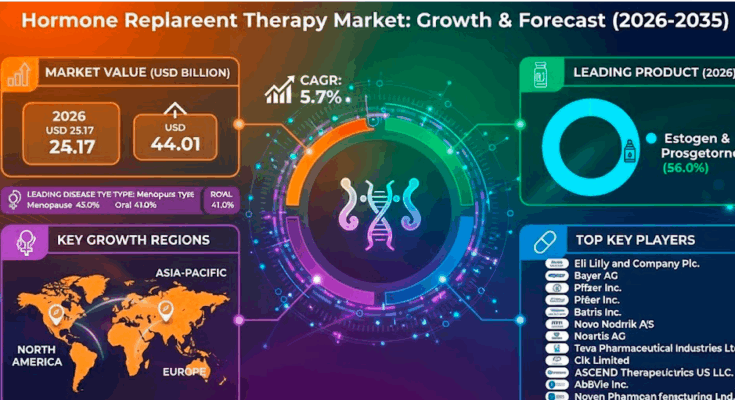

The global Hormone Replacement Therapy (HRT) market is entering a transformative growth phase, with valuation projected to reach $33.76 billion by the end of 2026. According to latest industry analyses, the sector is expanding at a compound annual growth rate (CAGR) of 8.2%, driven by an aging global demographic, the rapid integration of artificial intelligence in diagnostics, and a significant shift toward non-invasive delivery systems.

As healthcare providers worldwide move toward more precise, patient-centric models, the HRT landscape is evolving beyond traditional symptom management to address long-term quality of life and regenerative health.

Market Dynamics: Who, What, and Why

The resurgence of the HRT market is primarily fueled by the Silver Tsunami—a global increase in the geriatric population. By 2030, the number of women aged 50 and over is expected to exceed 1.2 billion, creating a sustained demand for menopause management. However, the market’s scope has broadened significantly:

-

Who: While post-menopausal women remain the largest consumer segment, there is a surging demand among men for Testosterone Replacement Therapy (TRT) to treat male hypogonadism and andropause.

-

What: The market encompasses a diverse range of therapies, including estrogen, thyroid, growth hormone, and parathyroid replacements.

-

Why: Clinical advancements and educational campaigns have successfully begun to destigmatize hormonal health, encouraging earlier diagnosis of conditions like hypothyroidism and growth hormone deficiency.

Strategic Trends: AI and Bioidentical Innovation

A defining characteristic of the 2026 market is the adoption of bioidentical hormone replacement therapy (BHRT). Unlike traditional synthetic hormones, bioidenticals are molecularly identical to human hormones, offering a perceived natural profile that has led to a 20-30% premium in adoption rates among health-conscious demographics.

Technological integration is also reshaping the patient experience. AI-driven platforms are now being utilized to monitor hormonal fluctuations in real-time, allowing for micro-dosing strategies that minimize side effects. Furthermore, the industry is witnessing a pivot from oral medications to transdermal patches and long-acting injectables, which provide more stable blood-serum levels and improve patient adherence.

Regional Outlook and Competitive Landscape

North America continues to hold the largest market share, estimated at approximately 38%, supported by favorable reimbursement policies and a robust pipeline of FDA-approved therapies. However, the Asia-Pacific region is emerging as the fastest-growing market. Increased healthcare spending in China and India, coupled with rising awareness of endocrine disorders, is driving a projected CAGR of over 7% in the region through 2032.

Leading pharmaceutical entities, including Pfizer Inc., Novo Nordisk A/S, Bayer AG, Abbott Laboratories, and Merck KGaA, remain at the forefront of innovation. Recent strategic moves include:

-

The launch of next-generation, once-weekly pediatric growth hormones.

-

Expansion of telehealth-based subscription models for HRT, significantly lowering the barrier to entry for new patients.

-

Investment in non-hormonal neurokinin antagonists to provide alternatives for patients with contraindications for traditional HRT.

Browse Full Report : https://www.factmr.com/report/2224/hormone-replacement-therapy-market

Addressing Safety and Regulatory Scrutiny

Despite robust growth, the industry continues to navigate complex regulatory environments. Heightened scrutiny from bodies like the FDA and EMA regarding long-term cardiovascular and oncologic risks has prompted manufacturers to invest heavily in post-market surveillance. The 2026 outlook emphasizes safety-first formulations, with a focus on micronized progesterone and lower-dose transdermal systems that demonstrate reduced risk profiles in clinical trials.

About the Hormone Replacement Therapy Market Report

This press release is based on comprehensive market data reflecting current 2026 projections, historical performance from 2020-2025, and long-term forecasts through 2034. It provides a strategic overview for investors, clinical professionals, and industry stakeholders navigating the global endocrine health sector.