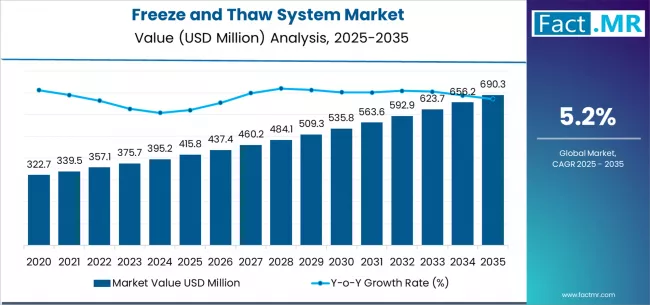

The global freeze and thaw system market is poised for steady growth over the next decade, driven by rising biopharmaceutical production, increasing adoption of single-use technologies, and stringent cold-chain requirements for biologics. According to a recent analysis by Fact.MR, the market is projected to expand from USD 415.8 million in 2025 to approximately USD 690.7 million by 2035, reflecting an absolute growth of USD 274.9 million over the forecast period. This expansion represents a CAGR of 5.2% from 2025 to 2035.

The growing need for safe, contamination-free storage and controlled thawing of temperature-sensitive biologics—including vaccines, cell & gene therapies, and plasma products—is significantly accelerating adoption of freeze and thaw systems worldwide.

Browse Full Report: https://www.factmr.com/report/freeze-and-thaw-system-market

Strategic Market Drivers

Biopharmaceutical Industry Expansion Fuels Demand

Rapid growth in biologics, monoclonal antibodies, vaccines, and advanced therapies is a primary growth catalyst. Freeze and thaw systems ensure product integrity during long-term storage and transportation of high-value biopharmaceutical materials.

With biologics now accounting for a major share of new drug approvals, manufacturers increasingly rely on automated freeze and thaw technologies to maintain consistency and regulatory compliance.

Rising Adoption of Single-Use Technologies

The industry-wide shift toward single-use bioprocessing systems is boosting demand for compatible freeze and thaw solutions. These systems reduce cross-contamination risks, lower cleaning validation costs, and improve operational flexibility—making them ideal for contract manufacturing organizations (CMOs) and biotech startups.

Growth of Cell & Gene Therapy Manufacturing

Cell and gene therapies require precise temperature control throughout production and storage. Freeze and thaw systems play a critical role in preserving cell viability, viral vectors, and genetic material, supporting the rapid commercialization of personalized medicine.

Increasing Focus on Cold-Chain Integrity

Stringent regulatory guidelines for cold-chain management are driving investment in advanced freeze and thaw equipment with enhanced temperature monitoring, automation, and data logging capabilities. Pharmaceutical companies are prioritizing systems that ensure repeatability, scalability, and compliance with global standards.

Regional Growth Highlights

North America: Biopharma Leadership and Advanced Infrastructure

North America dominates the global freeze and thaw system market due to its strong biopharmaceutical manufacturing base, extensive R&D investments, and presence of leading biotech firms. The U.S. continues to drive adoption through growing cell & gene therapy pipelines and vaccine production capacity.

Europe: Regulatory Compliance and Biologics Innovation

Europe remains a significant market, supported by stringent regulatory frameworks, expanding biologics manufacturing, and strong adoption of single-use systems. Germany, Switzerland, the U.K., and France are key contributors.

East Asia: Expanding Biomanufacturing Capabilities

China, Japan, and South Korea are rapidly scaling biopharmaceutical production. Government support for biotech innovation and increasing outsourcing to regional CMOs are fueling demand for freeze and thaw technologies.

Emerging Markets: Manufacturing Expansion and Healthcare Investment

India, Southeast Asia, Latin America, and the Middle East are witnessing rising adoption due to:

- Expansion of pharmaceutical manufacturing

- Growth of biosimilars production

- Increasing healthcare infrastructure investments

Market Segmentation Insights

By Product Type

- Freeze Systems – Dominant segment for long-term storage of bulk drug substances.

- Thaw Systems – Rapidly growing due to demand for controlled, uniform thawing.

By System Type

- Single-Use Systems – Fastest-growing segment driven by flexibility and contamination control.

- Reusable Systems – Preferred in large-scale, established manufacturing facilities.

By Application

- Biopharmaceutical Manufacturing – Largest segment due to biologics dominance.

- Cell & Gene Therapy – High-growth segment requiring precise temperature control.

- Blood & Plasma Storage

- Clinical Research & Drug Development

By End User

- Pharmaceutical & Biotech Companies

- Contract Manufacturing Organizations (CMOs)

- Research Institutes & Laboratories

Challenges Impacting Market Growth

High Capital Investment

Advanced freeze and thaw systems require significant upfront investment, limiting adoption among small-scale manufacturers.

Integration Complexity

System integration with existing bioprocessing infrastructure and automation platforms can pose technical challenges.

Regulatory Validation Requirements

Strict validation and documentation requirements increase deployment timelines and operational complexity.

Competitive Landscape

The freeze and thaw system market is moderately consolidated, with key players focusing on automation, scalability, and single-use compatibility to meet evolving biopharmaceutical needs.

Key Companies Profiled

- Thermo Fisher Scientific

- Sartorius AG

- Cytiva

- Merck KGaA

- GE HealthCare

- Meissner Filtration Products

- BioLife Solutions

- Single Use Support

- Charter Medical

- Azenta Life Sciences

Companies are investing in smart freeze and thaw platforms, enhanced thermal control, and scalable solutions for commercial biologics manufacturing.

Recent Developments

- 2024: Introduction of automated thawing systems with real-time temperature monitoring and data integration.

- 2023: Expansion of single-use freeze and thaw bags for large-volume biologics storage.

- 2022: Increased adoption of freeze and thaw technologies in mRNA vaccine manufacturing.

Future Outlook: Supporting the Next Wave of Biologic Innovation

The freeze and thaw system market is set for sustained growth through 2035, supported by:

- Rising biologics and biosimilars production

- Expansion of cell & gene therapies

- Growing reliance on single-use bioprocessing

- Increased regulatory focus on cold-chain integrity

- Technological advancements in automation and monitoring

As biopharmaceutical companies continue to scale production while ensuring product safety and compliance, freeze and thaw systems will remain a critical component of modern biomanufacturing workflows.