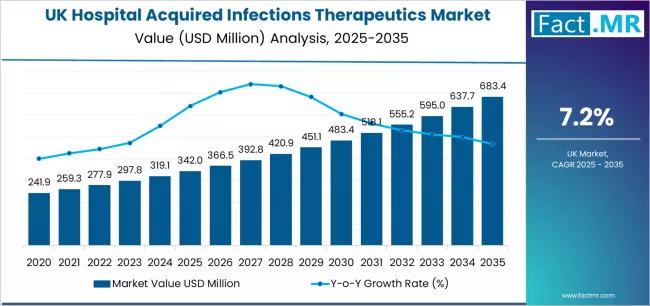

The demand for hospital-acquired infections (HAIs) therapeutics in the United Kingdom is set for strong expansion over the next decade, supported by increasing infection incidence, rising antimicrobial resistance (AMR), and heightened focus on patient safety and infection control across healthcare facilities. According to a new analysis by Fact.MR, the UK hospital-acquired infections therapeutics market is projected to grow from USD 342.0 million in 2025 to approximately USD 683.4 million by 2035, registering a CAGR of 7.2% during the forecast period.

This robust growth reflects the UK healthcare system’s increasing investments in advanced antimicrobial therapies, rapid diagnostics, and hospital infection prevention programs aimed at reducing morbidity, mortality, and healthcare costs associated with HAIs.

Key Market Drivers

Rising Burden of Hospital-Acquired Infections

Hospital-acquired infections such as pneumonia, bloodstream infections, urinary tract infections (UTIs), and surgical site infections (SSIs) remain a major concern across NHS hospitals. Prolonged hospital stays, invasive procedures, and increased use of medical devices are contributing to higher infection rates, driving demand for effective therapeutic interventions.

Antimicrobial Resistance Fuels Innovation

The growing prevalence of multidrug-resistant (MDR) pathogens, including MRSA, VRE, and carbapenem-resistant organisms, is accelerating the need for novel antibiotics and combination therapies. Pharmaceutical companies are focusing on next-generation antimicrobials, targeted therapies, and stewardship-driven treatment solutions.

Expansion of NHS Infection Control Programs

UK government initiatives and NHS-led infection prevention strategies are significantly strengthening demand for HAI therapeutics. Enhanced surveillance, early diagnosis, and rapid treatment protocols are improving patient outcomes and boosting therapeutic adoption across public and private hospitals.

Growth in Aging Population and Chronic Diseases

The UK’s aging population and rising prevalence of chronic illnesses have increased hospital admissions, leading to a higher risk of HAIs. Immunocompromised patients and long-term care recipients represent a key patient segment driving sustained market demand.

Browse Full Report:

https://www.factmr.com/report/united-kingdom-hospital-acquired-infections-therapeutics-market

Market Segmentation Insights

By Infection Type

- Urinary Tract Infections (UTIs) – Largest share due to catheter-associated infections

- Surgical Site Infections (SSIs) – High demand driven by surgical volumes

- Hospital-Acquired Pneumonia – Fastest-growing segment

- Bloodstream Infections – Critical care-driven demand

By Drug Class

- Antibiotics – Dominant segment across all infection types

- Antifungals – Rising adoption in ICU and immunocompromised patients

- Antivirals – Niche but growing use in hospital settings

By Route of Administration

- Injectable Therapies – Preferred in severe infections

- Oral Therapies – Used for step-down and outpatient treatment

By End User

- Public Hospitals (NHS) – Largest demand contributor

- Private Hospitals – Growing adoption of advanced therapeutics

- Specialty Clinics – Focused infection treatment centers

Regional Outlook: UK Healthcare Infrastructure Drives Market Growth

The United Kingdom remains a high-potential market due to its well-established healthcare infrastructure, centralized NHS system, and strong regulatory oversight. Increased funding for infection surveillance, antimicrobial stewardship, and hospital safety standards continues to support long-term growth of HAI therapeutics.

Challenges Impacting Market Growth

Antibiotic Development Costs

High R&D costs and low commercial returns for antibiotics remain a challenge, slowing new drug launches.

Regulatory and Stewardship Constraints

Strict antimicrobial stewardship programs limit overuse, impacting short-term sales volumes while promoting sustainable, long-term market stability.

Resistance Evolution

Rapid mutation of pathogens requires continuous innovation, increasing development complexity.

Competitive Landscape

The UK hospital-acquired infections therapeutics market is moderately competitive, with companies focusing on novel antibiotics, combination therapies, and resistance-targeted solutions.

Key Companies Operating in the Market

- Pfizer Inc.

- GlaxoSmithKline plc

- AstraZeneca plc

- Merck & Co., Inc.

- Sanofi

- Johnson & Johnson

- Bayer AG

- Shionogi & Co., Ltd.

Companies are investing in next-generation antimicrobials, rapid-response therapies, and collaborations with public health organizations.

Recent Developments

- 2024: Increased NHS funding for antimicrobial resistance research and hospital infection prevention

- 2023: Expansion of rapid diagnostic testing to enable early targeted therapy

- 2022: Introduction of stewardship-linked reimbursement models for novel antibiotics

Future Outlook: Sustained Growth Through Infection Control Innovation

The UK hospital-acquired infections therapeutics market is poised for steady expansion through 2035, driven by:

- Rising antimicrobial resistance

- Increased hospital admissions

- Government-led infection prevention initiatives

- Innovation in antimicrobial drug development

- Focus on patient safety and healthcare quality

As healthcare systems continue prioritizing infection control and resistance management, demand for advanced HAI therapeutics in the UK will remain strong over the next decade.