The global ophthalmic gas delivery market is entering a decade of sustained expansion as demand for advanced retinal surgery solutions rises worldwide. Ophthalmic gases are an essential component of vitreoretinal procedures, particularly for treating retinal detachment, macular holes, and complex diabetic eye conditions. Between 2026 and 2036, the market is expected to grow steadily, supported by demographic shifts, rising surgical volumes, and continuous improvements in ophthalmic surgical technology.

Market Size and Growth Outlook

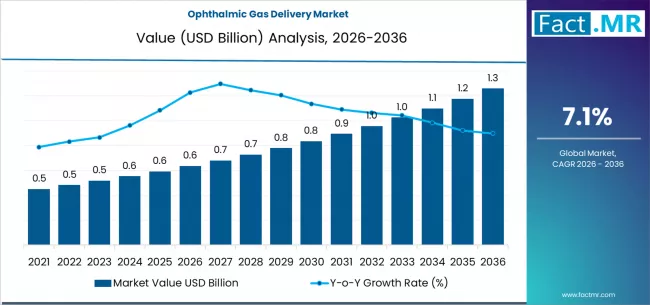

In 2024, the global ophthalmic gas delivery market was valued at approximately USD 1.5 billion. By 2026, revenues are estimated to cross USD 1.65 billion, reflecting increasing adoption of retinal surgical procedures across both developed and emerging healthcare systems. Over the forecast period from 2026 to 2036, the market is projected to grow at a compound annual growth rate (CAGR) of around 5%, reaching an estimated USD 2.7–2.9 billion by 2036.

This growth trajectory is primarily driven by the rising prevalence of age-related ophthalmic disorders. Globally, more than 300 million people are affected by vision-impairing retinal diseases, a figure expected to rise sharply as populations age. Retinal detachment incidence alone is increasing at an estimated 3–5% annually, directly contributing to higher utilization of ophthalmic gas delivery systems in surgical settings.

Key Demand Drivers

One of the strongest growth drivers is the rapid expansion of vitreoretinal surgeries. Advances in diagnostic imaging and early detection have significantly increased surgical intervention rates. In high-income countries, vitreoretinal procedure volumes have grown by over 30% in the past decade, while emerging economies are now recording double-digit annual growth as access to specialized eye care improves.

Another critical factor is the aging global population. By 2030, individuals aged 60 and above will account for more than 1.4 billion people worldwide, many of whom are at increased risk for retinal detachment, macular degeneration, and diabetic retinopathy. These conditions frequently require gas-assisted surgical intervention, reinforcing long-term demand stability.

Technological improvements are also fueling market expansion. Modern ophthalmic gas delivery systems are designed to offer precise gas concentration control, improved sterility, and reduced procedural risk, leading to better patient outcomes. These advancements have increased surgeon confidence and expanded the use of ophthalmic gases in both routine and complex retinal procedures.

Segment Analysis

By Gas Type, long-acting gases dominate overall market revenue. Perfluoropropane (C₃F₈) accounts for approximately 40–45% of total market share, owing to its extended intraocular longevity, which is particularly valuable in complex retinal detachments. Sulfur hexafluoride (SF₆) represents nearly 30–35% of demand, favored for procedures requiring faster absorption and shorter tamponade duration. Medical-grade air and mixed gas formulations collectively contribute the remaining share, primarily used in less complex surgical cases.

By End User, hospitals represent the largest segment, accounting for nearly 65% of total consumption. This dominance is attributed to higher surgical volumes, access to advanced operating rooms, and the presence of specialized vitreoretinal surgeons. However, ambulatory surgical centers (ASCs) are emerging as a high-growth segment, projected to expand at a CAGR exceeding 6% through 2036, driven by the shift toward outpatient ophthalmic surgeries and cost-efficient care models.

Regional Market Performance

North America leads the global ophthalmic gas delivery market with an estimated 35–38% share. The region benefits from high procedure volumes, advanced surgical infrastructure, and strong reimbursement frameworks. The United States alone performs several hundred thousand vitreoretinal surgeries annually, sustaining consistent demand for ophthalmic gases.

Europe holds approximately 25–27% of global revenue, supported by an aging population and increasing awareness of early retinal disease intervention. Countries such as Germany, France, and the United Kingdom are key contributors, with steady growth in both public and private ophthalmic care facilities.

Asia-Pacific is expected to be the fastest-growing regional market between 2026 and 2036, with a projected CAGR of 6–7%. Rapid urbanization, expanding healthcare access, and a rising diabetic population are accelerating demand across China, India, Japan, and Southeast Asia. By 2036, Asia-Pacific is anticipated to account for nearly 30% of global market revenue, significantly reshaping the competitive landscape.

Competitive Landscape

The ophthalmic gas delivery market is moderately consolidated, with a combination of global medical gas suppliers and specialized ophthalmic solution providers. Leading companies focus heavily on product reliability, regulatory compliance, and supply chain efficiency. Competitive differentiation increasingly depends on offering ready-to-use, pre-filled delivery systems that minimize preparation time and reduce the risk of dosing errors.

Strategic initiatives such as capacity expansion, partnerships with ophthalmic device manufacturers, and investments in sterile packaging technologies are shaping competition. Companies are also prioritizing geographic expansion, particularly in high-growth Asia-Pacific and Latin American markets, to strengthen long-term revenue streams.

Innovation and Future Trends

Looking ahead, innovation will remain central to market evolution. Manufacturers are developing next-generation gas delivery systems with enhanced precision and compatibility with advanced vitreoretinal surgical platforms. Digital integration, improved flow control, and enhanced safety mechanisms are expected to become standard features over the next decade.

Environmental considerations are also gaining importance, with companies exploring ways to reduce gas wastage and improve storage efficiency without compromising clinical performance. Regulatory scrutiny around medical gas purity and handling is expected to intensify, favoring established players with strong compliance frameworks.

Browse Full Report : https://www.factmr.com/report/ophthalmic-gas-delivery-market

Future Growth Outlook

From 2026 to 2036, the ophthalmic gas delivery market is expected to maintain steady, resilient growth, driven by rising surgical demand and demographic trends. While the market is not characterized by rapid disruption, its essential role in retinal surgery ensures long-term relevance and predictable expansion.

As global eye care demand continues to rise, ophthalmic gas delivery systems will remain a critical component of modern ophthalmology, supporting improved surgical outcomes and helping address the growing burden of vision impairment worldwide.