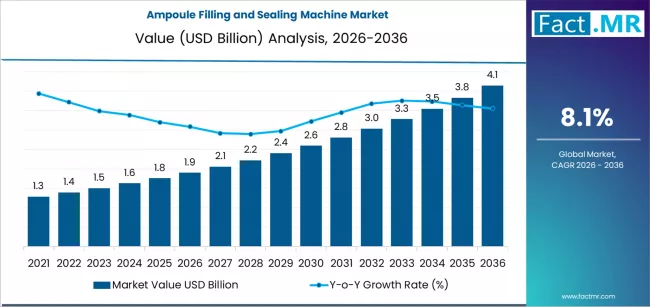

The global Ampoule Filling and Sealing Machine Market is projected to experience significant expansion from 2026 through 2036, driven by increasing demand from pharmaceutical and biotechnology sectors worldwide. The market is expected to grow from an estimated USD 1.9 billion in 2026 to USD 4.1 billion by 2036, representing a compound annual growth rate (CAGR) of 8.1 % over the decade.

This growth trajectory highlights the rising importance of ampoule filling and sealing technology as a critical component of modern drug production, particularly in the manufacture of injectables, vaccines, biologics, and other sterile pharmaceutical products.

Market Valuation and Forecast Highlights

-

2026 Market Valuation: USD 1.9 billion

-

2036 Market Forecast: USD 4.1 billion

-

Total Growth (2026–2036): Over 100 %

-

Global CAGR (2026–2036): ~8.1 %

The market expansion is being driven by increasing adoption of automated aseptic production systems, improvements in pharmaceutical manufacturing practices, and regulatory requirements for heightened sterility standards, particularly in injectable drug packaging.

Key Revenue Drivers

1. Expanding Injectable Pharmaceuticals Segment

The growth of new injectable therapies, including biologics, vaccines, and specialty drugs, has created an essential demand for sterile packaging solutions. The injectables manufacturing sector is projected to contribute a major share of market revenue, underscoring the central role of ampoule filling systems in pharmaceutical operations.

2. Rising Demand for Automation & Quality Control

Manufacturers are investing heavily in integrated wash-fill-seal lines, which combine multiple stages of processing into fully automated sequences. These solutions account for a significant portion of the market due to their enhanced contamination control, operational consistency, and efficiency benefits.

Automation not only increases throughput but also significantly reduces the risk of sterility breaches — a crucial factor for injectable products. Technological advancements in robotics, sensor integration, and aseptic machine design are further strengthening demand.

3. Evolving Regulatory & Compliance Landscape

Strict regulations in North America and Europe are driving pharmaceutical manufacturers to adopt advanced machines that meet stringent aseptic processing and quality standards. Heightened scrutiny around drug safety and packaging integrity continues to push investment in state-of-the-art filling and sealing solutions.

ROI Potential & Investment Implications

Investing in ampoule filling and sealing equipment offers strong long-term ROI for pharmaceutical producers and machine manufacturers alike. Key factors supporting this outlook include:

Sustained Sector Demand

Advances in healthcare, including personalized medicine and biologics, ensure an ongoing need for sterile delivery systems. This translates into steady replacement cycles, machine upgrades, and new installations.

Operational Efficiency Gains

Modern integrated systems reduce operational costs through minimal human intervention, increased throughput, and standardized processes. These factors enhance manufacturing capacity and reduce the long-term cost of ownership.

Technological Upgrades as Competitive Differentiators

Companies implementing next-generation machinery with IoT capabilities, automated quality checks, and real-time monitoring can achieve faster time-to-market and improved compliance outcomes, strengthening their competitive position.

Regional Performance & Opportunities

Asia Pacific: A Leading Growth Frontier

Markets such as India and China are expected to outpace global averages, driven by expanding pharmaceutical sectors, increased domestic production of injectables, and investment in advanced manufacturing technologies. Rapid healthcare infrastructure development and regulatory emphasis on sterility assurance have made ampoule filling systems a top priority for manufacturers in the region.

Middle East and Southeast Asia: Emerging Adoption

Countries including Saudi Arabia, U.A.E., Vietnam, and Indonesia are projected to see strong growth as pharmaceutical industrialization and technology adoption increase across these regions.

Mature Markets: North America & Europe

While growth rates in North America and Europe are more moderate, these markets remain important due to large installed bases, high regulatory standards, and continued investment in precision and compliance-oriented equipment.

Market Trends Shaping the Future

Integration with Smart Manufacturing

IoT-enabled monitoring, real-time quality analytics, and predictive maintenance systems are increasingly integrated with ampoule filling and sealing machines, maximizing uptime and reducing defects.

Shift Toward Fully Automated Solutions

Fully automated filling and sealing systems are becoming the industry standard, favored over semi-automated or manual alternatives due to higher throughput and lower risk of contamination in sterile applications.

Sustainable & Flexible Production Designs

Manufacturers are adopting flexible machine architectures capable of handling multiple vial formats and throughput levels. This improves asset utilization and ROI over longer lifecycles.

Competitive Landscape

The market features a mix of global automation and pharmaceutical equipment leaders, including Syntegon Technology, Groninger, IMA Group, OPTIMA Pharma, Marchesini Group, Bausch+Ströbel, Romaco, NJM Packaging, Cozzoli Machine Company, and Dara Pharma. These companies are investing in R&D, service networks, and advanced machine capabilities to capitalize on growing demand.

Browse Full Report : https://www.factmr.com/report/ampoule-filling-and-sealing-machine-market

Conclusion

The Ampoule Filling and Sealing Machine Market is set for strong growth through 2036, supported by structural industry drivers, rising operational efficiencies, and attractive ROI prospects for stakeholders across the pharmaceutical value chain. The forecast underscores the strategic importance of advanced aseptic technologies in global drug manufacturing and sterile packaging, making these machines essential for future-ready pharmaceutical operations.