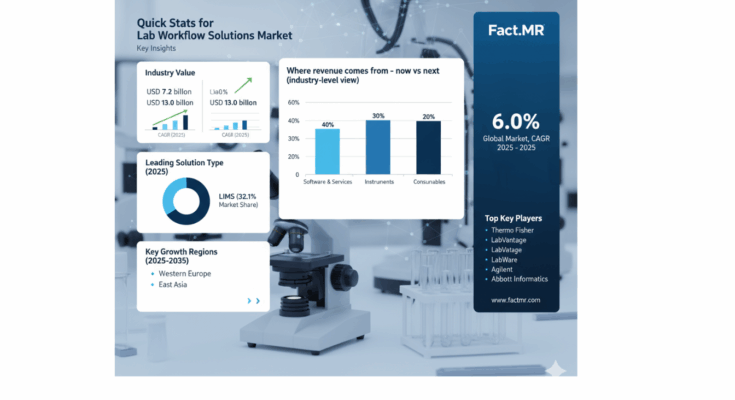

The global lab workflow solutions market is set for a robust growth trajectory over the next decade, with market value projected to rise from USD 7.2 billion in 2025 to USD 13.0 billion by 2035, reflecting a CAGR of 6.0%. This surge underscores accelerating adoption of digital laboratory systems, workflow optimization technologies, and AI-driven data management solutions across pharmaceutical, biotechnology, diagnostic, and academic research laboratories worldwide.

The market expansion is expected to occur in two distinct phases. The first half of the forecast period (2025–2030) will witness the market climbing from USD 7.2 billion to approximately USD 9.8 billion, contributing 45% of total decade growth. This growth is largely driven by the rising adoption of Laboratory Information Management Systems (LIMS), propelled by global laboratory digitization initiatives and increasing demand for streamlined data management and operational efficiency. Enhanced cloud-based capabilities, automated workflow solutions, and integrated scientific platforms are becoming standard expectations rather than premium options, reshaping laboratory operations.

The latter half of the decade (2030–2035) is expected to add USD 3.2 billion, driving the market to USD 13.0 billion. This phase will be defined by the mass-market adoption of AI-powered laboratory systems, seamless integration with comprehensive digital science platforms, and enhanced compatibility with existing laboratory infrastructures. The trajectory points to a transformation in how laboratories approach scientific workflow automation, operational efficiency, and regulatory compliance, creating opportunities for industry leaders to expand solution portfolios across multiple laboratory environments.

Lab Workflow Solutions Market Segmentation and Key Trends

-

By Offering: LIMS leads the market with 41% share, offering centralized data management, sample tracking, and workflow optimization. Electronic Laboratory Notebooks (ELN) hold a 31% share, addressing digital documentation and research workflow needs. Workflow automation and other solutions constitute 28%, reflecting growing demand for process optimization and automation.

-

By End User: Pharmaceutical and biotechnology laboratories dominate with 54% of market share, driven by regulatory compliance, R&D expansion, and complex drug development processes. Diagnostic laboratories represent 27%, while research and academic institutions account for 19%.

-

By Deployment: Cloud-based platforms lead with 58% share, providing multi-site accessibility, scalability, and cost efficiency. On-premise deployment remains important for highly regulated or legacy laboratory environments.

-

By Geography: North America, Western Europe, and East Asia emerge as key growth regions, with the United States leading adoption through pharmaceutical R&D programs, Germany excelling in regulatory compliance solutions, and Japan emphasizing precision laboratory applications. Emerging markets such as Mexico, India, and South Korea are witnessing accelerated adoption due to infrastructure modernization and government biotechnology initiatives.

Lab Workflow Solutions Market Driving Factors

-

Laboratory Digitization & Paperless Initiatives: Increasing adoption of electronic systems and digital records is driving demand for LIMS, ELN, and workflow automation platforms.

-

Pharmaceutical R&D Investment: Expanding drug pipelines and clinical programs are fueling demand for validated, integrated laboratory workflow solutions.

-

Regulatory Compliance & Data Integrity: Platforms with built-in audit trails, electronic signatures, and 21 CFR Part 11 compliance capabilities are becoming essential to meet stringent regulatory standards.

-

AI and Automation Integration: Predictive analytics, intelligent workflow optimization, and AI-powered process monitoring are emerging as key differentiators for laboratory efficiency.

Lab Workflow Solutions Market Opportunities for Industry Leaders

Laboratory technology providers can capitalize on this growth by:

-

Offering comprehensive lab packages that combine workflow solutions, system integration, validation support, training, and compliance services.

-

Providing cloud-first, scalable platforms capable of multi-site connectivity and seamless instrument integration.

-

Designing preconfigured research workflows for sample management, data analysis, quality control, and regulatory reporting.

-

Ensuring regulatory compliance by default, with robust validation documentation, electronic signatures, and audit trail capabilities.

-

Delivering intuitive user interfaces and expert consultation, balancing ease of use with advanced analytical capabilities.

Lab Workflow Solutions Market Regional Market Insights

-

United States: Leads with 6.5% CAGR, driven by extensive pharmaceutical R&D, biotech innovation, and integrated laboratory adoption. Major hubs include California, Massachusetts, and New Jersey.

-

Germany: Regulatory excellence drives adoption with 5.8% CAGR, emphasizing validated systems and precision laboratory data management.

-

United Kingdom: Growth at 5.6% CAGR is fueled by academic-pharmaceutical collaborations and research excellence programs in Cambridge, London, and Edinburgh.

-

Japan: Focused on precision solutions with 5.4% CAGR, supporting advanced pharmaceutical and laboratory research infrastructure.

-

South Korea & Mexico: Experiencing accelerated growth (5.6% and 6.2% CAGR, respectively) due to government biotechnology initiatives and laboratory infrastructure expansion.

Lab Workflow Solutions Market Competitive Landscape

The lab workflow solutions market is characterized by a competitive structure of 20–25 credible players, with the top 3–5 companies accounting for approximately 45–50% of revenue. Leading organizations, including Thermo Fisher, LabVantage, LabWare, Agilent, and Abbott Informatics, maintain leadership through robust platform capabilities, regulatory expertise, and integrated solutions for diverse laboratory environments. Emerging areas of differentiation include AI-powered analytics, cloud-native platforms, and automated regulatory compliance solutions.

Lab Workflow Solutions Market Conclusion

The lab workflow solutions market is entering a transformative decade marked by digitalization, AI integration, and regulatory compliance optimization. Market leaders are positioned to benefit from increasing demand for LIMS, ELN, workflow automation, and cloud-native solutions across pharmaceutical, biotechnology, diagnostic, and academic research laboratories. The next ten years will redefine laboratory data management, scientific workflow efficiency, and research optimization, underscoring the strategic importance of technology leadership and operational excellence for manufacturers, integrators, and stakeholders in this dynamic market.

Browse Full report : https://www.factmr.com/report/436/lab-workflow-solutions-market