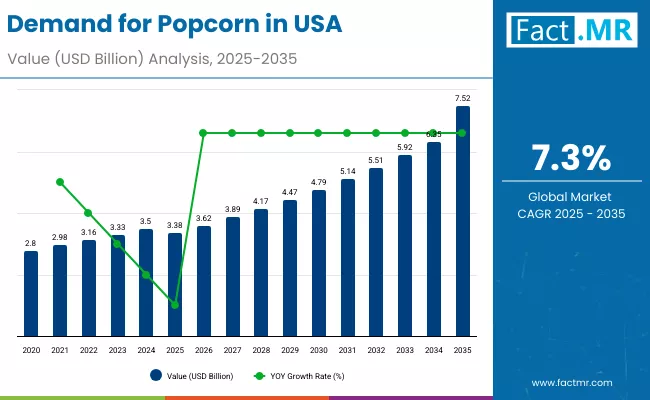

The United States popcorn market is poised for strong and consistent growth over the next decade, fueled by rising demand for convenient, healthy snacking options, expanding home entertainment culture, and continuous product innovation. According to a recent analysis by Fact.MR, demand for popcorn in the USA is projected to grow from USD 3.38 billion in 2025 to approximately USD 7.52 billion by 2035, registering an absolute increase of USD 4.14 billion over the forecast period. This reflects a total growth of 122.5%, with demand expanding at a robust CAGR of 7.30% from 2025 to 2035.

The shift toward ready-to-eat (RTE) snacks, increasing preference for low-calorie and whole-grain foods, and the growing popularity of flavored and gourmet popcorn varieties are significantly accelerating market demand across the country.

Strategic Market Drivers

Rising Preference for Healthy & Low-Calorie Snacks

Popcorn’s positioning as a whole-grain, fiber-rich, and low-fat snack makes it an attractive alternative to traditional fried snacks. Health-conscious consumers increasingly favor air-popped and lightly seasoned popcorn, especially among millennials and Gen Z.

Growing awareness of clean-label foods and portion-controlled snacking continues to support steady demand.

Browse Full Report: https://www.factmr.com/report/united-states-popcorn-market

Home Entertainment & Streaming Culture Boost Consumption

The rapid expansion of OTT platforms, home theaters, and gaming culture has reinforced popcorn’s role as a go-to snack for at-home entertainment. Consumers are increasingly purchasing microwave and ready-to-eat popcorn for movie nights and social gatherings.

Innovation in Flavors & Premium Offerings

Manufacturers are introducing innovative flavors, including:

- Caramel & kettle corn

- Cheese & savory blends

- Spicy, chocolate-coated, and gourmet variants

Premium packaging, organic ingredients, and non-GMO labeling are further expanding consumer appeal.

Convenience & Ready-to-Eat Food Demand

Busy lifestyles and on-the-go consumption habits are driving strong growth in microwave popcorn, pre-popped bags, and single-serve formats, particularly through supermarkets, convenience stores, and e-commerce channels.

Market Growth Highlights – United States

Strong Retail & Distribution Network

The U.S. benefits from a well-established retail infrastructure, including supermarkets, hypermarkets, club stores, and online platforms, enabling wide product accessibility.

Growing Demand Across Demographics

Popcorn demand spans across:

- Families and children

- Young professionals

- Fitness-conscious consumers

- Movie and sports enthusiasts

Seasonal consumption spikes during sporting events, festivals, and holidays further boost sales.

Market Segmentation Insights

By Product Type

- Microwave Popcorn – Largest segment due to convenience and affordability

- Ready-to-Eat Popcorn – Fastest-growing with premium and flavored offerings

- Raw Popcorn Kernels – Popular among health-focused consumers

By Flavor

- Butter & Salted – Dominant traditional segment

- Caramel & Sweet – High demand in indulgent snacking

- Cheese & Savory – Strong traction among younger consumers

- Flavored & Gourmet – Rapid growth driven by innovation

By Distribution Channel

- Supermarkets & Hypermarkets – Primary sales channel

- Convenience Stores – Strong impulse purchases

- Online Retail – Fastest-growing due to subscription models and bulk buying

Challenges Impacting Market Growth

Rising Raw Material & Packaging Costs

Fluctuations in corn prices and increasing costs of sustainable packaging may affect profit margins.

Health Concerns Over Additives

Excessive butter, salt, or artificial flavoring in some products can deter health-conscious consumers, prompting brands to reformulate.

Competitive Landscape

The U.S. popcorn market is moderately competitive, with key players focusing on product innovation, clean-label formulations, premium branding, and omnichannel distribution strategies.

Key Companies Operating in the Market

- Conagra Brands, Inc.

- PepsiCo (Smartfood)

- Weaver Popcorn Company

- The Hershey Company

- Campbell Soup Company

- LesserEvil Brand

- Quinn Foods

Manufacturers are investing in organic popcorn, non-GMO sourcing, plant-based seasonings, and eco-friendly packaging to gain competitive advantage.

Recent Developments

- 2024: Launch of organic and clean-label popcorn variants targeting fitness-focused consumers

- 2023: Expansion of gourmet and artisanal popcorn brands across e-commerce platforms

- 2022: Major snack brands introduce low-sodium and plant-based flavored popcorn

Future Outlook: A Decade of Flavor Innovation & Healthy Snacking

The next decade will witness strong momentum in the U.S. popcorn market, driven by:

- Rising health awareness

- Expansion of premium and gourmet popcorn

- Growth of home entertainment culture

- Demand for clean-label and organic snacks

- Innovation in flavors and packaging formats

As consumers continue to seek convenient, healthier, and enjoyable snacking experiences, demand for popcorn in the United States is expected to maintain strong, long-term growth through 2035.