The global Blood Flow Measurement Devices market is transforming rapidly as healthcare systems prioritize early diagnostic capability, perioperative monitoring, and long‑term management of cardiovascular and vascular disorders. Fueled by rising chronic disease burdens, technological breakthroughs, and expanding healthcare access in emerging regions, the market is on track for sustained growth through 2036.

Market Size & Growth Projections

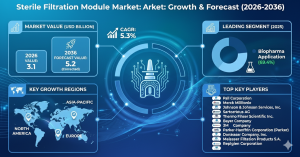

The global market is projected to grow substantially over the next decade. Estimates suggest that the market will expand from approximately USD 672.4 million in 2025 to around USD 1,125.8 million by 2035, reflecting a moderate CAGR of ~5.3% over the period.

-

This growth is broadly underpinned by the increasing global prevalence of cardiovascular diseases, diabetes‑related vascular complications, and cerebrovascular conditions, which require precise, real-time blood flow and hemodynamic monitoring.

-

A variety of device types contribute to this growth, including Doppler ultrasound systems, laser Doppler flowmetry devices, transit‑time flowmeters, and emerging wearable sensors.

While market valuations and CAGR figures vary, all highlight a strong positive trajectory in demand and investment across regions.

Strategic Benchmarking

Technology & Product Segments

The market can be benchmarked across key product technologies:

-

Ultrasound-based Systems – Including traditional and Doppler ultrasound, these dominate global volume due to widespread clinical adoption, non-invasiveness, and real-time imaging capabilities. They are particularly vital in cardiology, vascular diagnostics, and intraoperative use.

-

Laser Doppler & Microcirculation Monitoring Devices – These devices are gaining traction for detailed microvascular assessment, useful in wound care, reconstructive surgery, and research settings. They are valued for high-sensitivity microflow detection.

-

Transit-Time Flowmeters & Specialized Invasive Devices – Utilized heavily in surgical environments such as coronary artery bypass grafting (CABG) and transplant procedures, these tools provide precise intraoperative perfusion data.

-

Emerging Wearable & Wireless Monitors – Increasingly important, especially for home health monitoring and telemedicine integration, wearable flow measurement solutions with connectivity and AI analytics are poised to shape future demand.

Pricing Trends & Value Engineering

Pricing in the blood flow measurement device market is influenced by several factors:

1. Technology Complexity & Precision

Premium pricing is applied to high-precision, real-time systems such as advanced Doppler and laser Doppler units, which incorporate robust hardware and analytic software. In contrast, basic portable and entry-level devices with limited features are priced lower to enhance adoption in resource-constrained settings.

2. Integration & Digital Capabilities

Devices with enhanced connectivity—such as wireless transmission, cloud data integration, and EMR interoperability—command higher price points due to their value in workflow optimization and data analytics.

3. Cost Pressures in Emerging Markets

There is a trend toward cost containment and affordable device development, especially in Asia-Pacific and select Latin American countries, where public health investments are prioritizing scalable blood flow monitoring solutions.

4. Reimbursement & Healthcare Policy

Device pricing is also shaped by reimbursement dynamics; regions with favorable diagnostic reimbursement policies tend to exhibit stronger market uptake and stable pricing, whereas areas with limited insurance support see slower device penetration and more cost sensitivity among providers.

Regional Hotspots & Competitive Dynamics

North America: Continued Market Leadership

North America remains the largest and most technologically advanced market, capturing roughly 35–40%+ of global revenues. This dominance is driven by:

-

High healthcare spending and robust research & development ecosystems.

-

Widespread clinical adoption of minimally invasive and AI-enabled flow measurement technologies.

-

Large patient populations with chronic cardiovascular and metabolic disorders.

The United States is the regional anchor, benefiting from strong vendor presence, early adoption of innovative devices, and favorable reimbursement frameworks.

Europe: Strong Adoption with Diverse Clinical Needs

Europe typically accounts for about 25–30% of global market share. Key growth drivers include:

-

Aging populations with increasing vascular disease incidence.

-

Strong regulatory frameworks that encourage adoption of validated diagnostic technologies.

-

High utilization in specialized clinics and tertiary hospitals for perfusion monitoring.

Countries such as Germany, the UK, and France lead within Europe, often with supportive healthcare policies promoting early diagnosis.

Asia-Pacific: Fastest Growth Potential

Asia-Pacific is widely considered the fastest expanding regional market, even if total valuation presently lags behind North America and Europe. Contributing factors include:

-

Massive patient pools with rising cardiovascular and diabetic complications.

-

Increasing investments in healthcare infrastructure.

-

Growing adoption of portable and cost-effective diagnostic solutions, especially in China and India.

The combination of demographic scale and rising health expenditure positions Asia-Pacific as a future strategic hotspot.

Other Regions

Regions such as Latin America, Middle East, and Africa are smaller contributors today but are witnessing gradual adoption due to expanding specialty care centers, rising disease awareness, and enhanced private healthcare investments.

Market Opportunities & Challenges

Key Opportunities

-

Wearable & Connected Bio-Sensing: Real-time home and remote monitoring tools are expanding access beyond hospitals.

-

AI & Predictive Analytics: Integration of machine learning elevates diagnostic confidence and personalized care.

-

Telehealth & Rural Diagnostics: Low-cost, portable devices broaden service reach in underserved areas.

Primary Challenges

-

High Upfront Cost & Training Needs: Advanced systems remain expensive and require skilled operators.

-

Regulatory Hurdles: Stringent approvals can delay time-to-market for innovative products.

-

Reimbursement Variability: Inconsistent insurance support dampens adoption in certain regions.

Competitive Landscape

The market is highly fragmented, with a mix of large multinational med-tech firms and specialized niche players:

-

Companies specializing in intraoperative flowmeters, transit-time ultrasound, Doppler devices, and laser Doppler instruments dominate.

-

Strategic collaborations, product portfolio expansion, and regional distribution partnerships are core competitive strategies.

Browse Full Report : https://www.factmr.com/report/blood-flow-measurement-devices-market

Conclusion

As we look toward 2036, the blood flow measurement devices market stands at a pivotal moment of growth and innovation. With increasing clinical demand for precise vascular diagnostics, strong regional expansion trajectories, and accelerating adoption of digital and connected technologies, stakeholders—including device manufacturers, healthcare providers, and investors—have significant opportunities to shape the future of cardiovascular and vascular care worldwide.