The global bamboo fiber trays market is moving rapidly from early-stage adoption into a phase of accelerated commercialization, driven by regulatory pressure, structural shifts in food consumption, and measurable advances in molded fiber technology. As sustainability transitions from aspiration to operational requirement, bamboo fiber trays are emerging as a high-performance alternative to plastic and conventional paper-based food packaging.

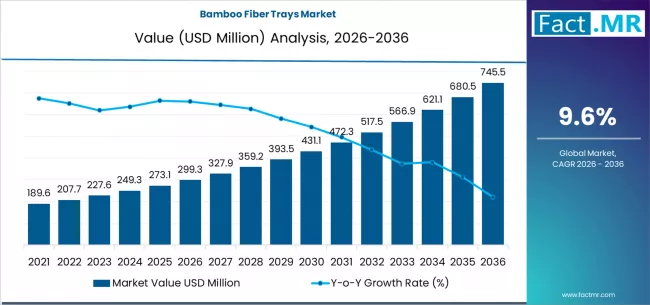

By the mid-2020s, the market is estimated to be valued in the USD 300 million range, with projections indicating it could more than double to over USD 700 million within the next decade. This expansion reflects a high single-digit to low double-digit annual growth rate, positioning bamboo fiber trays among the fastest-growing segments within the global sustainable food packaging ecosystem.

Market Momentum and Demand Fundamentals

Bamboo fiber trays are benefiting from multiple converging demand drivers. The global packaged and ready-to-eat food sector continues to expand, fueled by urbanization, time-constrained consumers, and rising penetration of organized retail and food delivery platforms. Today, ready meals, fresh food packaging, and foodservice applications collectively account for nearly half of total bamboo fiber tray demand, highlighting the category’s close alignment with modern food consumption patterns.

Unlike recycled paper pulp trays, bamboo fiber trays offer higher strength-to-weight ratios, improved heat tolerance, and enhanced rigidity. These characteristics make them compatible with automated filling lines, microwave heating, and high-speed logistics—key requirements for large food brands and quick-service restaurant operators.

At the same time, bamboo’s rapid renewability cycle strengthens its appeal as a long-term sustainable raw material. Bamboo reaches maturity in a fraction of the time required for hardwoods, supporting consistent fiber supply while reducing pressure on forest resources.

Regulatory and Policy-Driven Acceleration

Government intervention remains one of the strongest accelerators of market growth. Restrictions on single-use plastics, extended producer responsibility frameworks, and landfill diversion targets are pushing food manufacturers and retailers to adopt fiber-based, compostable packaging at scale.

In regions where plastic bans are already enforced or scheduled, bamboo fiber trays are increasingly being specified as default formats rather than pilot alternatives. This shift is reducing adoption friction and creating predictable, long-term procurement demand. For multinational food brands, standardized bamboo fiber trays also reduce compliance complexity across multiple regulatory jurisdictions.

Technology as a Growth Multiplier

Recent advances in molding, pressing, and drying technologies are reshaping the economics of bamboo fiber trays. High-pressure compression molding has significantly improved tray density, surface smoothness, and load-bearing capacity, enabling bamboo fiber trays to compete directly with plastic trays in demanding applications.

Production cycle times are declining, defect rates are improving, and scalability is increasing. As a result, unit costs are trending downward, narrowing the price gap between bamboo fiber trays and petroleum-based alternatives. This cost compression is critical for driving adoption in high-volume, price-sensitive food categories.

In parallel, innovation in bio-based coatings and barrier treatments is expanding use cases into moisture-rich and greasy food applications, further broadening addressable market size.

Competitive Landscape and Disruption Signals

The competitive environment is evolving as larger packaging groups scale production capacity and integrate bamboo fiber trays into broader molded fiber portfolios. Vertical integration—spanning fiber sourcing, molding, and distribution—is becoming a key competitive advantage, allowing leading players to stabilize input costs and protect margins.

However, the market is not without disruption risks. Bamboo fiber supply remains geographically concentrated, and any disruption in cultivation, processing, or export logistics could introduce short-term volatility. Additionally, competition from other fiber-based materials, including agricultural residue and recycled pulp trays, is intensifying—particularly in cost-driven segments.

Despite this, bamboo fiber trays maintain a differentiated position due to their mechanical strength, premium appearance, and strong sustainability narrative, which resonates with both regulators and consumers.

Regional Growth Dynamics

Asia-Pacific currently serves as the primary production base, benefiting from proximity to bamboo feedstock and established molded fiber manufacturing infrastructure. At the same time, North America and Europe represent the most attractive demand markets in value terms, driven by higher regulatory enforcement, premium food packaging standards, and strong consumer awareness.

Emerging economies are also showing rising adoption as urban food systems modernize and sustainability policies gain momentum. Over the next decade, demand growth is expected to remain geographically diversified, reducing reliance on any single market.

Market Scenarios Through the Next Decade

Baseline Scenario:

Under current regulatory and technology trajectories, the bamboo fiber trays market sustains strong growth and more than doubles in value. Adoption becomes mainstream in ready meals, fresh foods, and institutional catering, with standardized tray formats dominating volumes.

Accelerated Growth Scenario:

Stricter plastic regulations combined with faster cost reductions and material innovation push growth into double-digit territory. Bamboo fiber trays expand into frozen foods and higher-moisture applications, capturing additional share from plastic and coated paper trays.

Moderated Growth Scenario:

Raw material constraints or prolonged cost pressures slow adoption in price-sensitive segments. Growth remains positive but shifts toward premium food categories and regulated markets where sustainability compliance outweighs cost considerations.

Strategic Implications for Industry Stakeholders

For packaging manufacturers, the next phase of growth favors capital investment in high-throughput molding equipment, long-term fiber sourcing partnerships, and material innovation. Food brands and retailers that lock in bamboo fiber tray specifications early stand to reduce regulatory risk while strengthening ESG performance and brand credibility.

From an investor perspective, bamboo fiber trays represent a scalable sustainability play with strong structural tailwinds, improving margins, and expanding application scope.

Browse Full Report : https://www.factmr.com/report/bamboo-fiber-trays-market

Outlook

The global bamboo fiber trays market is transitioning from an emerging sustainable alternative into a core packaging solution for the food industry. With strong demand fundamentals, regulatory alignment, and continuous technological progress, bamboo fiber trays are positioned to play a central role in the next generation of food packaging—delivering performance, compliance, and sustainability at scale.