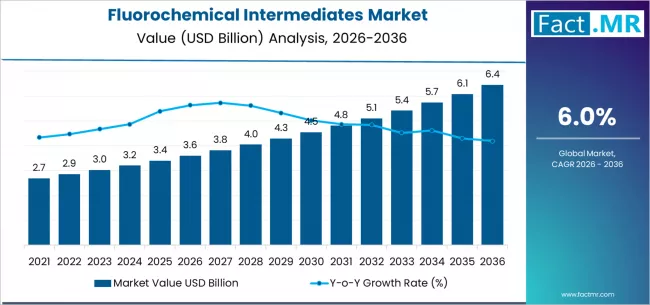

The global fluorochemical intermediates market is positioned for steady and resilient growth over the next decade, driven by expanding applications across pharmaceuticals, agrochemicals, refrigerants, polymers, and specialty materials. According to a recent analysis by Fact.MR, the market is projected to grow from USD 3.60 billion in 2026 to USD 6.45 billion by 2036, reflecting a 79.2% total increase and registering a compound annual growth rate (CAGR) of 6.0% between 2026 and 2036.

Rising demand for high-performance fluorinated compounds, increasing pharmaceutical synthesis activity, and growing adoption in electronics and advanced materials are key factors accelerating global market expansion.

Browse Full Report: https://www.factmr.com/report/fluorochemical-intermediates-market

Strategic Market Drivers

Expanding Pharmaceutical & Agrochemical Applications

Fluorochemical intermediates play a critical role in the synthesis of active pharmaceutical ingredients (APIs) and crop protection chemicals, owing to their ability to enhance chemical stability, bioavailability, and performance.

The growing prevalence of chronic diseases, expanding generic drug manufacturing, and rising demand for high-efficacy agrochemicals are driving sustained consumption worldwide.

Growth of Fluoropolymers & Specialty Materials

The rising use of fluoropolymers in industries such as automotive, electronics, construction, and energy is significantly boosting demand for fluorochemical intermediates.

These materials are valued for their:

- High thermal stability

- Chemical resistance

- Low friction properties

- Electrical insulation performance

Applications range from coatings and seals to wiring insulation and industrial linings.

Refrigerants & Clean Energy Transition

As global regulations phase out high–global warming potential (GWP) refrigerants, fluorochemical intermediates are increasingly used in the development of next-generation, low-GWP refrigerants.

The transition toward energy-efficient cooling systems in residential, commercial, and industrial sectors is creating new growth avenues.

Electronics & Semiconductor Manufacturing

The electronics industry relies heavily on fluorochemicals for etching, cleaning, and surface treatment processes. Growth in semiconductor manufacturing, display panels, and advanced electronics continues to strengthen market demand.

Regional Growth Highlights

East Asia: Global Manufacturing Hub

China, Japan, and South Korea dominate fluorochemical intermediates production due to strong chemical manufacturing infrastructure and high demand from pharmaceuticals, electronics, and polymer industries.

China remains a key supplier and consumer, supported by large-scale industrial output and export activity.

North America: Innovation & Pharmaceutical Strength

North America benefits from advanced pharmaceutical R&D, specialty chemical innovation, and growing semiconductor manufacturing investments. The U.S. continues to be a major consumer of high-purity fluorochemical intermediates.

Europe: Regulatory-Driven Specialty Growth

Strict environmental regulations and strong demand for sustainable fluorinated products are shaping the European market. Germany, France, and the U.K. are key contributors, especially in specialty chemicals and advanced materials.

Emerging Markets: Industrial & Agricultural Expansion

India, Southeast Asia, Latin America, and the Middle East are witnessing increasing demand due to:

- Expanding pharmaceutical manufacturing

- Rising agrochemical consumption

- Growing chemical processing industries

Market Segmentation Insights

By Product Type

- Fluorinated Alkanes & Alkenes – Widely used in refrigerants and polymers

- Fluoroaromatics – High demand in pharmaceuticals and agrochemicals

- Specialty Fluorinated Intermediates – Growing use in high-value applications

By Application

- Pharmaceuticals – Largest and fastest-growing segment

- Agrochemicals – Strong demand for high-performance crop protection

- Polymers & Plastics – Expanding industrial usage

- Refrigerants – Driven by environmental regulations

- Electronics & Semiconductors – High-purity demand

Challenges Impacting Market Growth

Environmental & Regulatory Constraints

Fluorochemicals are subject to strict environmental and safety regulations, increasing compliance costs and limiting usage of certain compounds.

High Production & Handling Costs

Complex manufacturing processes, high purity requirements, and safety considerations increase production costs, particularly for specialty intermediates.

Supply Chain Volatility

Dependence on specialized raw materials and limited global suppliers can create pricing fluctuations and supply risks.

Competitive Landscape

The fluorochemical intermediates market is moderately consolidated, with companies focusing on capacity expansion, sustainable chemistry, and high-value product development.

Key Companies Profiled

- Arkema S.A.

- Daikin Industries Ltd.

- Solvay S.A.

- AGC Chemicals

- Chemours Company

- Dongyue Group

- Gujarat Fluorochemicals Ltd.

- Navin Fluorine International

Companies are investing in eco-friendly fluorochemicals, advanced purification technologies, and supply chain optimization.

Recent Developments

- 2024: Expansion of pharmaceutical-grade fluorochemical production capacities

- 2023: Increased R&D investment in low-GWP refrigerant intermediates

- 2022: Strategic partnerships for sustainable fluorochemical manufacturing

Future Outlook: Steady Growth Driven by Specialty Demand

The fluorochemical intermediates market is set for consistent expansion through 2036, supported by:

- Rising pharmaceutical and agrochemical demand

- Growth of fluoropolymers and specialty materials

- Transition to next-generation refrigerants

- Expansion of electronics and semiconductor manufacturing

- Increasing focus on sustainable and compliant chemical solutions

As industries continue to demand high-performance and specialty chemical inputs, the global fluorochemical intermediates market is expected to maintain strong momentum over the coming decade.