The U.S. market for optical lens cutters and edgers is poised for steady, value-led growth through 2035 as eyewear retail modernization, rising demand for personalized lenses, expansion of optical chains and independents, and increased penetration of on-site lens finishing converge. Lens cutting and edging equipment — spanning manual, semi-automated, and fully automated CNC edgers, as well as integrated surfacing/edging production cells — sits at the intersection of ophthalmic optics, retail convenience, and manufacturing efficiency. As dispensaries and regional optical labs seek faster turnaround, higher precision for complex prescriptions (freeform/aspheric designs), and lower per-unit labor costs, demand for modern edgers and process automation continues to rise.

Retailers and lab operators pursue in-house finishing for several reasons: to shorten customer wait times for single-visit fittings, to capture value from premium lens upgrades and coatings, and to reduce reliance on outsourced labs. Meanwhile, specialty clinics and mobile optical services are adopting compact, flexible edgers that can be deployed close to point of sale. Makers of edgers and cutters are responding with compact, energy-efficient machines, improved software for rimless and custom frame shapes, and connectivity features that integrate with order-management and lens design software.

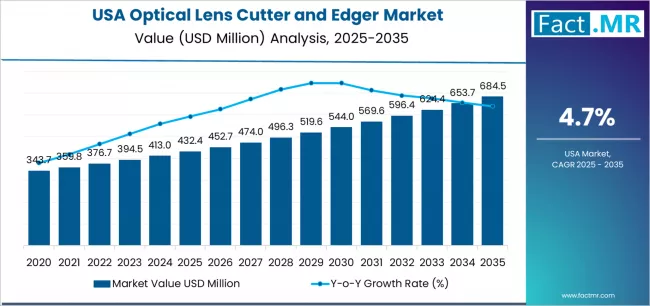

Quick Stats (2025–2035)

-

Market Direction (2025 baseline): Growing unit shipments and rising average selling prices as labs and retail chains upgrade capabilities.

-

Forecast Trend (2025–2035): Modest CAGR in unit terms with stronger value growth driven by automation and premium machine segments.

-

Leading Product Segment (2025): Semi-automated CNC edgers and lens-blocking systems for optical labs and larger retail groups.

-

Fastest-Growing Segment: Integrated surfacing + edging production cells and compact on-site edgers for single-visit dispensing.

-

Key Growth Regions (within USA): High adoption in metropolitan markets — California, Texas, Florida, New York — with expanding uptake in Sun Belt and fast-growing metro areas.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12286

Market Drivers

1. On-Site, Same-Day Dispensing Demand

Consumers increasingly expect fast service. Single-visit dispensing—where refraction, lens manufacturing (surfacing/edging), and fitting occur within hours—drives purchase of compact edgers and integrated finishing cells that can sit inside retail stores or regional labs.

2. Rising Complexity of Lens Designs

Growth in freeform progressive lenses, high-index materials, and specialty coatings requires precision cutting and software control. Labs upgrading to support high-add progressive and freeform surfacing invest in advanced edgers that minimize fitting adjustments and scrap.

3. Automation & Labor Efficiency Pressures

Labor costs and skilled-technician shortages incentivize automation. Fully automated edge-to-edge CNC systems, robotic blocking, and automated blocking/deblocking systems reduce manual intervention, improve throughput, and lower per-lens labor content—attractive for multi-site lab groups.

4. Consolidation & Chain Expansion

National and regional optical chains investing in centralized labs or in-store finishing centers create scale demand for higher-capacity edgers and workflow software. Consolidators prioritise equipment that standardizes output across sites.

5. Service & Aftermarket Revenue Models

Vendors are offering equipment-as-a-service, bundled maintenance, and consumable-supply contracts—lowering capital barriers and encouraging upgrades. Predictable service contracts make modern edgers more accessible to smaller shops.

Market Structure & Segment Insights

By Product Type

-

Manual & Entry-Level Edgers: Serve small independent shops and mobile opticians; lower cost but limited features.

-

Semi-Automated CNC Edgers: The backbone of regional labs and mid-sized retail finishing operations—flexible and cost-effective.

-

Fully Automated Production Cells: Targeted at high-volume central labs; integrate surfacing, blocking, edging, and inspection for end-to-end throughput.

-

Specialty Cutters & Rimless Systems: Needed for rimless, drill-mount, and designer frame work where precision and aesthetics are critical.

By End-User

Independent opticians and small chains buy entry and semi-automatic units; national chains, third-party labs, and optical manufacturers invest in automated production cells and higher-throughput systems.

By Service Model

Ownership remains common, but rental, subscription and managed-lab models are gaining traction—especially for smaller operators seeking modern capability without large upfront cost.

Challenges & Constraints

High Capital Cost for Automation

Large automated systems require substantial investment; ROI depends on sufficient volume, utilization, and predictable order streams. Smaller labs may be slow to adopt until costs fall or service models improve.

Integration & Skill Requirements

Advanced edgers require skilled setup, calibration, and integration with lens design software and lab management systems. Lack of trained technicians can delay ROI and complicate deployments.

Supply Chain & Spare Parts Lead Times

Specialized components, optical software licensing, and custom tooling can face long lead times, impacting vendor fulfillment and downtime for customers.

Regulatory & Quality Standards

Prescription accuracy, safety standards for ophthalmic devices, and consumer expectations require rigorous quality control—raising bar for equipment validation and inspection capabilities.

Opportunities & Strategic Moves

1. Expand Compact On-Site Finishing Solutions

Developing smaller, user-friendly edgers and turnkey training packages will accelerate adoption across independent stores seeking same-day service.

2. Offer Financing & Managed Services

Equipment-as-a-service, predictable maintenance plans, and consumable contracts reduce capital hurdles and drive faster equipment replacement cycles.

3. Invest in Connectivity & Analytics

Remote diagnostics, utilization dashboards, and integration with optical practice management systems reduce downtime, optimize throughput, and provide upsell data for consumables and service.

4. Training & Certification Programs

Vendor-led technician training and certification ensures high uptime and consistent output—making advanced equipment more attractive to risk-averse buyers.

Outlook

The U.S. market for optical lens cutters and edgers will expand steadily through 2035, driven by demand for on-site finishing, automation to control labor costs, and rising complexity of lenses. While unit growth will be modest, value growth will outpace units as labs and retailers invest in higher-margin automated and integrated systems. Suppliers that combine robust machinery, flexible commercial models, strong service networks, and software connectivity will capture the lion’s share of demand as the U.S. optical finishing landscape modernizes.

Browse Full Report: https://www.factmr.com/report/united-states-optical-lens-cutter-and-edger-market