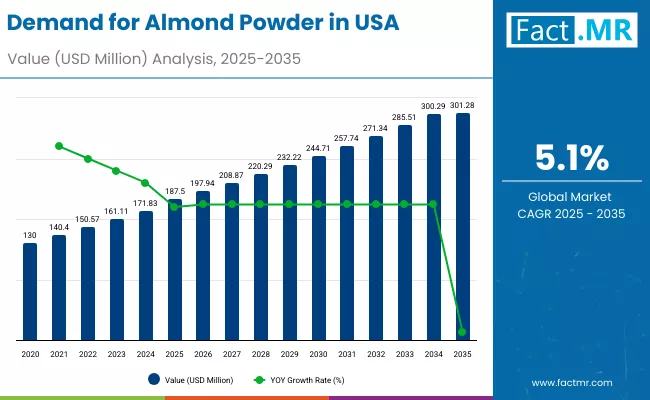

The United States almond powder market is poised for steady and sustained growth over the next decade, driven by rising health consciousness, expanding plant-based diets, and increasing use of almond-based ingredients across food, beverage, and nutraceutical applications. According to a new analysis by Fact.MR, demand for almond powder in the USA is projected to grow from USD 187.50 million in 2025 to approximately USD 301.28 million by 2035.

This represents an absolute increase of USD 113.78 million, translating into total growth of 60.68% over the forecast period. Market demand is expected to expand at a compound annual growth rate (CAGR) of 5.10% between 2025 and 2035, reflecting strong consumer preference for nutrient-dense, clean-label, and gluten-free food ingredients.

Strategic Market Drivers

Rising Health & Wellness Awareness

Growing awareness around balanced nutrition, heart health, and weight management is significantly boosting the consumption of almond powder in the U.S. Almond powder is rich in:

- Plant-based protein

- Healthy monounsaturated fats

- Vitamin E

- Magnesium and dietary fiber

These nutritional benefits make it a preferred ingredient among health-conscious consumers and fitness-focused demographics.

Browse Full Report: https://www.factmr.com/report/united-states-almond-powder-market

Growth of Plant-Based & Gluten-Free Diets

The rapid adoption of plant-based, vegan, keto, and gluten-free diets across the U.S. is accelerating demand for almond powder as a versatile alternative to wheat flour and dairy-based ingredients. Almond powder is widely used in:

- Gluten-free baking mixes

- Vegan desserts

- Low-carb and keto-friendly foods

- Dairy-free smoothies and protein blends

Its functional properties and clean-label appeal are making it a staple in modern food formulations.

Expanding Applications in Food & Beverage Industry

Food manufacturers are increasingly incorporating almond powder into:

- Bakery and confectionery products

- Breakfast cereals and snack bars

- Plant-based beverages and dairy alternatives

- Sauces, dressings, and nutritional supplements

Premiumization trends and innovation in functional foods are further supporting market expansion.

Strong Demand from Sports Nutrition & Nutraceuticals

Almond powder’s protein content and micronutrient profile are driving adoption in sports nutrition, meal replacements, and nutraceutical products. Brands targeting active lifestyles and preventive healthcare are increasingly formulating almond-based powders and blends.

U.S. Market Growth Highlights

California: Core Production & Supply Hub

California dominates almond production in the U.S., providing strong raw material availability and supporting stable supply chains for almond powder manufacturers.

Urban & Health-Focused Consumers Drive Demand

Major metropolitan regions across the U.S. are witnessing higher consumption, fueled by:

- Rising disposable income

- Demand for premium health foods

- Growth of specialty health stores and e-commerce platforms

Market Segmentation Insights

By Nature

- Conventional Almond Powder – Larger share due to affordability and widespread use

- Organic Almond Powder – Fast-growing segment driven by clean-label and sustainability trends

By Application

- Bakery & Confectionery – Leading segment due to gluten-free and premium baked goods

- Beverages & Smoothies – Rapid growth in plant-based drinks

- Dietary Supplements & Sports Nutrition – Increasing use for protein enrichment

- Infant & Clinical Nutrition – Growing interest in natural nutrient sources

By Distribution Channel

- B2B (Food Manufacturers) – Dominant demand share

- Retail & E-commerce – High growth driven by direct-to-consumer brands

Challenges Impacting Market Growth

Price Volatility of Almonds

Fluctuations in almond prices due to climate conditions, water availability, and farming costs can impact profit margins and pricing strategies.

Shelf-Life & Storage Sensitivity

Almond powder requires careful handling and storage to prevent oxidation, adding logistical complexity.

Competition from Alternative Nut & Seed Powders

Almond powder faces competition from cashew, coconut, oat, and seed-based alternatives in certain applications.

Competitive Landscape

The U.S. almond powder market is moderately fragmented, with players focusing on:

- Clean-label and organic certifications

- Product innovation for functional foods

- Expansion of private-label offerings

- Sustainable sourcing and transparent supply chains

Key Focus Areas Among Manufacturers

- Fine milling technologies for improved texture

- Blends tailored for keto, vegan, and sports nutrition

- Enhanced packaging for longer shelf life

Future Outlook: Nutrition-Led Growth Through 2035

The outlook for the U.S. almond powder market remains highly positive, supported by:

- Continued growth of plant-based diets

- Expansion of functional and fortified foods

- Rising demand for gluten-free and allergen-friendly ingredients

- Increasing role of almond powder in preventive healthcare nutrition

As consumers increasingly prioritize natural, protein-rich, and minimally processed ingredients, demand for almond powder in the United States is expected to witness consistent, long-term growth through 2035, reinforcing its position as a key ingredient in the evolving health and wellness food ecosystem.