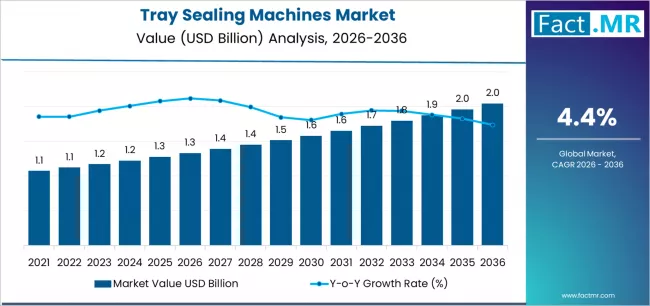

The global tray sealing machines market is set for steady expansion over the next decade, driven by growing demand for convenient packaged foods, extended shelf-life solutions, and advancements in modified atmosphere packaging (MAP) technology. According to a new analysis by Fact.MR, the market is projected to grow from USD 1.33 billion in 2026 to approximately USD 2.04 billion by 2036, reflecting a 53.4% total growth and an absolute increase of USD 0.71 billion over the forecast period. This growth corresponds to a CAGR of 4.4% between 2026 and 2036.

The rapid expansion of the food processing industry, combined with increasing consumption of ready-to-eat meals, fresh produce, and protein-rich foods, is accelerating global adoption of tray sealing machines.

Strategic Market Drivers

Rising Demand for Packaged & Convenience Foods

Urbanization, busy lifestyles, and changing dietary habits are significantly boosting demand for pre-packaged meals, fresh-cut produce, and chilled food products. Tray sealing machines ensure hygienic packaging, leak-proof sealing, and longer shelf life, making them indispensable in modern food packaging operations.

Browse Full Report: https://www.factmr.com/report/tray-sealing-machines-market

Growth of Modified Atmosphere Packaging (MAP)

The growing adoption of MAP technology to preserve food freshness and reduce spoilage is driving investments in advanced tray sealing equipment. MAP-enabled tray sealers are widely used for:

- Meat & poultry

- Seafood

- Dairy products

- Fresh fruits & vegetables

Expansion of Food Processing & Retail Infrastructure

The expansion of supermarkets, hypermarkets, and online grocery platforms worldwide is increasing the need for standardized, visually appealing, and tamper-proof food packaging solutions.

Automation & Efficiency in Packaging Lines

Food manufacturers are increasingly adopting automated and semi-automated tray sealing machines to improve throughput, reduce labor dependency, and ensure consistent packaging quality.

Regional Growth Highlights

North America: Strong Demand for Ready-to-Eat Meals

North America remains a prominent market due to high consumption of processed and convenience foods, along with strict food safety regulations. The U.S. continues to lead adoption across meat, poultry, and frozen food packaging applications.

Europe: Sustainability & Advanced Packaging Technologies

Europe’s growth is supported by stringent food safety standards, sustainability initiatives, and widespread adoption of MAP and recyclable packaging materials. Germany, France, Italy, and the U.K. are key contributors.

East Asia: Expanding Food Manufacturing Sector

China, Japan, and South Korea are witnessing strong demand driven by expanding food processing industries, rising urban populations, and increasing preference for packaged meals.

Emerging Markets: Rapid Urbanization & Retail Growth

Countries across India, Southeast Asia, Latin America, and the Middle East are experiencing rising demand due to:

- Growing middle-class population

- Expansion of cold-chain infrastructure

- Increasing consumption of packaged meat and dairy products

Market Segmentation Insights

By Machine Type

- Automatic Tray Sealing Machines – Dominant segment due to high-speed operation and large-scale production capability.

- Semi-Automatic Machines – Widely used by small and medium food processors.

- Manual Machines – Limited adoption in small-scale operations.

By Packaging Technology

- Modified Atmosphere Packaging (MAP) – Fastest-growing segment.

- Vacuum Sealing

- Skin Packaging

- Standard Sealing

By End-Use Industry

- Food & Beverage – Largest segment, led by meat, poultry, seafood, and ready meals.

- Pharmaceuticals

- Cosmetics

- Industrial Products

Challenges Impacting Market Growth

High Initial Investment

Advanced tray sealing machines, especially MAP-enabled systems, require significant upfront investment, posing challenges for small-scale manufacturers.

Maintenance & Operational Costs

Regular maintenance and skilled operator requirements can increase total cost of ownership.

Packaging Material Compatibility

Ensuring compatibility with evolving sustainable and recyclable packaging materials remains a technical challenge.

Competitive Landscape

The tray sealing machines market is moderately fragmented, with manufacturers focusing on automation, energy efficiency, and flexible packaging solutions.

Key Companies Profiled

- MULTIVAC Group

- ULMA Packaging

- Proseal (JBT Corporation)

- Ilpra S.p.A.

- Ishida Co., Ltd.

- Sealpac International

- Robert Reiser & Co., Inc.

- Harpak-ULMA Packaging

- Omori Machinery Co., Ltd.

- G. Mondini S.p.A.

Companies are investing in high-speed sealing systems, compact designs, digital controls, and eco-friendly packaging compatibility.

Recent Developments

- 2024: Introduction of smart tray sealing machines with IoT-enabled monitoring for predictive maintenance.

- 2023: Increased adoption of MAP tray sealers by meat and seafood processors to extend shelf life.

- 2022: Food packaging companies accelerate transition to recyclable and mono-material trays compatible with advanced sealing systems.

Future Outlook: Steady Growth Driven by Food Packaging Innovation

The tray sealing machines market is expected to witness consistent growth through 2036, supported by:

- Rising demand for packaged and ready-to-eat foods

- Expansion of modern retail and cold-chain infrastructure

- Technological advancements in MAP and vacuum sealing

- Emphasis on food safety, hygiene, and sustainability

- Increasing automation in food processing facilities

As food manufacturers prioritize efficiency, product freshness, and regulatory compliance, tray sealing machines will remain a critical component of the global packaging ecosystem over the coming decade.