The U.S. market for construction elevators — including personnel hoists, material hoists, mast-climbing work platforms and temporary site elevators — is expected to grow steadily through 2035 as construction activity, urban regeneration projects, and safety/efficiency requirements drive deployment across residential, commercial, infrastructure and industrial builds. Construction elevators are a critical site asset: they speed vertical logistics, improve worker productivity, reduce cycle times for material delivery, and support safer access on complex high-rise and retrofit projects. As general contractors and specialty subcontractors prioritize productivity and predictable schedules, demand for reliable, higher-capacity, and more automated hoisting solutions is rising.

Quick Stats (2025–2035) — estimates and directional indicators

-

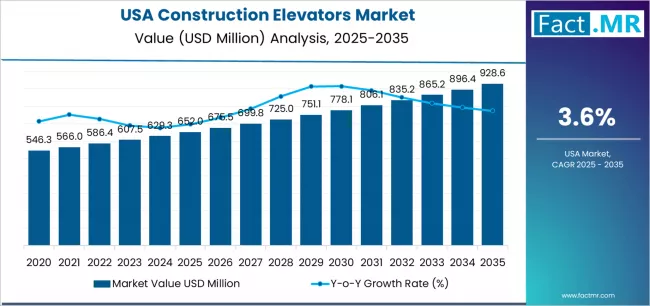

Market Value 2025 (approx.): Estimated in the mid-hundreds of millions USD (equipment + rental market).

-

Market Forecast Value 2035 (approx.): Projected to be meaningfully higher, reflecting steady new-build volumes and replacement/rental growth.

-

Forecast CAGR (2025–2035): Moderate growth in the low-to-mid single digits; rental penetration and service revenues rise faster than equipment sales.

-

Leading Product Type (2025): Personnel/material mast-climbing hoists and modular material hoists for mid-rise and high-rise builds.

-

Fastest-Growing Segment: Rental & on-demand fleet services, digital/connected elevators, and higher-capacity material hoists for modular construction.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12302

Market Drivers

1. Urbanization, High-Rise Construction & Retrofit Activity

Major metropolitan areas and secondary cities continue to see mixed-use development, apartment towers, and office renewals that require efficient vertical logistics. Retrofit and façade-repair projects also drive recurring demand for personnel hoists and mast systems, as scaffolding-free access is increasingly preferred for speed and safety.

2. Shift to Rental & Fleet Models

Many contractors prefer rental and managed-service models to reduce capital tie-up and handle project-to-project variability. Rental fleets that provide installation, maintenance, and certified operators are growing, supporting predictable project timelines and lowering total cost of ownership for contractors.

3. Productivity & Schedule Pressures

Compressed project schedules and labor-cost pressures make reliable hoisting equipment essential. Faster material delivery, fewer rehandles, and reduced congestion on site improve overall productivity metrics, making investment in advanced hoist solutions attractive.

4. Safety, Compliance & Training

Enhanced OSHA and local-safety standards, plus client-driven safety expectations, are encouraging adoption of modern hoists with better fail-safes, remote monitoring, and professional installation. Manufacturers and rental providers that emphasize certified training and compliant maintenance gain market trust.

5. Modular & Offsite Construction Trends

Increasing use of prefabricated modules, volumetric units, and large preassembled components increases demand for high-capacity material hoists and specialized rigging-capable elevators to place heavy components quickly and safely.

6. Technology & Connectivity

IoT-enabled telematics, remote diagnostics, predictive maintenance, and access-control systems are emerging features. Connected fleets reduce downtime, optimize preventive maintenance, and permit data-driven utilization that appeals to rental managers and contractors alike.

Market Structure & Segment Insights

By Product Type

-

Personnel Hoists / Man-Lifts: Essential for worker access on mid- and high-rise projects; safety and speed are critical.

-

Material Hoists / Mast Climbers: Workhorses for rapid material movement; higher-capacity variants support modular units and heavy components.

-

Mast-Climbing Work Platforms: Popular for façade work and finishing trades that need continuous site access.

-

Specialty Lifts & Crane-Integrated Solutions: Used for extremely heavy or irregular loads where standard hoists are not suitable.

By Business Model

-

Rental & Managed Services: Largest and fastest-growing channel as contractors prefer flexibility.

-

Direct Sales to Large Contractors / Owners: Strategic buyers for long-term large-scale projects and infrastructure programs.

-

Aftermarket Services & Parts: Significant recurring revenue from maintenance, certification, spare parts, and operator training.

By End-User

General contractors, façade specialists, mechanical/electrical contractors, modular manufacturers, and public-sector infrastructure teams are key buyers and renters.

Challenges & Constraints

Regulatory & Permit Complexity

Local permitting, street closures, and coordination with utilities can complicate hoist deployment. Providers with strong logistics and local permitting experience are at an advantage.

Safety & Liability Concerns

Catastrophic incidents, though rare, draw regulatory scrutiny and can slow approvals. Strong safety records, documented maintenance regimes, and operator training are essential.

Capital Intensity & Fleet Utilization

Owning and maintaining hoist fleets is capital intensive; low utilization or poor redeployment planning can hurt returns. Data-driven fleet management and flexible reallocation are key to profitability.

Skilled Operators & Maintenance Technicians

Certified operators and specialized technicians are required; shortages increase labor costs and can limit rapid fleet expansion in some regions.

Opportunities & Strategic Directions

1. Expand Rental-as-a-Service & Full-Site Solutions

Offering turnkey installation, maintenance, operator staffing, and telemetry-backed uptime guarantees attracts price-sensitive contractors seeking predictable schedules.

2. Invest in Higher-Capacity & Modular Hoist Lines

Developing hoists for larger prefabricated elements and modular units positions suppliers to capture growing volumetric construction demand.

3. Digital Fleet Management & Predictive Maintenance

Telematics, utilization dashboards, and predictive analytics reduce downtime and improve asset allocation — a compelling value proposition for fleet customers.

4. Training, Certification & Safety-as-a-Service

Providing certified operator training, safety audits, and compliance documentation enhances trust, reduces liability, and differentiates service providers.

Outlook

The U.S. construction-elevator market will grow steadily through 2035, driven by urban construction, retrofit cycles, modular construction trends, and increasing rental adoption. Providers that blend robust, high-capacity equipment with rental flexibility, strong safety credentials, and digital fleet services will capture disproportionate market share. As contractors focus on speed, safety, and certainty of delivery, construction elevators will remain indispensable tools for efficient, modern jobsite logistics.

Browse Full Report: https://www.factmr.com/report/united-states-construction-elevators-market