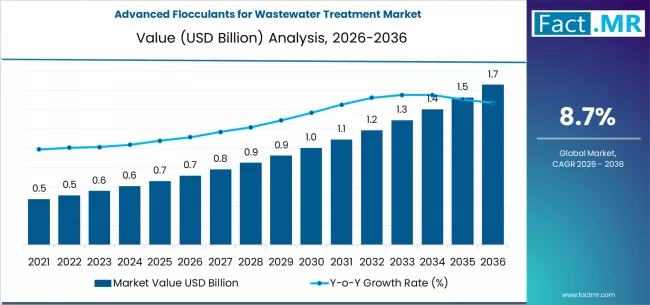

The global advanced flocculants for wastewater treatment market is poised for strong and sustained growth, driven by increasing water scarcity, tightening environmental regulations, and rapid expansion of industrial and municipal wastewater treatment infrastructure. According to a new analysis by Fact.MR, the market is projected to grow from USD 0.72 billion in 2026 to USD 1.66 billion by 2036, registering a robust CAGR of 8.7% during the forecast period.

The rising need for efficient solid-liquid separation, enhanced contaminant removal, and sustainable water reuse solutions is accelerating the adoption of advanced flocculant technologies across industries worldwide.

Browse Full Report: https://www.factmr.com/report/advanced-flocculants-for-wastewater-treatment-market

Strategic Market Drivers

Rising Global Water Scarcity Fuels Adoption

Growing population pressure, climate change, and declining freshwater availability are forcing governments and industries to invest heavily in wastewater recycling and reuse. Advanced flocculants improve sedimentation, turbidity removal, and sludge dewatering efficiency, making them essential for modern treatment facilities.

Stringent Environmental Regulations Accelerate Demand

Governments worldwide are enforcing strict wastewater discharge norms to curb water pollution. Regulatory frameworks such as zero liquid discharge (ZLD) policies and tighter industrial effluent standards are pushing operators to adopt high-performance flocculants that ensure compliance while reducing operational costs.

Industrialization and Urban Expansion

Rapid industrial growth in sectors such as chemicals, textiles, mining, food & beverages, oil & gas, and pharmaceuticals is significantly increasing wastewater generation. Advanced flocculants are being widely deployed to treat complex industrial effluents containing heavy metals, suspended solids, and organic pollutants.

Technological Advancements in Flocculant Formulations

Innovations in polymer chemistry, bio-based flocculants, and hybrid formulations are enhancing flocculation efficiency, reducing chemical dosage, and minimizing environmental impact—further expanding application scope across municipal and industrial wastewater treatment systems.

Regional Growth Highlights

North America: Regulatory Compliance & Infrastructure Investment

North America remains a major market due to strict environmental regulations, aging water infrastructure upgrades, and increasing adoption of advanced wastewater treatment technologies across municipal and industrial sectors.

Europe: Sustainability and Circular Water Economy Focus

Europe’s strong emphasis on water reuse, circular economy initiatives, and eco-friendly chemical solutions is driving widespread adoption of advanced flocculants. Countries such as Germany, France, and the U.K. are leading in sustainable wastewater management.

East Asia: Rapid Industrial and Urban Development

China, Japan, and South Korea are witnessing accelerated demand driven by expanding industrial output, urbanization, and government investments in wastewater treatment plants to control water pollution.

Emerging Markets: High Growth Potential

India, Southeast Asia, Latin America, and the Middle East are experiencing rising demand due to:

- Expanding industrial manufacturing bases

- Increasing municipal wastewater treatment capacity

- Growing awareness of water reuse and conservation

Market Segmentation Insights

By Product Type

- Organic Flocculants – Dominant segment due to high efficiency and broad industrial usage

- Inorganic Flocculants – Widely used in primary treatment processes

- Bio-based Flocculants – Fastest-growing segment driven by sustainability trends

By Application

- Municipal Wastewater Treatment – Largest market share due to urban population growth

- Industrial Wastewater Treatment – High growth in chemicals, mining, and textiles

- Oil & Gas – Increasing adoption for produced water treatment

- Food & Beverage – Strong demand for compliance with discharge norms

Challenges Impacting Market Growth

High Treatment Costs

Advanced flocculants are more expensive than conventional chemicals, which may limit adoption in cost-sensitive regions.

Complex Wastewater Composition

Highly variable industrial effluents require customized flocculant formulations, increasing operational complexity.

Environmental Concerns

Improper chemical handling and disposal can lead to secondary pollution, driving demand for greener alternatives.

Competitive Landscape

The advanced flocculants market is moderately fragmented, with key players focusing on sustainable formulations, performance optimization, and expansion into emerging markets.

Key Companies Profiled

- BASF SE

- SNF Group

- Kemira Oyj

- Solenis LLC

- Ecolab Inc.

- Arkema Group

- Ashland Global Holdings

- Accepta Ltd.

Companies are investing in bio-based flocculants, low-toxicity polymers, and high-efficiency formulations to meet evolving regulatory and sustainability requirements.

Recent Developments

- 2024: Introduction of eco-friendly, bio-based flocculants for municipal wastewater treatment

- 2023: Expansion of advanced polymer flocculant production capacity in Asia-Pacific

- 2022: Increased adoption of high-performance flocculants to support zero liquid discharge (ZLD) initiatives

Future Outlook: Sustainable Water Treatment Takes Center Stage

The advanced flocculants for wastewater treatment market is set to experience transformative growth over the next decade, supported by:

- Rising global water stress

- Expansion of industrial wastewater treatment

- Stricter environmental regulations

- Growth in water reuse and recycling projects

- Innovation in bio-based and sustainable chemical solutions

As water conservation becomes a global priority, advanced flocculants will play a critical role in ensuring efficient, compliant, and sustainable wastewater treatment systems through 2036 and beyond.