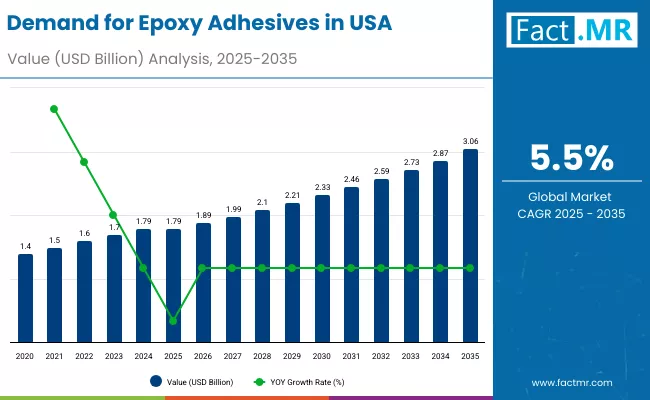

The U.S. epoxy adhesives market is positioned for steady and resilient growth over the next decade, supported by rising construction activity, expanding automotive and aerospace manufacturing, and increasing demand for high-performance bonding solutions. According to a new analysis by Fact.MR, demand for epoxy adhesives in the United States is projected to grow from USD 1.79 billion in 2025 to approximately USD 3.06 billion by 2035, reflecting a 71.0% total increase and an absolute growth of USD 1.27 billion during the forecast period. This expansion represents a compound annual growth rate (CAGR) of 5.50% from 2025 to 2035.

The growing preference for durable, chemical-resistant, and high-strength adhesive solutions across infrastructure, transportation, and industrial applications is significantly accelerating epoxy adhesive adoption nationwide.

Strategic Market Drivers

Construction & Infrastructure Development Drive Demand

Rising investments in commercial buildings, residential construction, bridges, and transportation infrastructure are fueling epoxy adhesive demand. These adhesives are widely used for:

- Structural bonding

- Concrete repair

- Flooring systems

- Tile and stone installation

Their superior load-bearing capacity, moisture resistance, and long service life make epoxy adhesives essential for modern construction projects across the U.S.

Browse Full Report: https://www.factmr.com/report/united-states-epoxy-adhesives-market

Automotive, Aerospace & Transportation Manufacturing Expansion

Epoxy adhesives are increasingly replacing mechanical fasteners in automotive and aerospace manufacturing due to their:

- High bonding strength

- Lightweight benefits

- Resistance to heat, chemicals, and vibration

Growing production of electric vehicles (EVs), aircraft components, rail systems, and marine structures is driving consistent demand for advanced epoxy bonding solutions.

Growth in Electronics & Electrical Applications

The U.S. electronics industry continues to adopt epoxy adhesives for circuit boards, encapsulation, insulation, and thermal management. Their excellent dielectric properties and durability under extreme conditions support expanding usage in:

- Consumer electronics

- Industrial electronics

- Renewable energy systems

Advancements in Adhesive Formulations

Innovations in low-VOC, fast-curing, and bio-based epoxy adhesives are improving performance while meeting evolving environmental and safety regulations. Enhanced formulations enable wider adoption across high-precision and sustainability-driven applications.

Regional Market Highlights

United States: Strong Industrial & Infrastructure Momentum

The U.S. market benefits from:

- Federal infrastructure spending programs

- Rising residential and commercial construction

- Advanced manufacturing capabilities

States with strong automotive, aerospace, and construction hubs are leading epoxy adhesive consumption.

Market Segmentation Insights

By Product Type

- One-Component Epoxy Adhesives – Preferred for ease of use and fast application

- Two-Component Epoxy Adhesives – Dominant segment due to superior bonding strength and durability

By Application

- Construction – Largest segment driven by infrastructure and building projects

- Automotive & Transportation – Rapid growth supported by EV production

- Aerospace & Defense – High-performance structural bonding

- Electrical & Electronics – Encapsulation and insulation applications

- Industrial Manufacturing – Machinery, tools, and equipment assembly

Challenges Impacting Market Growth

High Cost Compared to Conventional Adhesives

Epoxy adhesives typically cost more than acrylic or polyurethane alternatives, limiting penetration in cost-sensitive applications.

Longer Curing Times

Certain epoxy formulations require extended curing times, which can slow manufacturing processes without advanced curing technologies.

Environmental & Regulatory Compliance

Stricter VOC emission and chemical safety regulations necessitate continuous reformulation and compliance investments by manufacturers.

Competitive Landscape

The U.S. epoxy adhesives market is moderately consolidated, with key players focusing on product innovation, sustainable formulations, and high-performance applications.

Key Companies Profiled

- 3M Company

- Henkel AG & Co. KGaA

- Sika AG

- H.B. Fuller Company

- Arkema Group

- Huntsman Corporation

- RPM International Inc.

- Illinois Tool Works (ITW)

Manufacturers are investing in low-emission epoxies, faster curing systems, and customized industrial-grade solutions.

Recent Developments

- 2024: Launch of low-VOC epoxy adhesives aligned with U.S. green building standards

- 2023: Increased adoption of epoxy bonding solutions in EV battery assembly and lightweight vehicle structures

- 2022: Expansion of epoxy adhesive usage in large-scale infrastructure repair and rehabilitation projects

Future Outlook: A Decade of High-Performance Bonding Solutions

Over the next decade, the U.S. epoxy adhesives market will benefit from:

- Infrastructure modernization initiatives

- Growth of EVs and aerospace manufacturing

- Technological advancements in adhesive chemistry

- Rising demand for sustainable and long-lasting materials

As industries prioritize structural integrity, durability, and advanced material performance, demand for epoxy adhesives in the USA is expected to maintain strong and consistent growth through 2035.