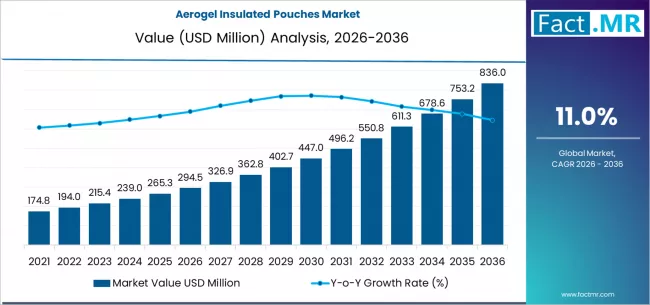

The global aerogel insulated pouches market is poised for robust growth over the 2026–2036 forecast period, driven by the increasing demand for high-performance thermal packaging solutions across pharmaceuticals, biologics, and cold-chain logistics. In 2026, the market is estimated to be valued at approximately USD 294.5 million and is projected to reach USD 836.0 million by 2036, representing a compound annual growth rate (CAGR) of around 11.0%. This expansion reflects the critical role of reliable temperature-controlled packaging in reducing product losses, enhancing supply chain efficiency, and meeting stringent regulatory standards.

Market Drivers

The market growth is primarily fueled by the global expansion of cold-chain logistics, particularly in pharmaceuticals and specialty drugs. Vaccines, biologics, and other temperature-sensitive products require strict thermal management, and aerogel insulation offers significant advantages over traditional materials. Compared with expanded polystyrene (EPS) or polyurethane (PU) foams, aerogel composites provide ultra-low thermal conductivity while maintaining lightweight and flexible profiles, making them ideal for both domestic and international transport.

Regulatory compliance is another key driver. Good Distribution Practices (GDP) and industry standards for packaging temperature-sensitive goods are becoming increasingly rigorous, compelling logistics providers and pharmaceutical manufacturers to adopt high-performance insulation solutions. Direct-to-patient delivery models, fueled by the growth of e-pharmacy and home healthcare, are also increasing demand for compact, reliable insulated mailers that ensure temperature integrity throughout transit.

Sustainability is emerging as an important consideration. Lightweight aerogel reduces transport carbon footprint and minimizes material usage compared to bulky foam packaging. The combination of superior insulation and reduced environmental impact strengthens the value proposition of aerogel insulated pouches for both manufacturers and end-users.

Market Challenges

Despite the strong growth prospects, the market faces challenges primarily related to cost. The production and processing of silica aerogels remain expensive, limiting the adoption of these high-performance pouches in cost-sensitive markets. Price pressures from traditional insulation materials continue to challenge manufacturers to innovate more cost-effective production techniques while maintaining the material’s superior thermal properties.

Emerging Trends

The integration of Internet of Things (IoT) technology into aerogel insulated pouches is gaining traction. Temperature sensors, tracking devices, and smart labeling enable real-time monitoring, improving compliance and reducing the risk of temperature excursions during transit. This trend aligns with the growing demand for visibility in cold-chain operations and is expected to be a key differentiator among market participants.

Another notable trend is the focus on modular and reusable pouch systems. These designs enhance sustainability by reducing single-use waste and lowering overall logistics costs, which is particularly attractive for large-scale distribution networks. The combination of high-performance insulation, intelligent monitoring, and reusable design positions aerogel pouches as a premium solution in the temperature-sensitive logistics sector.

Market Segmentation

By End-Use:

Pharmaceutical and biologics cold-chain applications represent the largest market segment, accounting for nearly 40% of the market. This dominance is driven by the stringent temperature requirements of high-value products such as vaccines, biologics, and specialty drugs. Other end-use segments include specialty food logistics, protein and seafood exports, and precision pharmaceutical logistics, all of which increasingly demand reliable insulated packaging to maintain product integrity.

By Packaging Format:

Insulated flexible pouches are the preferred format, capturing approximately 43% of the market. These pouches provide advantages in ease of handling, weight reduction, and compatibility with parcel delivery systems. Their flexibility allows for various product sizes and shapes, making them suitable for diverse cold-chain applications.

By Material:

Aerogel composites combined with polyethylene (PE) films hold the largest market share, representing around 48% of the market. This combination balances insulation performance with manufacturability and cost-efficiency. The use of composite materials enhances durability and flexibility while maintaining low thermal conductivity.

By Technology:

Ultra-low thermal conductivity insulation is the dominant technology segment, accounting for over 50% of the market. This is due to the superior thermal protection it provides at thinner profiles, allowing for lighter and more compact packaging solutions. The technology supports the growing need for high-performance, space-efficient solutions in logistics operations.

Regional Insights

Emerging markets are experiencing the fastest growth in demand for aerogel insulated pouches. India is projected to grow at a CAGR of approximately 12.5%, driven by increasing pharmaceutical exports and rapid cold-chain infrastructure development. China follows closely with an 11.4% CAGR due to expanding biopharma manufacturing and logistics modernization.

Mature markets such as the United States are growing at around 9.3% CAGR, reflecting stable demand from the well-established biopharma sector. Brazil, Germany, and Japan are witnessing slower growth in the range of 5.5–8.0% CAGR, with adoption driven primarily by regulatory compliance and niche high-value applications.

Competitive Landscape

The aerogel insulated pouches market is moderately consolidated, with key players competing based on product performance, customization, and integration with logistics technologies. Companies are differentiating themselves by offering advanced insulation, smart monitoring capabilities, and partnerships with pharmaceutical and logistics providers. Strategic initiatives include expanding production capacity, developing cost-effective aerogel materials, and exploring partnerships in emerging markets to leverage local distribution networks.

Strategic Implications

For companies operating in this market, innovation in cost reduction and process efficiency is critical to expanding adoption beyond pharmaceutical applications into food, consumer goods, and other temperature-sensitive sectors. Bundling insulation solutions with digital monitoring technologies adds value for regulated cold chains and can serve as a competitive differentiator.

Sustainability initiatives, including reusable and modular pouch systems, align with both environmental priorities and cost optimization strategies. Businesses should also focus on emerging markets, particularly India, China, and Brazil, where demand for high-performance thermal packaging is accelerating due to industrial growth and infrastructure investments.

The combination of high insulation performance, intelligent tracking, lightweight design, and sustainability positions aerogel insulated pouches as a premium, future-ready solution for global cold-chain logistics. Companies that successfully integrate these elements into their product offerings will be well-positioned to capitalize on the anticipated double-digit growth of the market through 2036.

Browse Full Report : https://www.factmr.com/report/aerogel-insulated-pouches-market

Conclusion

The aerogel insulated pouches market is set to experience significant expansion between 2026 and 2036, driven by the convergence of regulatory requirements, cold-chain logistics growth, and the need for high-performance, lightweight, and sustainable insulation solutions. While cost remains a challenge, innovation in manufacturing and material efficiency, along with the integration of smart monitoring technologies, provides ample opportunities for market participants. With pharmaceutical and biologics applications leading the demand, and emerging markets presenting high-growth opportunities, strategic investments in product development, market expansion, and sustainable packaging solutions will be key to capturing market share and driving long-term growth.