The aircraft topcoats market is projected to experience significant growth over the next decade, driven by the expanding global aviation industry, increasing commercial aircraft deliveries, and growing demand for maintenance, repair, and overhaul (MRO) activities. Topcoats serve as the final protective and aesthetic layer applied to aircraft exteriors, providing critical properties such as corrosion resistance, UV protection, aerodynamic efficiency, and long-term durability. These coatings not only enhance the operational lifespan of aircraft but also contribute to fuel efficiency by maintaining smooth surface profiles that reduce drag.

Market Size and Growth

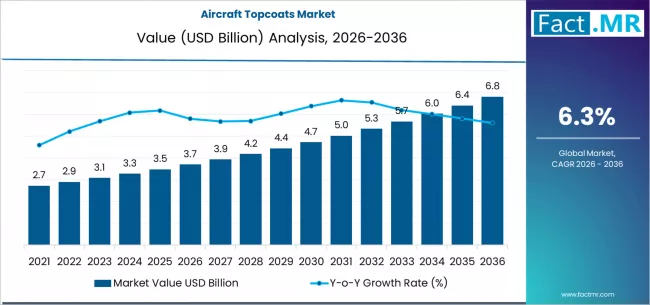

The global aircraft topcoats market is estimated to be valued at approximately USD 3.7 billion in 2026 and is projected to reach USD 6.8 billion by 2036, representing a compound annual growth rate (CAGR) of around 6.3%. This substantial growth is supported by rising air traffic worldwide, particularly in emerging economies, and the increasing adoption of advanced coating technologies that improve aircraft performance while meeting environmental and regulatory standards.

The growth trajectory is further reinforced by the increasing demand for lighter and more durable coatings that reduce the need for frequent repainting and maintenance. Technological advancements in formulation, including waterborne, low-VOC, and fluoropolymer-based topcoats, have enhanced coating longevity, chemical resistance, and environmental compliance, positioning these materials as the preferred choice across both commercial and military aviation sectors.

Market Segmentation

By Resin Type

Polyurethane coatings dominate the aircraft topcoats market, accounting for nearly 48% of the total market share in 2026. Polyurethane is widely preferred due to its exceptional durability, chemical resistance, and flexibility, which allow it to withstand extreme environmental conditions while maintaining gloss and color retention over time. Other resin types, including epoxy and fluoropolymer coatings, serve niche applications such as military aircraft or specialized commercial jets, where performance requirements exceed standard specifications.

By Aircraft Type

Commercial aircraft are the largest end-users of topcoats, projected to account for more than 60% of the market in 2026. The growth in this segment is largely fueled by the increasing number of aircraft deliveries in regions such as North America, Europe, and Asia-Pacific, along with significant aftermarket demand for repainting and maintenance. Military aircraft and business jets also contribute to market revenue, with high-performance coatings being critical for mission-critical applications and private aviation sectors, respectively.

By Application

Topcoats are primarily applied for protection and aesthetics. Protective applications focus on corrosion resistance, UV protection, and resistance to chemical and environmental stress, while aesthetic applications ensure high-quality finishes with color stability and gloss retention. Advances in topcoat chemistry have enabled multi-functional coatings that combine protective and aesthetic properties in a single layer, reducing operational costs and improving application efficiency.

Regional Dynamics

North America is expected to remain a key market, driven by the presence of major aircraft manufacturers, high demand for commercial air travel, and a strong MRO network. Europe also maintains significant market share due to a mature aerospace sector and ongoing investments in advanced coatings for fleet modernization. The Asia-Pacific region is forecasted to achieve the highest growth rate during the forecast period, fueled by expanding aviation infrastructure, rising aircraft orders, and growing middle-class populations driving air travel demand in countries such as China and India. Emerging markets in Latin America and the Middle East are also witnessing gradual adoption of aircraft topcoats, primarily in commercial and military applications.

Growth Drivers

Several factors are propelling the expansion of the aircraft topcoats market:

-

Increasing Commercial Aircraft Deliveries: The steady growth in global air traffic has prompted airlines to expand and modernize their fleets, generating demand for high-performance coatings.

-

Aftermarket Maintenance Demand: Aircraft require regular maintenance and repainting to ensure safety, performance, and compliance with airline standards, which supports sustained topcoat consumption.

-

Technological Advancements: Innovations in resin chemistry and coating application techniques, such as automated spray systems and powder coatings, enhance efficiency and performance, encouraging adoption.

-

Environmental Regulations: Stricter environmental standards and mandates for low-VOC and waterborne coatings drive the market toward more sustainable topcoat solutions.

-

Lightweight Coatings: Lighter coatings contribute to reduced aircraft weight, improving fuel efficiency and lowering operating costs, which is a growing priority for airlines globally.

Market Challenges

Despite strong growth prospects, the aircraft topcoats market faces certain challenges:

-

High Raw Material Costs: Advanced topcoats often rely on premium resins and additives, increasing production costs and potentially limiting adoption in cost-sensitive segments.

-

Technical Complexity: The formulation and application of aerospace-grade coatings require specialized equipment and expertise, presenting barriers for smaller manufacturers and service providers.

-

Competitive Pressure: The market is highly competitive, with major players investing in research and development to differentiate their products, potentially limiting margins for smaller companies.

Competitive Landscape

The aircraft topcoats market is characterized by the presence of leading global players who compete on the basis of technological innovation, product performance, service coverage, and partnerships with OEMs and MRO providers. Key companies have focused on expanding their regional footprints, introducing environmentally friendly formulations, and providing specialized coatings for commercial, military, and business aviation sectors. Strategic mergers, acquisitions, and collaborations are common strategies for strengthening market position and broadening product portfolios.

Browse Full Report : https://www.factmr.com/report/aircraft-topcoats-market

Future Outlook

The aircraft topcoats market is poised for steady growth over the next decade, driven by technological advancements, fleet expansion, and rising demand for performance-oriented coatings. Polyurethane remains the dominant resin type, and commercial aircraft are expected to continue as the leading application segment. Emerging regions such as Asia-Pacific are likely to present lucrative opportunities, particularly in the context of expanding air travel and new aircraft production.

Manufacturers that focus on innovation, sustainability, and cost-efficient coating solutions are expected to maintain a competitive edge. The increasing emphasis on environmental compliance, lightweight materials, and longer-lasting coatings will shape market strategies and product development in the coming years. By 2036, the market is projected to reach USD 6.8 billion, reflecting a compound annual growth of 6.3% from 2026, highlighting both the resilience and expansion potential of this sector.