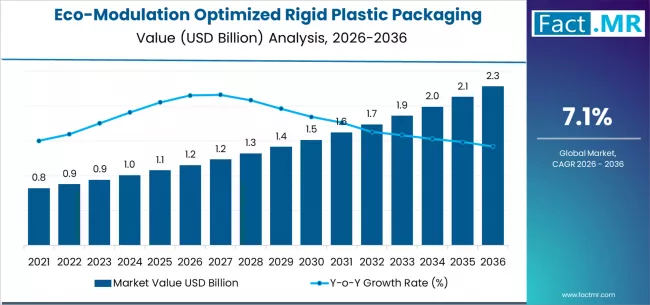

The global eco-modulation optimized rigid plastic packaging market is positioned for strong expansion over the next decade, driven by tightening sustainability regulations, rising adoption of circular economy practices, and growing demand for environmentally optimized packaging solutions. According to a recent analysis by Fact.MR, the market is valued at USD 1.15 billion in 2026 and is projected to reach USD 2.28 billion by 2036, registering a robust CAGR of 7.1% during the forecast period.

Eco-modulation strategies—where packaging fees are adjusted based on recyclability, material efficiency, and environmental performance—are rapidly reshaping rigid plastic packaging design, material selection, and manufacturing processes across industries.

Browse Full Report: https://www.factmr.com/report/eco-modulation-optimized-rigid-plastic-packaging-market

Strategic Market Drivers

Sustainability Regulations Accelerate Adoption

Government policies and Extended Producer Responsibility (EPR) frameworks across Europe, North America, and parts of Asia are compelling manufacturers to redesign rigid plastic packaging to reduce environmental impact. Eco-modulation fee structures reward recyclable, lightweight, and mono-material packaging, driving widespread adoption.

Manufacturers are increasingly focusing on:

- Reduced material usage

- Improved recyclability

- Use of recycled content

- Design-for-circularity principles

Food & Beverage Sector Leads Demand

In 2026, the food & beverage application segment is projected to hold a dominant 45% market share, supported by growing demand for sustainable bottles, jars, containers, and food-grade rigid plastic packaging.

Brand owners are prioritizing eco-optimized packaging to:

- Meet regulatory compliance

- Improve sustainability scores

- Enhance brand image among eco-conscious consumers

Bottles & Jars Dominate Packaging Formats

Bottles & jars account for nearly 40% of the market share by packaging format, driven by high consumption in beverages, condiments, dairy products, personal care, and household products.

Eco-modulation optimization in bottles and jars focuses on:

- Lightweighting

- Recycled PET (rPET) integration

- Label and cap redesign for recyclability

Circular Economy & Recycling Infrastructure Expansion

Improved recycling technologies, deposit return schemes (DRS), and chemical recycling innovations are strengthening the business case for eco-modulated rigid plastic packaging across global markets.

Regional Growth Highlights

Europe: Regulatory Leadership Fuels Market Expansion

Europe leads the market due to advanced eco-modulation fee systems under EPR regulations. Countries such as France, Germany, Italy, and the Nordics are driving innovation in recyclable rigid plastic packaging.

North America: Corporate Sustainability Commitments Drive Growth

The U.S. and Canada are witnessing rising adoption as major FMCG brands commit to 100% recyclable or reusable packaging targets, accelerating investment in eco-optimized rigid plastics.

East Asia: Manufacturing Scale Meets Sustainability Goals

China, Japan, and South Korea are integrating eco-modulation principles into packaging production, supported by expanding recycling capacity and government sustainability initiatives.

Emerging Markets: Rising Awareness and Regulatory Evolution

Markets in India, Southeast Asia, Latin America, and the Middle East are experiencing gradual uptake, driven by:

- Growing environmental awareness

- Multinational brand compliance

- Developing waste management infrastructure

Market Segmentation Insights

By Packaging Format

- Bottles & Jars – Largest segment (40% share in 2026)

- Containers & Tubs

- Trays & Clamshells

- Industrial Rigid Packaging

By Application

- Food & Beverage – Leading segment (45% share in 2026)

- Personal Care & Cosmetics

- Household & Cleaning Products

- Pharmaceuticals

- Industrial & Chemical Packaging

By Material Type

- PET & rPET

- HDPE & LDPE

- PP

- Other recyclable rigid plastics

Challenges Impacting Market Growth

Higher Compliance & Redesign Costs

Eco-modulation optimization requires packaging redesign, testing, and certification, increasing short-term costs for manufacturers.

Recycling Infrastructure Gaps

Limited recycling capabilities in certain regions hinder full optimization of rigid plastic packaging.

Complex Regulatory Landscapes

Varying eco-modulation criteria across regions increase compliance complexity for global packaging suppliers.

Competitive Landscape

The market is moderately fragmented, with packaging manufacturers, material suppliers, and brand owners investing heavily in eco-design innovation and recyclable rigid plastic solutions.

Key Companies Focus Areas

- Lightweight rigid packaging designs

- Increased recycled content usage

- Mono-material packaging formats

- Smart labeling for recyclability communication

Recent Developments

- 2024: FMCG brands accelerate adoption of eco-modulated packaging to reduce EPR fees

- 2023: Packaging manufacturers introduce high-rPET content rigid containers

- 2022: Expansion of eco-modulation fee structures across European markets

Future Outlook: Sustainable Rigid Packaging Takes Center Stage

The next decade will witness transformative growth in eco-modulation optimized rigid plastic packaging, driven by:

- Expansion of EPR and eco-fee regulations

- Rising consumer demand for sustainable packaging

- Growth in recycled plastic supply chains

- Innovation in recyclable rigid packaging designs

- Strong focus on circular economy models

As sustainability becomes a core business priority, eco-modulation optimized rigid plastic packaging is set to play a critical role in reshaping global packaging systems through 2036.