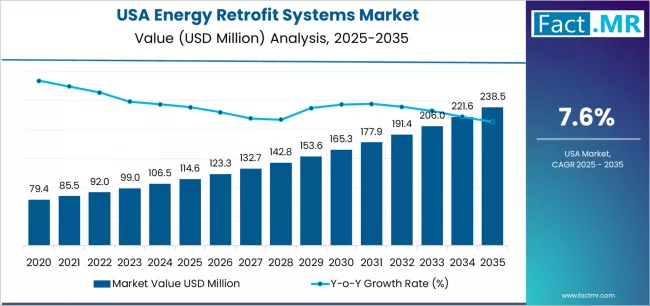

The United States energy retrofit systems market is set for strong growth over the next decade, driven by rising energy efficiency mandates, aging building infrastructure, and growing investments in sustainability and decarbonization initiatives. According to a new analysis by Fact.MR, demand for energy retrofit systems in the U.S. is projected to grow from USD 114.6 million in 2025 to approximately USD 238.5 million by 2035, reflecting an absolute increase of USD 123.9 million over the forecast period.

This expansion represents total growth of 108.1%, with market demand forecast to expand at a robust CAGR of 7.6% between 2025 and 2035. Rising adoption of energy-efficient building upgrades across commercial, residential, and public infrastructure is accelerating market momentum nationwide.

Growing emphasis on reducing carbon emissions, improving building performance, and lowering long-term operational costs is positioning energy retrofit systems as a critical component of the U.S. clean energy transition.

Browse Full Report: https://www.factmr.com/report/united-states-energy-retrofit-systems-market

Strategic Market Drivers

Aging Building Stock Accelerates Retrofit Demand

A significant portion of U.S. residential and commercial buildings were constructed decades ago and operate with outdated energy systems. Energy retrofit solutions—including insulation upgrades, HVAC modernization, LED lighting, and smart energy controls—are increasingly deployed to improve efficiency, reduce energy waste, and extend building lifespans.

Federal, state, and municipal retrofit programs are further accelerating adoption across schools, hospitals, offices, and public housing.

Government Policies and Energy Efficiency Regulations

Strong policy support remains a key growth driver. Federal initiatives, tax incentives, and state-level energy efficiency mandates—such as building performance standards and net-zero targets—are encouraging building owners to invest in retrofit solutions.

Incentives under clean energy programs and climate-focused legislation are significantly lowering upfront costs, making retrofit projects financially viable for a wider range of end users.

Rising Energy Costs and Sustainability Awareness

Escalating electricity and fuel costs across the U.S. are pushing businesses and homeowners to prioritize long-term energy savings. Energy retrofit systems help reduce utility expenses while improving indoor comfort and operational efficiency.

At the same time, growing awareness of environmental sustainability and corporate ESG commitments is driving organizations to upgrade existing infrastructure rather than construct new buildings.

Smart Technologies and Digital Energy Management

Advancements in smart meters, IoT-enabled energy monitoring, and AI-based building management systems are enhancing the effectiveness of retrofit projects. These technologies enable real-time energy optimization, predictive maintenance, and measurable performance improvements—further strengthening retrofit adoption.

Market Segmentation Insights

By Retrofit Type

- HVAC Retrofits – Largest segment due to high energy consumption of legacy systems

- Lighting Retrofits – Strong adoption driven by LED upgrades

- Building Envelope Retrofits – Insulation, windows, and roofing improvements

- Energy Management Systems – Rapid growth with smart building adoption

By End Use

- Commercial Buildings – Offices, retail, and hospitality lead demand

- Residential Buildings – Growing retrofit activity in multi-family housing

- Institutional Buildings – Schools, hospitals, and government facilities

- Industrial Facilities – Energy optimization and compliance-driven upgrades

Regional Growth Highlights

Northeast and West Coast Lead Adoption

States such as California, New York, Massachusetts, and Washington are leading the market due to stringent energy efficiency regulations, aggressive carbon reduction targets, and strong government funding for retrofit initiatives.

Southern and Midwestern States Gain Momentum

Increasing energy prices, extreme weather conditions, and expanding infrastructure modernization programs are driving retrofit investments across Texas, Florida, Illinois, and Ohio.

Challenges Impacting Market Growth

High Initial Investment Costs

Despite long-term savings, high upfront retrofit costs can deter small building owners and residential users, particularly without incentive support.

Project Complexity and Skilled Labor Shortage

Energy retrofit projects require specialized audits, system integration, and skilled labor, which can increase timelines and costs.

Competitive Landscape

The U.S. energy retrofit systems market is moderately fragmented, with companies focusing on integrated retrofit solutions, performance-based contracting, and smart energy technologies.

Key Companies Profiled

- Siemens AG

- Johnson Controls

- Honeywell International

- Schneider Electric

- Ameresco

- Trane Technologies

- Engie Services

- ABB Ltd.

Companies are investing in digital energy platforms, AI-powered building analytics, and turnkey retrofit services to strengthen market presence.

Recent Developments

- 2024: Expansion of federal funding programs supporting public building energy retrofits

- 2023: Increased adoption of performance-based energy retrofit contracts in commercial buildings

- 2022: Rapid deployment of smart energy management systems across institutional infrastructure

Future Outlook: A Decade of Energy-Efficient Transformation

The next decade will witness accelerated adoption of energy retrofit systems in the U.S., driven by:

- Net-zero and carbon reduction targets

- Rising energy costs

- Federal and state incentive programs

- Smart building and IoT integration

- Focus on sustainable infrastructure renewal

As the U.S. continues to modernize its aging building stock and prioritize energy efficiency, the energy retrofit systems market is positioned for sustained, long-term growth through 2035.