Glass Mat) Batteries – Increasing adoption for start-stop and high-performance applications.

- EFB (Enhanced Flooded Batteries) – Favored in micro-hybrid systems for improved charge acceptance.

By Vehicle Type

- Passenger Cars – Largest consumer segment driven by widespread use and regular replacement cycles.

- Commercial Vehicles – Significant demand due to longer operating hours and higher power requirements.

- Two-Wheelers & Specialty Vehicles – Steady usage in scooters, motorcycles, and niche utility vehicles.

Market Challenges

While growth remains steady, several factors may impact future expansion:

- Electrification Trend: Increasing adoption of pure battery-electric vehicles may minimize long-term dependence on lead acid batteries for propulsion.

- Competition from Advanced Chemistries: Lithium-ion alternatives may penetrate auxiliary power applications in high-end vehicles.

- Supply Chain Volatility: Fluctuations in lead prices and environmental regulations can influence production costs.

- Stringent Recycling Regulations: Compliance requirements may raise operational expenses for recyclers and manufacturers.

Competitive Landscape

The UK’s automotive lead acid battery industry is moderately consolidated, with established manufacturers and global brands focusing on product durability, extended life cycles, and improved performance for start-stop systems. Companies prioritize recycling capabilities, advanced AGM/EFB technologies, and strong distribution partnerships with automotive service providers.

Key Companies Include:

- Exide Technologies

- Yuasa Battery Europe

- VARTA (Clarios)

- Hoppecke Batteries

- Banner Batteries

- GS Yuasa International

These companies continue to enhance battery technology while deepening footprints in both OEM and aftermarket channels.

Future Outlook: Steady Demand Amid Transition to Electrified Mobility

Over the coming decade, the UK automotive lead acid battery market will maintain stable growth as replacement demand, affordability, and technological upgrades drive continued adoption. Even as electric vehicles rise, lead acid batteries will remain integral for auxiliary power storage in hybrids and to support essential vehicle functions.

Manufacturers that prioritize sustainability, recycling efficiency, and advanced AGM/EFB battery innovations are positioned to gain strong competitive advantage in the evolving UK mobility landscape.