The global semi-auto flex filling lines market is poised for strong expansion over the next decade, supported by rising demand for flexible packaging, growth of small and medium-sized enterprises (SMEs), and increasing adoption of cost-effective, scalable filling solutions across food, cosmetics, and personal care industries.

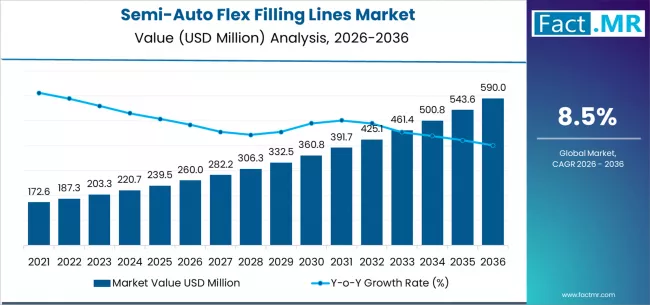

According to a new analysis by Fact.MR, the market is valued at USD 260.0 million in 2026 and is projected to reach USD 590.0 million by 2036, registering a robust CAGR of 8.5% between 2026 and 2036. This growth reflects increasing investments in semi-automated packaging systems that balance efficiency, affordability, and operational flexibility.

The accelerating shift toward pouches, bags, and flexible packaging formats, combined with the need for low-capex automation among SMEs, is significantly boosting market adoption worldwide.

Browse Full Report: https://www.factmr.com/report/semi-auto-flex-filling-lines-market

Strategic Market Drivers

SME Food & Cosmetics Producers Fuel Market Expansion

Small and medium-sized food, beverage, and cosmetics manufacturers are increasingly adopting semi-auto flex filling lines to scale production without the high costs associated with fully automated systems. In 2026, the SME food & cosmetics producers segment is projected to hold a 45% market share, highlighting its central role in driving demand.

These systems offer:

- Lower initial investment

- Ease of operation and maintenance

- Flexibility across multiple SKUs

- Faster changeovers for small batch production

This makes them ideal for startups, regional brands, and contract manufacturers.

Rising Demand for Flexible Packaging Formats

The global packaging industry is rapidly shifting toward pouches, sachets, and bags due to their lightweight nature, convenience, and sustainability advantages. As a result, semi-auto pouch & bag filling lines account for 50% of the market by system type in 2026, making them the dominant configuration.

Flexible packaging growth in sauces, dairy products, powders, liquids, cosmetics, and household products continues to strengthen demand for adaptable filling technologies.

Cost-Effective Automation for Emerging Markets

In developing regions, manufacturers are seeking semi-automated solutions that improve productivity while maintaining manual oversight. Semi-auto flex filling lines deliver higher throughput than manual filling while avoiding the complexity and expense of fully automated machinery.

This trend is particularly strong in Asia-Pacific, Latin America, and the Middle East, where manufacturing infrastructure is expanding rapidly.

Improved Machine Design & Filling Accuracy

Advancements in:

- Servo-assisted dosing systems

- Precision volumetric and gravimetric fillers

- Hygienic machine design

- Easy integration with sealing and labeling units

are enhancing performance, consistency, and product quality, making semi-auto systems increasingly competitive.

Regional Growth Highlights

Asia-Pacific: Fastest-Growing Manufacturing Hub

Asia-Pacific leads market growth due to:

- Expanding SME manufacturing base

- Rapid urbanization and packaged food consumption

- Growth of local cosmetics and personal care brands

India, China, Indonesia, and Vietnam are key contributors to demand.

North America: Strong SME and Contract Packaging Demand

In North America, demand is driven by:

- Growth of private-label and artisanal food brands

- Expansion of contract packaging services

- Emphasis on flexible and sustainable packaging

The U.S. remains the largest contributor in the region.

Europe: Sustainability and Packaging Innovation

European manufacturers are increasingly adopting semi-auto filling lines to meet:

- Sustainable packaging goals

- Regulatory requirements for food safety and hygiene

- Demand for premium, flexible packaging formats

Germany, Italy, France, and the U.K. are leading markets.

Market Segmentation Insights

By System Type

- Semi-Auto Pouch & Bag Filling Lines – 50% market share due to high flexibility

- Semi-Auto Bottle & Container Filling Lines

- Semi-Auto Sachet Filling Lines

By Application

- SME Food & Cosmetics Producers – 45% share in 2026

- Pharmaceuticals

- Home & Personal Care Products

- Chemicals & Industrial Products

By End Use

- Food & Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Chemicals

Challenges Impacting Market Growth

Limited Throughput vs Fully Automated Lines

While cost-effective, semi-auto systems offer lower production capacity, limiting adoption among large-scale manufacturers.

Operator Dependency

Performance and output consistency depend on skilled operators, increasing labor reliance.

Integration Constraints

Some semi-auto systems face challenges integrating with upstream and downstream automation.

Competitive Landscape

The semi-auto flex filling lines market is moderately fragmented, with manufacturers focusing on modular designs, customization, and SME-focused solutions.

Key Companies Profiled

- Tetra Pak (semi-auto solutions segment)

- Bosch Packaging Technology

- IMA Group

- Coesia Group

- Nichrome India Ltd.

- Barry-Wehmiller Companies

- Matrix Packaging Machinery

- Volpak

Companies are investing in:

- Compact and modular filling systems

- Multi-format filling capability

- Improved hygiene and CIP features

- Energy-efficient designs

Recent Developments

- 2025: Launch of modular semi-auto filling lines designed for SMEs and startups

- 2024: Increased adoption of pouch filling systems in cosmetics and nutraceuticals

- 2023: Expansion of semi-auto filling equipment manufacturing capacity in Asia

Future Outlook: Flexible Automation for a Growing SME Economy

The next decade will witness sustained growth in the semi-auto flex filling lines market, driven by:

- Rapid expansion of SME manufacturing

- Rising demand for flexible packaging

- Cost-conscious automation strategies

- Growth in food, cosmetics, and personal care industries

- Increasing focus on sustainable packaging formats

As manufacturers seek scalable, affordable, and adaptable packaging solutions, semi-auto flex filling lines are set to play a critical role in global packaging automation through 2036.