The peptide synthesis market is poised for robust expansion over the coming decade as peptides move from niche research reagents into mainstream therapeutic, diagnostic, and specialty-product applications. Growth is being driven by a rising pipeline of peptide- and peptide-conjugate therapeutics, increasing use of peptides in vaccine development and immunotherapy, expanding demand from contract development and manufacturing organizations (CDMOs), and advances in automated synthesis, purification, and analytics that lower cost and improve throughput. From preclinical discovery to GMP-grade active pharmaceutical ingredients (APIs), peptide synthesis underpins a wide array of life-science innovation.

Quick Stats for Peptide Synthesis Industry

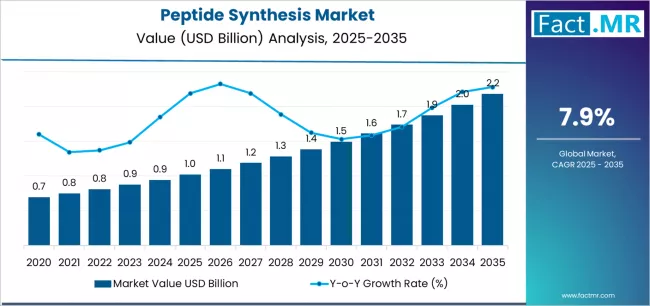

- Peptide Synthesis Market Value (2025): USD 1.02 billion

- Peptide Synthesis Market Forecast Value (2035): USD 2.18 billion

- Peptide Synthesis Market Forecast CAGR: 7.9%

- Leading Product Type in Peptide Synthesis Market: Reagents & Consumables (48.0%)

- Key Growth Regions in Peptide Synthesis Market: Asia Pacific, North America, and Europe

- Top Players in Peptide Synthesis Market: Thermo Fisher Scientific, Merck KGaA, GenScript, Bachem Holding, Biotage, Creative Diagnostics, PolyPeptide Group, Syngene International, Puresynth Research Chemicals, Lonza

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12245

Market Drivers

1. Therapeutic Momentum

Peptide-based drugs and peptide–drug conjugates are gaining traction across indications such as oncology, metabolic diseases, endocrinology, infectious disease, and pain management. Peptides offer high target specificity, predictable metabolism, and favorable safety profiles. The growing number of clinical-stage peptide candidates and approvals for novel peptide therapeutics intensifies demand for reliable synthesis at both research and commercial scales.

2. Outsourcing & CDMO Adoption

Biotech and pharma companies increasingly rely on specialized CDMOs for peptide synthesis, scale-up, and regulatory-compliant manufacturing. Outsourcing accelerates development timelines and reduces capital intensity for sponsors, driving demand for contract peptide synthesis services ranging from milligram-scale discovery lots to multi-kilogram GMP batches.

3. Technological Advances

Improvements in solid-phase peptide synthesis (SPPS), continuous-flow synthesis, peptide ligation methods, and automated synthesizers have enhanced yield, reduced synthesis time, and improved reproducibility. Advances in purification (high-performance preparative chromatography), sequence verification (mass spectrometry), and analytical methods support higher standards of quality and traceability — vital for clinical and commercial supply.

4. Growing Applications Beyond Therapeutics

Peptides are increasingly used in diagnostics, biomaterials, cosmetics (bioactive peptides for skin care), nutraceuticals, and research reagents. Diagnostic assays and targeted imaging agents employing peptide ligands stimulate demand for specialized, often labeled or modified, peptides. This diversification cushions the market and broadens revenue streams for peptide producers.

5. Conjugates & Complex Modalities

The rise of peptide–drug conjugates, peptide-based delivery systems, and peptide–protein hybrids necessitates more complex chemistries, orthogonal protection strategies, and site-specific conjugation capabilities. Suppliers capable of delivering high-purity, site-specifically modified peptides command premium pricing and long-term partnerships.

Market Structure & Service Segments

Discovery-Scale Synthesis: Agile, low-volume synthesis for screening and lead optimization. Speed, flexibility, and a wide portfolio of modifications (non-natural amino acids, PEGylation, labeling) are core demands.

Preclinical & Toxicology Supply: Larger, well-characterized batches meeting GLP-style documentation and stability profiling for animal studies.

GMP Commercial Manufacturing: Multi-kilogram supply chains with full regulatory documentation, validated processes, and robust QC — essential for marketed peptide medicines.

Analytical & Formulation Services: Peptide stability, solubility, impurity profiling, and formulation development (e.g., depot formulations, lyophilized presentations) are high-value add-ons.

Specialty Modifications: Custom chemical modification, conjugation, cleavage strategies, and incorporation of constrained motifs (stapled peptides, cyclic peptides) differentiate suppliers.

Regional Dynamics

North America and Europe lead in demand owing to concentrated biotech R&D, strong clinical pipelines, and established CDMO networks. Asia-Pacific is the fastest-growing region as local biotech ecosystems mature, clinical trials expand, and regional CDMOs scale capabilities to capture both domestic and global clients. Emerging markets in Latin America and the Middle East show growing research activity and incremental demand for discovery and preclinical services.

Challenges & Constraints

Manufacturing Complexity & Cost: Peptide synthesis—especially for long sequences, complex post-translational mimics, or highly hydrophobic sequences—can be technically demanding and costly. Yield losses, difficult purifications, and scale-up hurdles can inflate timelines and pricing.

Regulatory Expectations: GMP peptide manufacture requires stringent quality systems, impurity characterization, and process validation. Smaller suppliers may face barriers to enter or scale in the regulated supply space.

Supply Chain & Raw-Material Dependencies: Availability and price volatility of specialized amino acids, coupling reagents, and protecting groups can impact lead times and margins. Securing reliable sources for high-quality raw materials is essential.

Stability & Delivery Challenges: Many peptides have poor oral bioavailability and require parenteral administration or specialized delivery platforms, increasing formulation complexity and development cost.

Opportunities & Strategic Imperatives

Vertical Integration & End-to-End Services: Providers that combine discovery, analytical, formulation, and GMP manufacturing deliver faster timelines and reduce technical transfer risk — highly attractive to sponsors.

Scale-Up & Cost-Reduction Innovations: Investments in continuous-flow peptide synthesis, greener chemistries, and process intensification lower per-gram costs and open commercial opportunities for wider therapeutic adoption.

Niche Differentiation: Specializing in complex modifications (e.g., radiolabeling, fluorescent tags), constrained peptides, or peptide conjugates creates defensible service niches with premium margins.

Partnerships with Biotech & Academia: Early-stage collaborations and supply agreements with research institutions and start-ups secure long-term pipelines and feed demand as candidates progress to clinic.

Outlook

The peptide synthesis market is set to expand substantially through 2035, supported by therapeutic innovation, broader non-therapeutic applications, and rising outsourcing to expert CDMOs. Companies that invest in scalable, high-quality manufacturing, broaden analytical and formulation offerings, and adopt cost-saving synthesis technologies will capture the largest share of growth. As peptide modalities mature and delivery challenges are progressively solved, peptides will play an increasingly central role across modern drug development, diagnostics, and specialty-product markets — sustaining long-term demand for synthesis and associated services.

Browse Full Report: https://www.factmr.com/report/peptide-synthesis-market