The demand for chemical protective suits in the United States is rising steadily as industries prioritize worker safety, regulatory compliance, and preparedness against hazardous exposures. Chemical protective suits — a category of personal protective equipment (PPE) designed to shield workers from exposure to harmful chemicals, biological agents, and hazardous particulates — are essential for sectors such as manufacturing, petrochemicals, healthcare, emergency response, and laboratory operations.

Drivers such as stricter occupational safety standards, increased industrial activity, heightened awareness around hazard control, and growth in sectors involving chemical handling and hazardous environments are shaping the market. Furthermore, supply chain responsiveness, enhanced product innovation (breathability, comfort, integrated protection), and expanding procurement through government and corporate safety programs are supporting sustained demand.

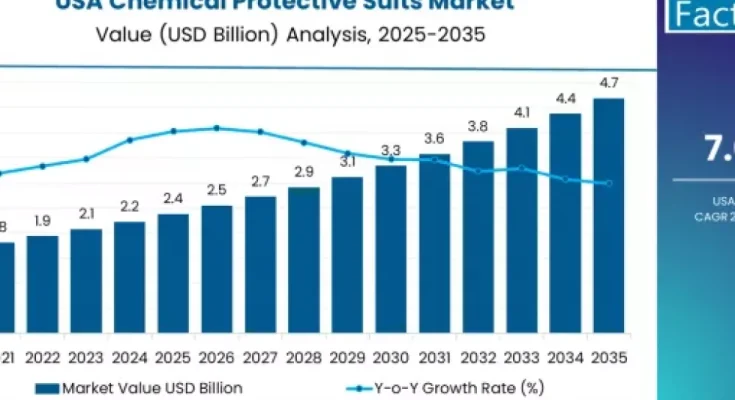

Quick Stats (2025–2035)

-

Estimated Market Value in 2025: ~USD 420 million

-

Projected Market Value in 2035: ~USD 820 million

-

Forecast CAGR (2025–2035): ~7.1% annually

-

Leading End-Use Sector (2025): Industrial & manufacturing safety

-

Fastest-Growing Segment: Healthcare & emergency response

-

Key Driver: Regulatory compliance and hazardous material handling awareness

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12475

What Are Chemical Protective Suits?

Chemical protective suits are specialized garments designed to protect the wearer from chemical exposures and hazardous environments. These suits vary in design and protective performance, covering full body protection, integrated hoods, gloves, and boot covers, and are often combined with respirators and face shields for comprehensive protection.

Types of chemical protective suits include:

-

Barrier suits: For liquid splash protection

-

Gas-tight suits: For high-risk environments with toxic gases or vapors

-

Combined PPE systems: Integrated with respiratory protection

-

Disposable suits: For single-use, low-risk exposures

-

Reusable suits: For repeated use in controlled industrial environments

They are calibrated to standards that measure resistance to permeation, penetration, and degradation by specific classes of chemicals.

Market Drivers in the USA

1. Stringent Safety & Occupational Regulations

Workplace safety regulators in the United States enforce strict standards governing PPE use in hazardous environments. Employers are required to provide adequate protective gear — including chemical protective suits — to minimize risk in chemical plants, laboratories, and hazardous materials operations.

2. Rising Industrial & Manufacturing Activity

Growth in manufacturing, petrochemical refining, pharmaceuticals, material processing, and construction increases worker exposure to hazardous chemicals. These sectors require robust protective suit solutions to ensure safety and operational compliance.

3. Expansion of Healthcare & Emergency Response Programs

Public health emergencies, biothreat response planning, hazmat operations, and hospital preparedness protocols drive demand for chemical protective suits in healthcare and emergency services. Suit use for decontamination response teams and hazardous incident control units is increasing.

4. Increased Awareness of Worker Safety & Training

Corporations and government agencies are investing more in comprehensive safety training and PPE programs. Worker education campaigns and safety culture transformations help increase adoption rates.

5. Innovation in Suit Performance & Comfort

Advancements in materials science — including breathable laminates, lightweight fabrics, and ergonomic designs — are making chemical protective suits more comfortable and versatile. Improved performance encourages broader usage even in less extreme environments.

Market Segmentation & Insights

By Type of Suit

-

Barrier Protection Suits: Widely used for splash and particulate protection in laboratories and industrial settings.

-

Fully Encapsulating Gas-Tight Suits: Used in high-risk scenarios involving airborne toxins or unknown hazard exposures.

-

Reusable Protective Suits: More common in industrial environments where frequent suit use is required.

-

Disposable Protective Suits: Used in healthcare, light industrial use, and emergency response where contamination control is essential.

By Material Technology

-

Polypropylene & Polyethylene Laminates: Common in disposable and low-risk applications.

-

Multi-Layer Laminated Fabrics: Provide higher chemical resistance for industrial use.

-

Advanced Polymer Membranes: Offer breathable, durable protection often used in premium or high-performance suits.

By End-Use Industry

-

Industrial & Manufacturing: Largest share due to ongoing use in chemical plants, refineries, and processing facilities.

-

Healthcare & Emergency Response: Fastest-growing segment as medical facilities emphasize biohazard protection and readiness for hazardous exposures.

-

Research & Laboratories: Stable demand in academic, pharmaceutical, and biotech labs handling hazardous materials.

-

Government & Defense: Demand from military, hazmat teams, and public safety agencies for chemical threat response capabilities.

By Distribution Channel

-

Direct Supply Agreements: Enterprise contracts with large industrial, healthcare, and government organizations.

-

Industrial Safety Distributors: Provide a broad range of PPE solutions to small and medium enterprises.

-

E-commerce & Online Marketplaces: Fast-growing channel for consumer and professional buyers seeking convenience and variety.

Key Challenges

1. Balancing Protection, Comfort & Cost

High-performance chemical suits often carry premium price tags and may be less comfortable for prolonged use. Balancing cost, comfort, and protection for different risk profiles remains a challenge.

2. Supply Chain & Logistics Complexity

Fluctuating demand spikes — especially during public health emergencies or industrial accidents — can strain supply chains. Ensuring consistent availability of suits that meet regulatory standards is critical.

3. Regulatory Compliance & Certification

Protective suits must meet multiple standards (chemical permeation resistance, EN / ANSI performance benchmarks). Ensuring compliance and maintaining certifications can increase development and manufacturing complexity.

4. Worker Acceptance & Proper Use

Even with availability, ensuring proper fit, training, and consistent use in hazardous environments requires ongoing education and safety culture reinforcement.

Opportunities & Strategic Directions

1. Growth in Healthcare & Biohazard Preparedness

Expanding demand for chemical protective suits in hospitals, emergency medical services, and hazard response units — including mobile and on-site rapid response kits — presents a high-growth opportunity.

2. Innovative Materials for Comfort & Safety

Development of breathable, lightweight, and ergonomic protective materials enhances wearer experience and adherence. Integration with smart textiles and sensor technologies (e.g., wearables that monitor exposure) can differentiate offerings.

3. Retrofit & Customization Services

Offering tailored suit configurations, custom sizing, and package solutions for specific industry use cases (e.g., refineries, labs, first-responder units) helps suppliers capture niche segments.

4. Digital Procurement & Supply Management

Online procurement platforms, safety subscription models, and managed PPE inventory services simplify buying and ensure consistency, particularly for dispersed industrial operations.

5. Expanded Training & Certification Programs

Brands that offer or partner on training curricula — proper suit use, decontamination procedures, hazard recognition — become trusted partners, not just suppliers.

Outlook (2025–2035)

The demand for chemical protective suits in the United States is anticipated to grow steadily from an estimated USD 420 million in 2025 to around USD 820 million by 2035, at a CAGR of approximately 7.1%. The market is driven by expanding industrial activities, stringent safety regulations, healthcare preparedness, and awareness of workplace hazards.

Industrial manufacturers, healthcare systems, emergency response agencies, and research institutions will continue to drive adoption of protective suits that balance performance, comfort, and compliance. Investments in innovation — especially materials science, smart integrations, and ergonomic design — will improve overall user experience and broaden use cases.

Companies that excel in quality assurance, regulatory compliance support, user education, and supply reliability are well placed to capture value in this evolving market. As stakeholder emphasis on safety culture deepens, chemical protective suits will remain a foundational element of occupational and environmental hazard mitigation strategies in the USA.

Browse Full Report: https://www.factmr.com/report/united-states-chemical-protective-suits-market